A new research report from fintech firm Broadridge Financial Solutions finds that financial services firms now view digital transformation as essential to their business and are already looking to the next wave of technology to help get ahead.

The firm’s new 2023 Digital Transformation and Next-Gen Tech study, based on a survey conducted by ThoughtLab Group of 500 C-suite executives and their direct reports across the buy side and sell side globally, reveals that 71 percent said AI is now significantly changing the way they work, and 60 percent agree that within ten years, blockchain and distributed ledger technology (DLT) will become the core of financial markets infrastructure.

Despite a more challenging economic environment, firms are also accelerating their funding of digital transformation initiatives as they anticipate further widescale adoption of new and more powerful technology. Firms now spend 27 percent of their overall IT budget on digital transformation—a 16 percentage point increase compared to the 2022 study.

“A new chapter in digital transformation is emerging,” said Tim Gokey, chief executive officer of Broadridge, in a news release. “In our work with clients across the financial services industry we see leading firms are already reaping the benefits from digitalization and the use of technologies such as AI and blockchain/DLT, as they adapt to economic headwinds and new competitive dynamics. Firms are now looking ahead to what their customers will require five to ten years from now, and how technology can help them to deliver that vision.”

The study categorized firms as digital “Leaders” vs. “Non-leaders”, based on how advanced they are in 10 of the most essential aspects of digital transformation. These aspects include their innovation culture, use of emerging technologies, seamless customer experience, internal skill-building, and adoption of security and privacy protocols.

Digital transformation goes mainstream

Adapting to a digital world and embracing the potential of new technology now underpins organizations’ core business strategies, with more than half of digital Leaders (53 percent) viewing higher revenue growth as one of the most important benefits of digital transformation.

Investment in next-gen technology is now understood to be essential in preparing for the future. Fifty-seven percent of firms agree that falling behind in digital transformation will hurt their ability to attract and retain talent, further impeding their ability to unlock new and innovative tools and platforms.

The 2030 technology landscape

Significant advancements in AI, data analytics, and real-world applications for blockchain and DLT are driving momentum and optimism among leading financial institutions. In fact, 80 percent of survey respondents say the industry will have modernized its tech stack before we land a human on Mars, a major technology feat currently estimated to happen by the early 2030s.

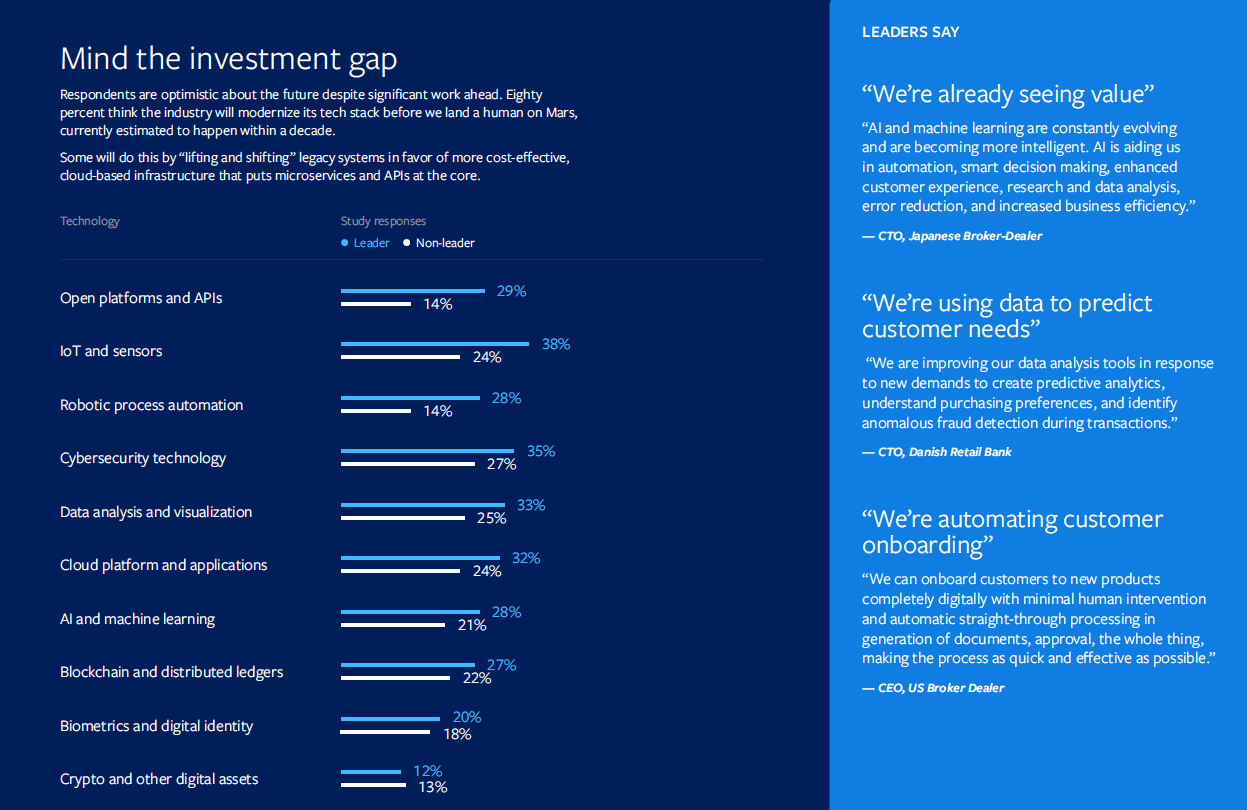

Respondents expect more nascent technologies to make significant progress as well. Firms classified as Leaders plan to increase investment in quantum computing by 16 percent on average over the next 2 years, even though they are only increasing investments in the metaverse by 5 percent on average, indicating more of a “wait and see” approach before committing funds.

The digital divide

Industry incumbents face challenges from new entrants to the market and will need to embrace digital solutions to maintain their market position. The study examined the differences between traditional financial firms and Digital Natives, defined as online banks, brokers, robo-advisors, and digital wealth management firms established in the last 15 years and not part of an incumbent firm.

The report found Digital Natives are more likely than traditional firms to place transformation as their most important strategic priority (78 percent versus 51 percent), marked by greater increases in digital investments. Seventeen percent of digital natives also report being at the advanced stages of deploying AI, blockchain, cloud, and other emerging technologies, vs. 7 percent of traditional firms.

Download the full report here.

This Broadridge survey was conducted by ThoughtLab Group to understand how financial services companies are digitally transforming and adopting AI, blockchain, and cloud technologies. C-suite executives and their direct reports from 500 financial institutions globally on the buy side and sell side were surveyed, with fielding completed in Nov 2022. The total assets or AUM of companies in the sample ranged from $1 billion to over $250 billion. The study scored firms on a range of factors related to progress with digital transformation. Firms were then categorized as digital Leaders or Non-leaders in the Broadridge Digital Transformation Maturity Framework. For further details on survey methodology, please contact a Broadridge media representative.