According to new CMO Council research, frustration with cumbersome and repetitive authentication processes are overwhelmingly causing consumers to search for brands and digital experiences that securely unify and simplify identity verification.

The report, Authentication Frustration: How Companies Lose Customers in The Digital Age, with research partners Business Performance Innovation Network (BPI Network) and identity assurance technology firm Daon, is based on a survey of 2,000 consumers across the United States, Canada, the United Kingdom, and Ireland, and finds that a huge majority of 81 percent prefer to do business with companies that do a better job of recognizing and verifying their identity “simply, quickly and safely.” Over 60 percent of respondents say they have abandoned business transactions due to authentication frustration.

Problems with passwords remain a major grievance of consumers, who say they strongly prefer physical biometric authentication methods, such as facial and fingerprint recognition. Almost 7 in 10 consumers (68 percent) say they have problems remembering and using passwords. Forty-percent of respondents report using at least 11 passwords, including 23 percent who have 16 or more.

“Password pain is hardly a new phenomenon. Yet it continues to be a persistent problem for consumers,” said Donovan Neale-May, executive director of the CMO Council and BPI Network, in a news release. “Businesses and brands need to listen to what consumers are so clearly telling them. Simplify and improve authentication and you will gain customer loyalty and grow your business. Fail to do so, and you can expect greater customer churn and revenue losses.”

“Data protection, privacy and identity theft are massive challenges for today’s digital business world,” said George Skaff, senior vice president of marketing at Daon, in the release. “The issue has become significantly more severe in recent months as consumers relied heavily on digital transactions throughout the Covid pandemic. At Daon, we believe companies need to adopt an ‘Identity Continuity’ model of authentication, in which biometric and non-biometric factors come together on a single platform to create a unified identity experience across the entire customer relationship lifecycle—from identity proofing and onboarding to authentication and recovery.”

Market data shows that consumers have dramatically accelerated their use of digital channels and interactions during the pandemic. A recent study by McKinsey found that global business executives estimate that their digital interactions with customers and partners have accelerated by some 3 to 4 years due to the pandemic.

Among other key findings in the report:

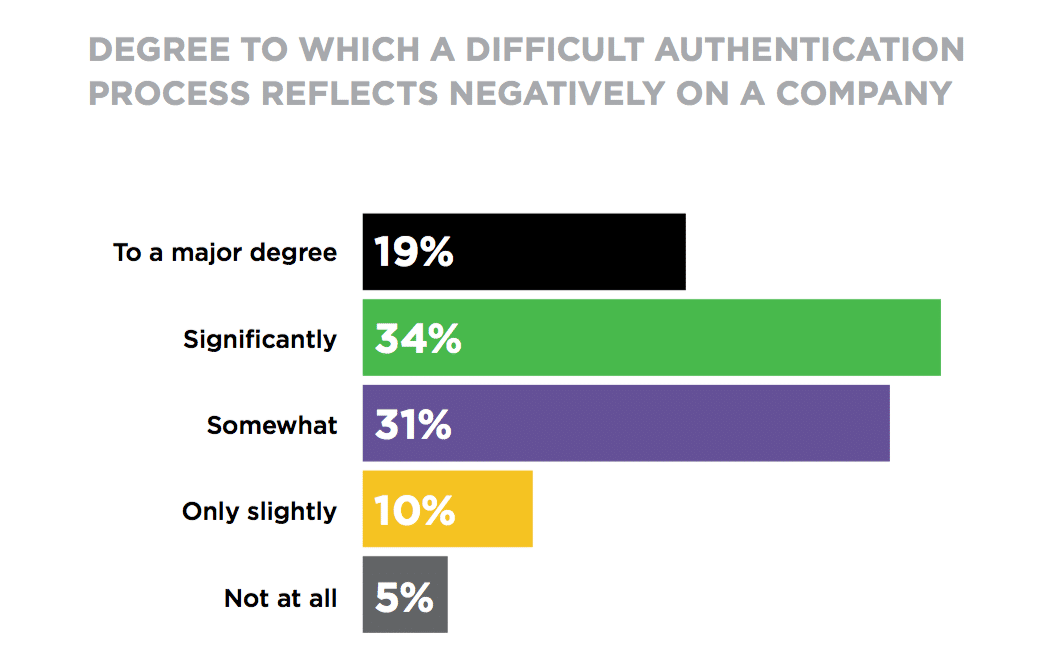

Eighty-five percent of respondents say a difficult authentication process reflects negatively on a company and its brand

This includes 53 percent who say it has a “major” or “significant” negative impact. Financial services companies are a frequent source of authentication frustration. Consumers say the top areas where the encounter difficult identity experiences are:

- 43 percent Digital devices

- 37 percent Banks

- 29 percent Credit and debit cards

- 27 percent Mobile payment services

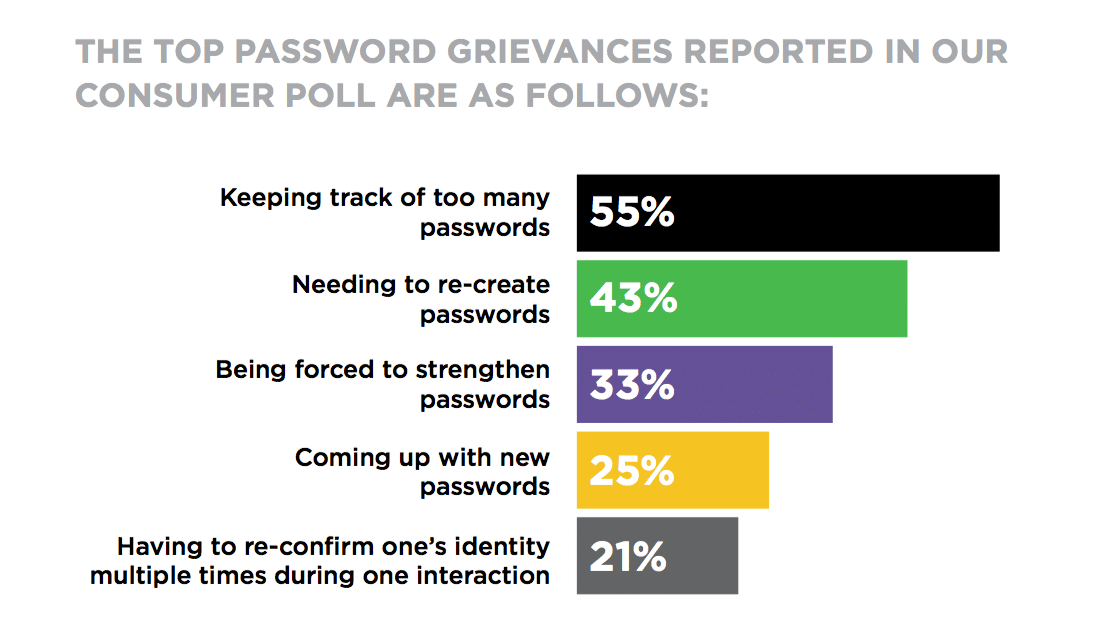

Most vexing problems with passwords:

- 55 percent Keeping track of numerous passwords

- 43 percent Needing to re-create passwords

- 34 percent Being asked to strengthen passwords

- 25 percent Coming up with new passwords

Consumers overwhelmingly prefer biometric authentication, including the use of voice, fingerprint, face, eyes, and behaviors

- 44 percent say they “absolutely” believe biometric authentication is an easier and better form of verification

- 34 percent say they would prefer to use biometrics as long as it is secure

- Only 10 percent prefer passwords and other forms of authentication over biometrics

The report is part of a new initiative by the BPI Network, CMO Council and Daon, called Unify How You Verify. The thought leadership program explores the critical business need to simplify and unify the way companies recognize and authenticate their customers and partners across channels of engagement.

In addition to research into consumer attitudes toward current authentication processes, the initiative will include a further report based on interviews and interactions with senior executives and experts in identity management, security, customer support, and ecommerce, on what can be done to improve customer experiences and drive greater revenue, satisfaction and compliance.

Download the full report here.

The Unify How You Verify program will host a webinar discussion on research findings into modernizing the customer authentication experience on Oct. 27. Register to participate in the webinar here.