How to Hear a Crisis Coming: 5 Steps for Setting Up Your Media Monitoring Tool for Successful Crisis Detection and Management

A PR crisis is an interesting creature. It’s constantly shape-shifting, it can originate from almost anywhere, and it tends to start quietly—but can quickly grow to a loud roar. When dealing with a beast of this nature, it’s easy for PR and communications professionals to feel like they’re up against the impossible. But…most are lucky enough to already have the most powerful weapon to combat a crisis at their disposal—media monitoring.

What makes media monitoring so powerful?

Media monitoring is listening. It’s keeping your eyes and ears open to the conversations around your brand—essential to many aspects of a crisis, such as:

Prevention: a robust media monitoring program can equip you with the knowledge you need to entirely avoid a potential misstep.

Detection: media monitoring can act as an early warning system and expose signs of a crisis, giving brands extra time to get their bearings and navigate a crisis effectively.

Reaction: the insights gleaned from monitoring can help inform a brand’s timing, statements, messaging, and post-crisis actions.

Employing a media monitoring solution to its maximum potential during a crisis begins with preparation and know-how. This guide offers practical tips gathered from our team of media monitoring experts that will help you set up your monitoring processes to optimize your or your client’s crisis management activities. We’ve broken the process down into five steps:

- Step 1: Choose your keywords

- Step 2: Set up searches

- Step 3: Use coverage alerts

- Step 4: Send media briefings

- Step 5: Assess the crisis

Step 1: Choose your keywords

Crisis detection starts with the keywords you track, so it’s crucial to pay attention to them. An overlooked keyword can result in a missed mention regarding a threat to your brand’s reputation.

Here are some categories to keep in mind when building your list:

- Your organization’s name, brands, and products

- Spokespeople (C-suite, board members, and anyone else taking a public-facing role)

- Partners, suppliers, and vendors

- Competitors and their products

- Industry terms and governing associations and bodies

- Events and charities your organization is involved in

- Other vulnerabilities you’re aware of (hint: what’s keeping you up at night?)

Download the full guide for access to our Prepping Your Crisis-Detection Keywords worksheet.

To be fully prepared for a crisis, it’s prudent to consider what could possibly go wrong for your brand. Go back to the question: what’s keeping you up at night? Although it can be hard to predict the source of a future crisis, extensive knowledge of your brand and industry experience can point to certain scenarios that may be a potential source of bad press.

Here are a few categories of crises that may influence the keywords you choose to track:

- Natural or human-created disasters (hurricanes, plane crashes, workplace accidents)

- Product issues (recalls, defects)

- HR/policy conflict (discriminatory policies)

- Employee issues (sexual harassment)

- Spokesperson indiscretions (insensitive or offensive comments and behaviors)

- Legal/criminal charges (embezzlement, insider trading)

Of course, you’ll want to balance the desire to know everything that might be important to your brand with ensuring that only relevant mentions are picked up. If you’re inundated by irrelevant articles and mentions, it will be more difficult to notice the first signs of a crisis.

To strike the right balance, keep the following best practices in mind when adding keywords to your searches:

- Capture mentions across all languages relevant to your brand. For example, if you’re interested in all media coverage across Europe, you’ll want to make sure you are including mentions in the official languages used by every country in that region. Similarly, if you know that a significant portion of your audience speaks a second language, like Spanish, you’ll want to capture mentions in Spanish, even if it’s not an official language in the country your brand operates in.

- Review the spelling of all proper names of brands and spokespeople related to your organization. There are often common misspellings that can plague an individual or brand that you should keep a close eye on. Account for variations of spelling with an “OR” statement, using Boolean logic. Let’s say your CEO’s name is Catherine McGee, you will likely want to track variations of that name like “Katherine” OR “Cathy”.

- Determine if your industry terms or brand-related keywords are too broad. Some terms important to your brand can bring in more mentions than you need. Try combining them with an “AND” statement, using Boolean logic. Imagine you’re monitoring the food industry, but tracking “food” is pulling in too many irrelevant mentions. Try using “Your company name” AND “food”.

- Keep track of negative keywords. If you find that your monitoring searches are returning too many irrelevant results, keep track of keywords that you need to suppress, called “negative keywords”. Once you’ve identified the keywords bogging down your results you can remove them using the “NOT” statement in Boolean logic.

For example, if you’re tracking the technology company Apple, you’ll most likely need a list of negative keywords such as “Red Delicious” or “Ambrosia”. - Ensure you’re using singular and plural terms for anything related to your brand. Wildcards (*) are incredibly valuable as they can account for singular and plural versions or other variations of a root word.

If you’re interested in tracking wildfires in the state of California you could format your search as “California* wildfire*” to account for “California wildfire”, “Californian wildfire” “California wildfires” and “Californian wildfires”. - Take extra precautions with broadcast monitoring. Due to voice-to-text features commonly used in media monitoring, it’s not uncommon for a brand’s or spokesperson’s name to appear misspelled. For example, if you’re monitoring “Ikea”, you may want to consider a phonetic spelling like “Eye-kia”.

- Periodically review your keywords. Truthfully, a keyword list is never truly done and will continue to evolve as your brand and the landscape in which it operates also evolves. Your keyword updates will need to reflect things like spokesperson, product, and key message turnover.

Bonus Tip: Once a crisis is underway, the keywords you track will change. The crisis coverage coming in will guide more specific searches bettering your chances of not missing a single relevant mention as the crisis unfolds. You can learn more about how to evolve with a crisis in our guide Tips for Effective Media Monitoring During a Crisis.

2. Set up searches

It’s important to balance the specificity of your searches with the overall number you create. In other words, do you want to have a lot of very specific searches, or fewer broader ones?

Your preference will depend on a variety of factors, like the size of your communications team, how complex your organization’s structure is, and the amount of coverage alerts, media briefings, and reports you want to create (but more on that later).

Video: Setting Up a Media Monitoring Search for Crisis Detection

Creating search topics

Our media monitoring experts recommend taking a balanced approach and keeping your searches well-organized.

Go general before going specific

When setting up a comprehensive monitoring program, it’s often helpful to have a generic set and a specific set of searches.

Generic searches include broad keywords like your company name or industry-related terms. These types of searches will return a lot of results and are useful for high-level reporting but will be cumbersome for automated alerts due to the high volume of mentions.

Specific searches focus on individual elements or activities you want to track, like a spokesperson or product launch. It’s okay for these specific searches to overlap with your general ones. These more specific searches will serve better for automated alerts, coverage briefings, and focused reports.

Think of stakeholder groupings

Consider if segmenting your searches by stakeholder groupings will result in more impactful insights from media coverage. Generally, the more closely you align searches with the specific parties that need them, the better chance you have of detecting a crisis early. For example, if you send HR-related industry highlights to your HR leadership, they can flag if there are any potential threats regarding your organization’s hiring policies.

You may consider doing this within your own crisis team as well. If one member of your team focuses on all content for a certain language—let’s use Spanish as the example again—set up a search filtered to Spanish just for them. You may also consider setting up a separate search for social media mentions if you have a dedicated social media team.

Consider alerts, briefings, and reports

How are you going to use your searches? If you plan to set up a series of coverage alerts, leverage reports on specific topics, or send media briefings, you’ll want to make sure you’ve made your topics specific enough to avoid extra work later. For instance, if you know that you’ll want a report that dissects sentiment on social media posts, set up a separate search focused only on social media.

Let the crisis inform your searches

As a crisis emerges, you may notice certain story angles surface. It’s helpful to track each angle separately so you can see which ones are dying down and which ones are picking up momentum.

Once a crisis is over, do a post-mortem to see if there are any new crisis-related keywords that should be added to your regular tracking that you may not have thought of before. Consult with your team to see if there is anything that you can do differently next time to detect a crisis sooner or evolve with it more fluidly.

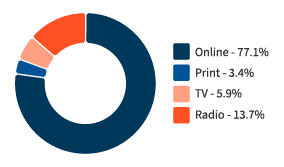

Another consideration when setting up your media monitoring searches is where—as in what types of media should you track coverage in. Deciding which media types make the most sense depends on multiple factors, such as where your brand is usually covered and which types of media your audience consumes.

Here is a breakdown of the various media types to consider:

- Social Media: Social media and crises often go hand-in-hand. If you’re concerned with the reaction of the public, you should absolutely add a variety of social media sources to your media monitoring searches. You may be tempted to focus on the platforms where your brand posts the most often but try not to ignore other sites that communications professionals are less familiar with (hello Reddit!).

- Online: Anyone can publish online these days, from well-known and credible news sites to blogs with less stringent editorial standards. You may choose to keep an eye on certain smaller websites and blogs without including them in your overall report (depending on how relevant your comms team considers them). Even if you decide not to include them in your overall reporting, it’s important not to discount these sources entirely because another publication may pick up their story and spread the information further.

- Broadcast: Despite the downturn in cable subscriptions, television still holds substantial sway over public perception. Likewise, you ignore radio at your peril, seeing as in 2019 it reached 92% of the American population weekly. Good media monitoring software employs cutting-edge speech-to-text transcription, so you can trust you won’t miss that priceless soundbite (provided you’ve set up your keywords as mentioned in Step 1: Set up your searchers).

- Print: Modern media monitoring hasn’t forgotten its roots. Newspapers and magazines still make up a good portion of press coverage, and, depending on your target audience, print might be a crucial media type to your brand.

- Podcasts: Despite having been around for some time, podcasts have only started to flourish in recent years, with 37% of Americans listening to podcasts monthly in 2020. There are podcasts dedicated to every topic under the sun, often with a no holds barred attitude when discussing opinions.

Bonus Tip: Every media package is different, and not all are created equal. Make sure that your media monitoring provider offers comprehensive sources and that you know exactly what limits your monitoring will have. Your package needs to include all the websites and watch and listen to all the broadcast stations important to your brand.

Step 3: Use coverage alerts

Automated coverage alerts are especially useful in scenarios where having real-time notifications of media coverage is crucial—like a crisis. They are also an essential step in early crisis detection, as they notify PR pros of media mentions meeting specified criteria.

Generally, you should set up alerts for anything that worries your comms team or leadership team. Do you need to keep a close eye on disinformation sources? Do you need to know immediately if your brand is covered in a specific outlet? Do you prefer to be alerted right away about any mentions with negative sentiment?

Video: Setting Up a Coverage Alert for Crisis Detection

Luckily, once you’ve taken the time to set up well-organized topics (see Step 2: Set up searches) creating your coverage alerts will be a breeze!

There are two main decisions to make when setting up alerts:

1. Who should receive them?

Your CEO likely doesn’t want to read every single brand mention, so it’s often best in a crisis to restrict comprehensive alerts to members of your crisis team. Your team can then triage the alerts and pass along a curated set of the most important mentions to your leadership team and other departments using media briefings (more on that in Step 4: Send media briefings).

You may also want to segment coverage alerts by team member. If one team member is responsible for the communications efforts behind a certain product line, you may want to send the alerts to them only. You can also segment alerts by geography, language, and keyword groupings, depending on what makes the most sense for your team.

If you’re working with a PR agency (or if you’re an agency pro working with brands or other partners), consider if any of those outside contacts need to receive alerts. Even if they are not directly involved in the crisis, it’s a good idea to include them as other PR activities will be affected by a crisis.

2. How often do they need to be sent?

Determine whether you need to be alerted immediately about mentions that meet your criteria, or if you’d be better served with a daily or weekly roundup.

The timing for alerts will likely vary with the type of search you’ve set up. Some communications pros want immediate alerts for certain keywords, negative sentiment, or if the mention occurs in a specific media outlet or type. Less urgent alerts can be set up with daily or weekly notifications.

By ensuring that the frequency of the alerts going to your crisis team matches their overall importance, you’ll ensure that coverage requiring immediate action is caught and flagged as soon as possible.

Bonus Tip: Keep copyright limits in mind when sharing media coverage with various stakeholders. Most media monitoring packages include limitations on how many people you can share content with. Plus, gated online content will sometimes only show a specific word count.

Step 4: Send media briefings

Media briefings are the peanut butter to coverage alerts’ jelly.

While both alerts and briefings play key roles in guiding a brand through a crisis, it’s important to remember their distinct purposes. Coverage alerts send email notifications about a new media mention immediately, while a media briefing email contains a set of mentions (typically curated) and is usually sent on a daily or weekly basis.

It’s best to think of a coverage alert as a heads up on a single mention sent to a handful of key individuals on your team, and a media briefing as a more complete story of the coverage surrounding your brand, often sent to members outside of the communications team.

Media briefings give you the opportunity to curate the most relevant stories for sharing with stakeholders. You decide what qualifies as important—maybe it’s mentions that indicate where the crisis is headed or mentions in notable outlets.

The same considerations mentioned in Step 3: Use coverage alerts, also apply to setting up your media briefings, but with one additional point.

1. Who should receive them?

While it makes sense for certain members of your team to receive round-the-clock coverage alerts, there’s a broader group of individuals that will benefit from media briefings. Decide on the crisis-stakeholders that should be updated regularly about coverage. This may include senior leadership, spokespeople, members of departments effected by the crisis, or maybe even all employees.

2. How often do they need to be sent?

Determine whether it makes sense to send crisis-related coverage briefings daily, bi-weekly, weekly, or other. Frequency depends on the amount of coverage the crisis is generating and whether any decisions need to be made by the recipient group. You may choose to give senior leadership a daily update each morning, but only send a company-wide briefing once a week.

Stay flexible during a crisis in case the frequency of briefings needs to increase, or a special edition is required.

3. Who manages them?

Media briefings will relay the information that your crisis team, and other involved stakeholders use to inform their decisions and keep a finger on the pulse of the crisis. Make sure whoever oversees these briefings can capture the most relevant information. We also recommend having a backup who can take over coverage briefings if the dedicated team member is unable to do them.

Download the full guide to use the Choosing Coverage Alerts vs. Media Briefings worksheet to organize your needs for each of your media monitoring searches.

Bonus tip: It’s important to understand what your media monitoring tool offers for media briefings. Ideally, your tool should offer coverage alerts and coverage briefing functionality.

Step 5. Assess the crisis

Coverage reporting is crucial in understanding how a crisis is progressing and when a brand is starting to regain control of their public image.

Regularly creating reports during a crisis helps your team understand the impact of the latest coverage and determine the necessary next steps. It will also help you understand how your crisis response is being perceived by the media and the public. Our monitoring experts recommend setting up a series of reports and sharing them with your crisis team and other stakeholders.

Luckily, reports can be easily compiled in any top-tier media monitoring tool, or if your organization has complex needs you can also request media intelligence services to track the evolution of a crisis.

Make sure your media monitoring tool allows you to export coverage reports for easy insertion into a PowerPoint presentation, PDF, email, or however you normally share your PR metrics.

You may not know your exact reporting needs ahead of time, as every crisis is unique, but it’s good to understand the reporting capabilities at your fingertips. Here are some common reports you should have access to through your media monitoring provider:

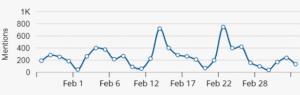

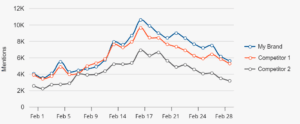

Coverage Over Time & Trend Comparisons

Tracking the volume of your brand’s coverage over time during a crisis can help you determine overall shape, any notable spikes, and when the story is dying down (or resurging).

With coverage over time, you can annotate when the crisis happened, when your organization responded, and other key events that happened along the way to keep a clear view of why spikes or drops occurred. It will also help highlight how quickly you responded to the crisis and if your response was timely.

Bonus tip: Once your crisis wraps up, decide if you need to do a follow up report later—maybe on the one-year anniversary of the event?

Comparing coverage trends across different monitoring topics allows you to track multiple storylines/angles and how much coverage you received vs. other parties involved in the crisis. For example, if the crisis involved one of your competitors, they can be a separate line on the chart.

Coverage can be tracked by reach or overall number of mentions.

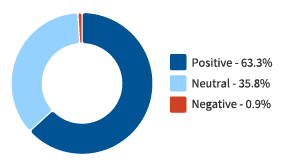

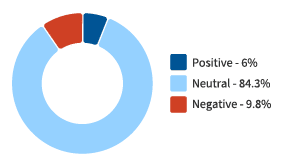

Sentiment Breakdown

Sentiment breakdown of coverage over time can be helpful in determining how your brand is being perceived. Benchmark these stats on a regular basis, so you can see your sentiment breakdown before, during, and after the crisis.

During a crisis, pay careful attention to your sentiment after the release of any statements or press releases issued by your brand. This way you’ll get a sense of how the media and the public reacted to your messaging.

Coverage Sentiment Breakdown Before a Crisis

Coverage Sentiment Breakdown During a Crisis

After a crisis, sentiment tracking will show you if you were able to reach pre-crisis levels of positive sentiment—or if you have more work to do.

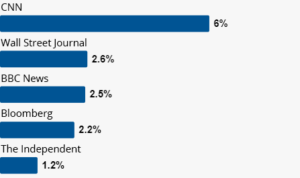

Media Type Breakdown & Top Outlets/Authors

Knowing where your story is being reported on is crucial for planning your response. Let’s say your story is getting a lot of television coverage, it may then be appropriate to arrange a TV interview for one of your spokespeople to formally respond to the crisis.

When reporting on media types, you may wish to dive into the traditional vs. social media coverage separately, as you’ll likely see a contrast in the messaging from journalists vs the reaction of your customers and real-life people effected by the crisis.

It’s also advantageous to report on the top outlets and journalists by reach who are covering your crisis to identify the most prominent voices. You may want to include approaching them with a story angle and hopefully gaining their support as part of your response strategy.

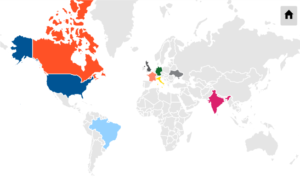

Geographic Breakdown

When tracking crisis-specific topics, a geographic breakdown of the coverage can help you determine the regional scope. Was the story mainly covered in North America or was it reported internationally? You’ll know where to focus your outreach once you know the scope.

But remember… this type of report doesn’t work well for online news and social media, where the regional scope is more difficult to track and news often transcends traditional boundaries.

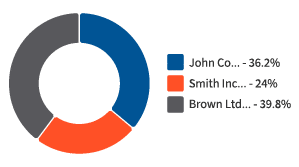

Share of Voice

Share of voice can be used in some interesting ways. Most commonly it’s used to compare a brand’s coverage to its competitors’ coverage over a specific time. But during a crisis, you may wish to use this to compare all parties or organizations involved in and/or reacting to the crisis, even if they are not competitors. This is a strong indicator of where the media is focusing its attention.

After reading this guide and following the steps, your media monitoring tool should be an invaluable part of your crisis management strategy.

Our media monitoring service provides all the essential functions we mentioned throughout this guide, like reporting, coverage alerts, media briefings and advanced keyword search. If you’d like to know how our service compares to others see our G2 page, or take advantage of a free tour.