You don’t have to be a Beckham, Chrissy Teigen or Grumpy Cat to make big cash as an online influencer. Influencer marketing has become a key comms strategy in recent years as brands look for new ways to directly reach consumers—and according to Rakuten Marketing, momentum for this trend is growing as brands are able to see measurable sales activity as a result of influencer campaigns.

In a study spanning five countries including the U.S., marketers said they will spend more money with influencers—and the shift in dollars is moving from celebrities with existing star power to micro-influencers.

Rakuten’s new survey of more than 700 marketers in consumer-facing brands such as fashion, cosmetics and travel companies from reveals that U.S. marketers are willing to spend up to $32,000 on a campaign with a micro-influencer (<30,000 followers) compared to $39,000 with a celebrity influencer (>500,000 followers).

The firm’s new survey also includes 3,500 consumer respondents globally, including over 1,000 in the U.S., with as many as 99 percent revealing they discover new products thanks to influencers that they follow. As many as three out of four Americans will click on a shared image or link recommended by an influencer, confirming that more consumers are making product discoveries introduced through original image-based content on social media.

“It is safe to say that the marketing space has evolved considerably in the past decade or so thanks, in part, to the rise of social media and image-based content,” said Paris Loesch of Rakuten Marketing, in a news release. “This study proves that brands are ready to capitalize on integrated marketing strategies that include influencer partnerships—especially if success is measurable. Most importantly, we are seeing the true value of an influencer’s impact on consumer behaviors.”

In the U.S., marketers are more interested to work with micro-influencers, making up to 41 percent of those employed by brands which argues that follower size may not be the only factor that marketers consider.

Other findings include:

- Celebrity influencers make up just 28 percent of annual influencer spend compared to 40 percent for micro-influencers

- Nearly three out of four brands agree that they believe influencers are concerned whether their posts drive sales for brands and 67 percent of U.S. marketers are able to tell when influencer campaigns drive sales

- At 39 percent, brands would be encouraged to invest more in an influencer program if they could see the impact of their activity across the wider consumer purchasing journey

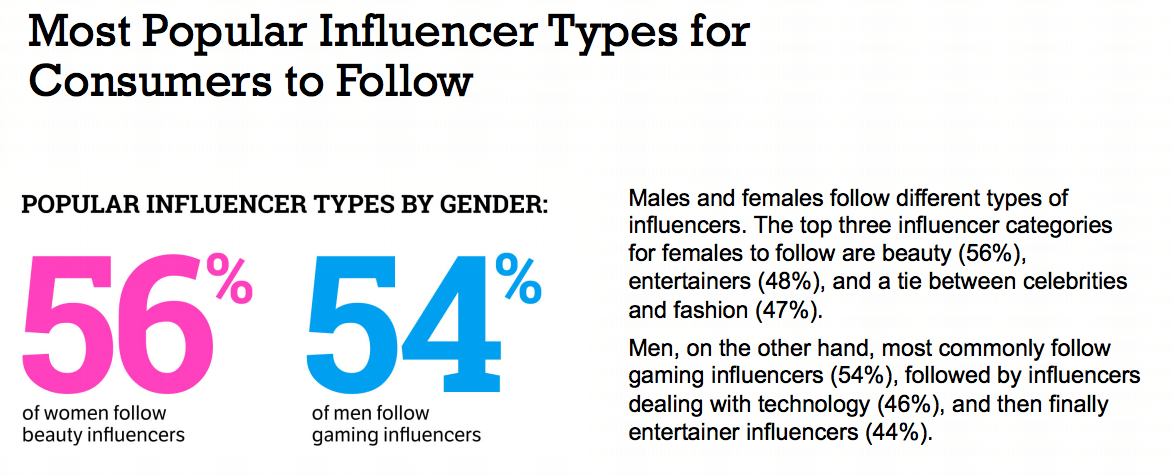

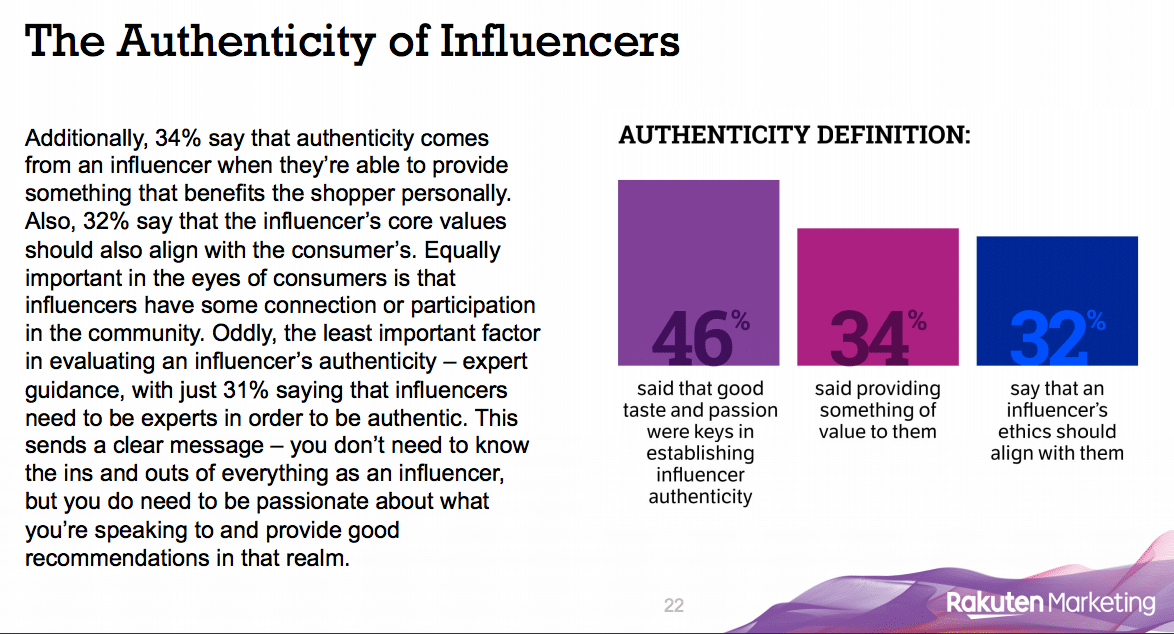

U.S. consumers value authenticity and true brand advocacy when it comes to the influencers, and men are an unlikely target audience.

- 88 percent of surveyed consumers have been inspired to purchase based on what they saw from an influencer

- Four in five surveyed consumers (81 percent) have made a purchase through clicking a link or image an influencer shared

- 66 percent of American consumers trust a product recommendation so long as the influencer discloses their relationship with a brand

- Brands should take note that 38 percent of consumers would stop following an influencer if they post content that does not align with their core values, personal opinions and ethics

- Men are more likely to recommend an influencer overall – this trend rings true across all regions surveyed globally

- 83 percent of men are inspired to make a purchase based on an influencer recommendation sitting just below women consumers at 89 percent

- Women are thriftier as men tend to spend more money on products recommended by influencers and the price point per item, starting at $100 or more, is higher than what women tend to spend

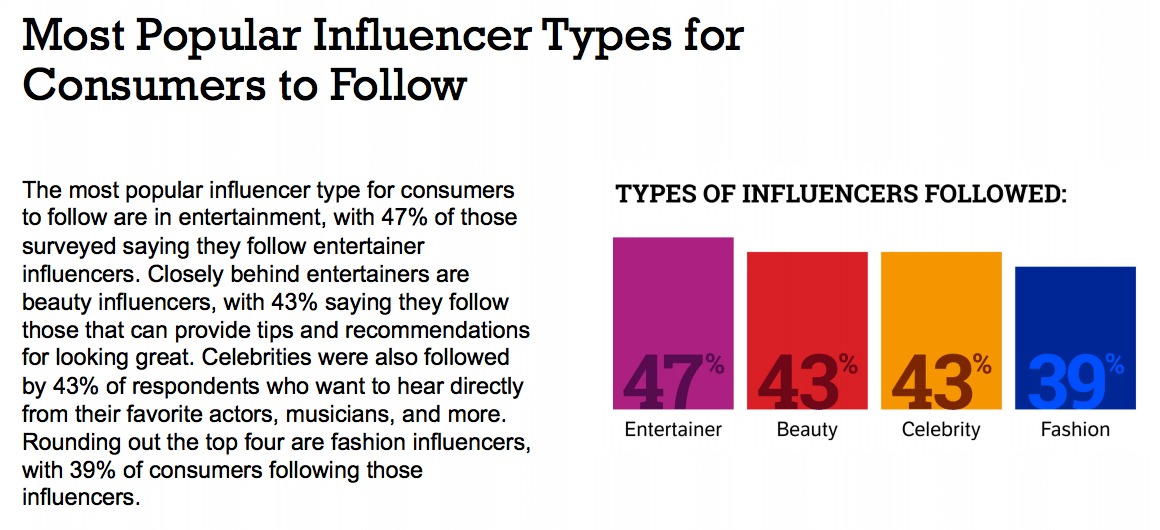

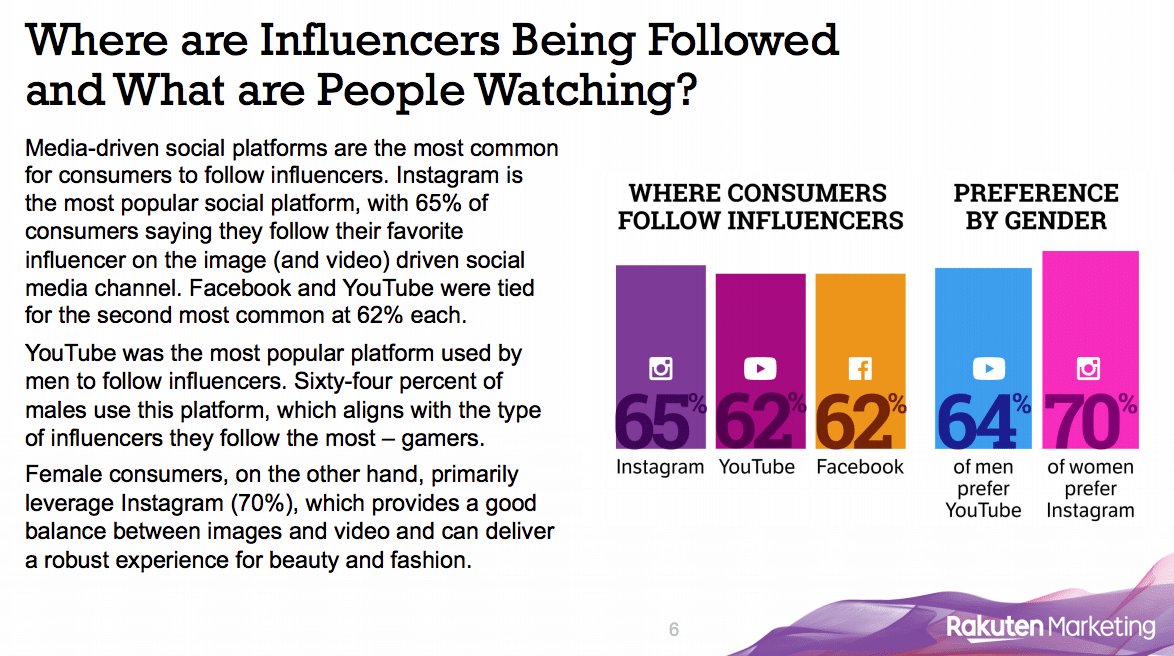

Globally, Instagram is the most commonly used platform in use among consumers when viewing influencer content. Facebook, YouTube and Snapchat are not far behind with their numbers continuing to grow.

Download the full report here.

Rakuten Marketing conducted research with Viga in December 2018 and January 2019. The survey includes the responses of 719 global marketers and 3,596 global consumers interviewed across the United States (200 and 1,030, respectively), Australia, United Kingdom, France and Germany. The respondents include marketers at varying management levels ranging from organizations of less than 50 employees to over 50,000 working directly on influencer programs.