The COVID crisis has already decimated most industries and obliterated traditional strategy, and with numbers again heading in the wrong direction, chief executives are trying to stay positive but many are preparing for the worst. New research from global leadership community YPO offers new insights into the impact the global pandemic has had on businesses, and chief executive perspectives over the past few weeks as compared to YPO’s previous COVID-19 surveys from March 17 and April 22.

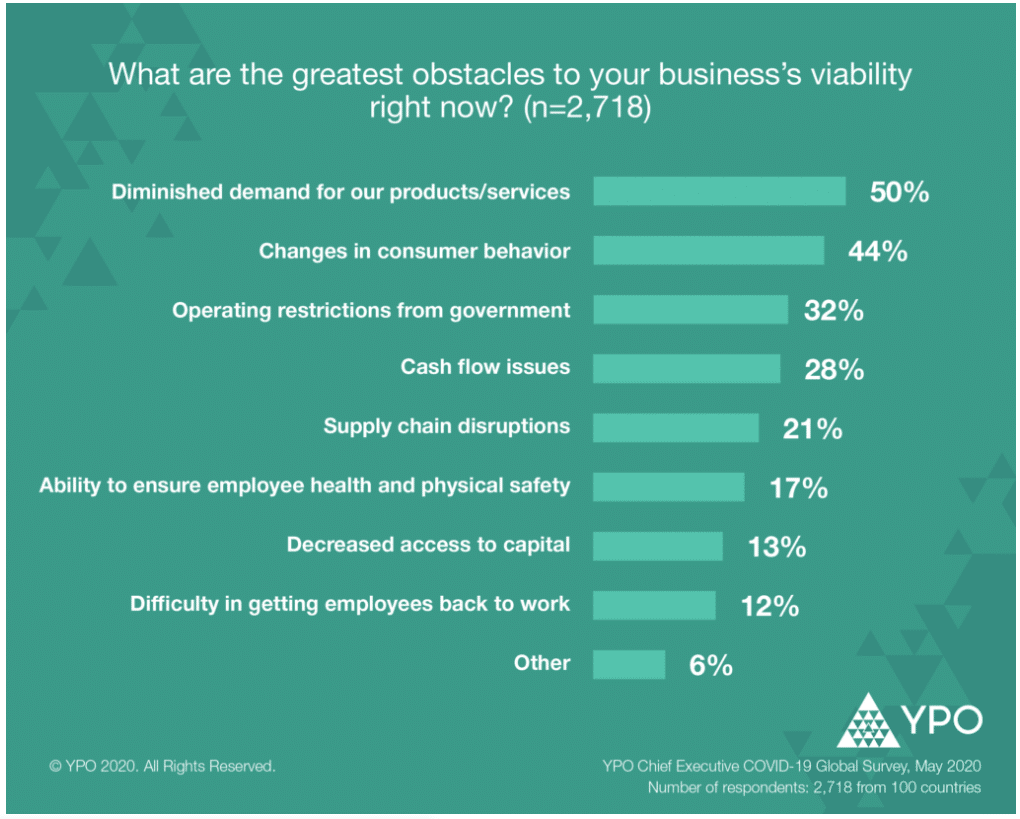

The latest data indicate an increase in optimism among chief executives compared to the April survey, but half (50 percent) say the diminished demand for their products/services is the greatest obstacle to their business’s viability, followed by changes in consumer behavior (44 percent) and operating restrictions from government (32 percent).

Key additional findings include:

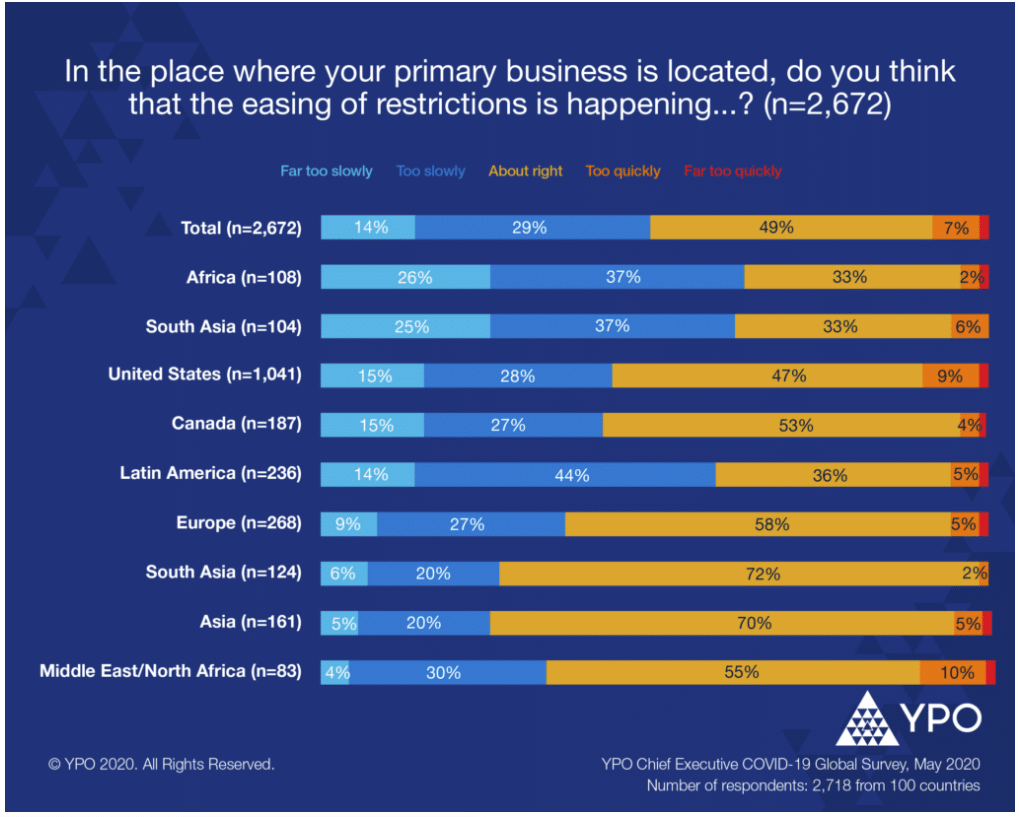

- Business leaders are split when it comes to the topic of the easing of restrictions and businesses reopening, with 49 percent sharing it is just right, 43 percent saying it is too slow and 8 percent believing it is too fast.

- A resurgence of COVID-19 would have significant consequences for business globally, with 6 percent of chief executives sharing their business would be at risk of not surviving a second wave, with 72 percent noting it would pose a moderate-to-large threat.

- Most business leaders (55 percent) reported their companies received some form of government support during the past few months, while 45 percent said they did not receive it, 44 percent of which stated that they did not receive it because they did not require the support. Of those who received government support, most selected to use the support towards payroll (81 percent).

Data on businesses that received government support

Business leaders in Australia/New Zealand (71 percent), United States (67 percent), and Canada (65 percent) were more likely to have received government support, while those in South Asia* (5 percent), Africa (24 percent), and Latin America (26 percent) were less likely to have received government support. Government support did not have a significant impact on recipient chief executives’ business outlooks or perspectives on the pace of reopening.

Company size was a significant factor in determining which businesses received government support. Leaders of organizations with more than 500 employees reported receiving lower levels of government support (38 percent) as compared to their peers who run companies with less than 100 employees (65 percent) and companies with 100-500 employees (59 percent).

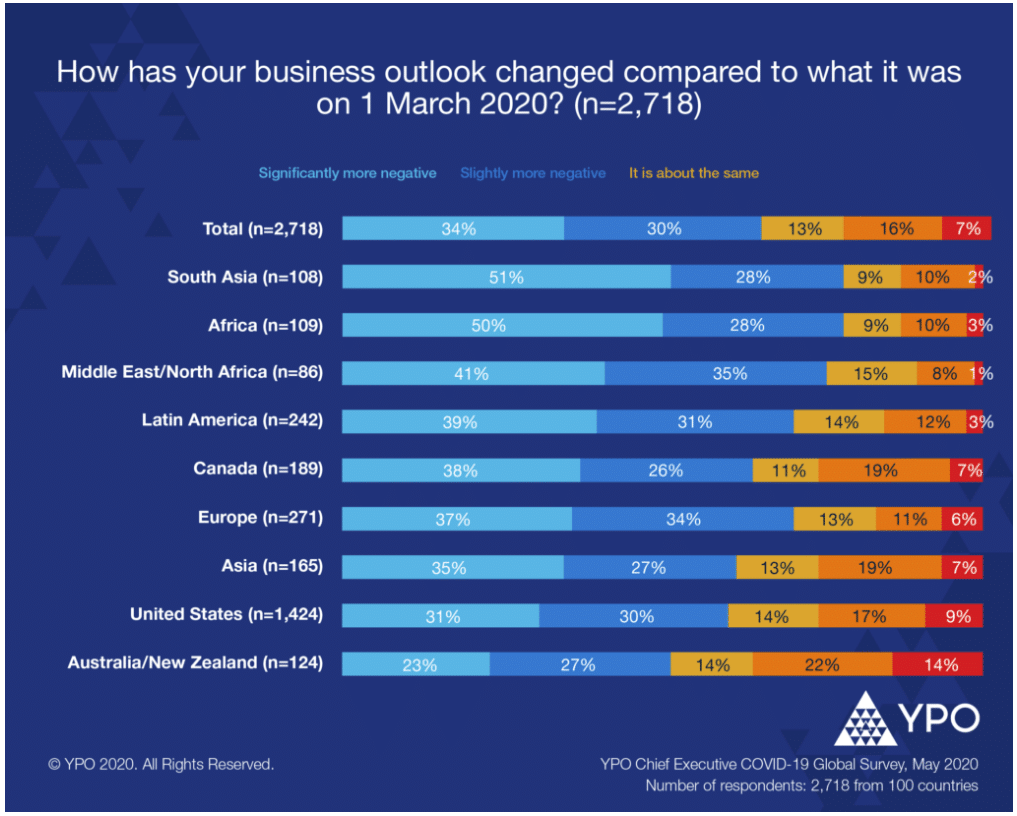

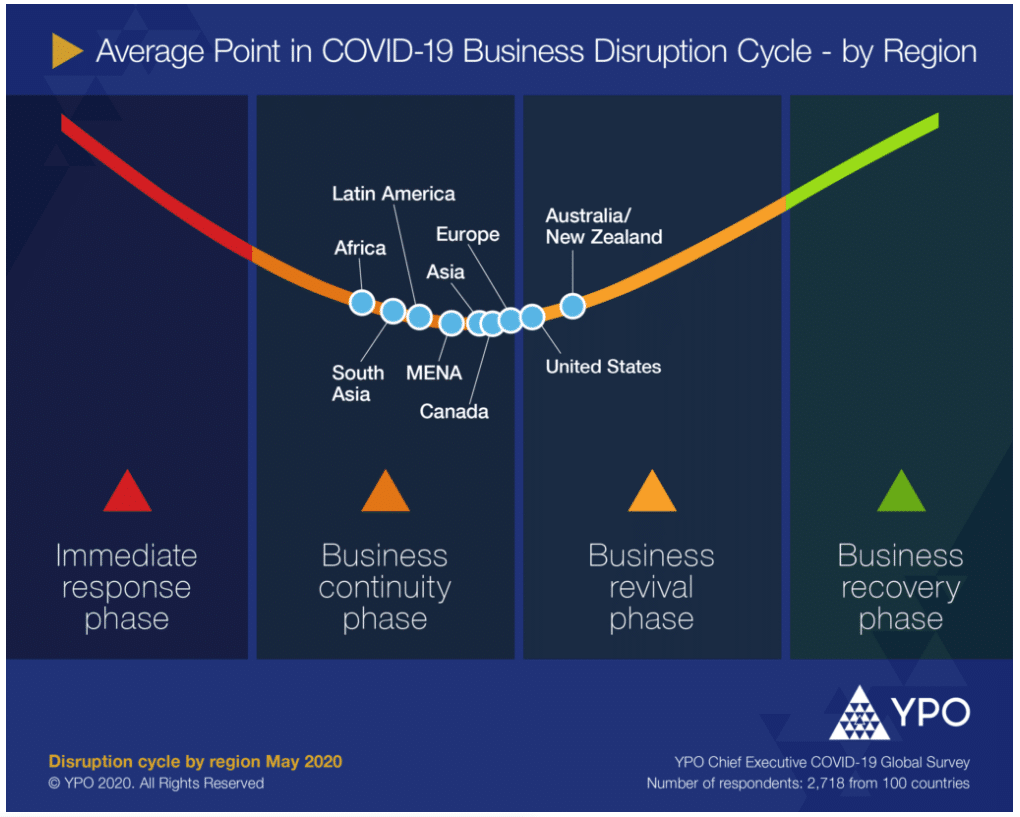

The majority (64 percent) of respondents say their business outlook is more negative compared to 1 March; this is a marked improvement from the previous month, when 84% of chief executives had a negative outlook.

As the COVID-19 pandemic progresses, regional differences are emerging, with chief executives in South Asia (51 percent), Africa (50 percent) and MENA (41 percent) saying their business outlook has become significantly more negative since March 1, while leaders in Australia/New Zealand (35 percent), Canada (35 percent) and United States (26 percent) have the most positive outlook when compared to 1 March.

Sentiments of a prolonged recovery remain prevalent

Chief executives anticipate continuing negative effects one year from 1 March on revenue (49 percent), headcount (39 percent) and total fixed investment (39 percent). This too is directionally more positive when compared to the chief executives’ April responses to the anticipated continuing negative effects one year from 1 March on revenue (65 percent), headcount (49 percent) and total fixed investment (53 percent).

Business leaders in the United States (14 percent), Europe (14 percent) and Asia** (15 percent) are the least likely to expect their total number of employees to be down more than 20 percent a year from now. Chief executives in South Asia (40 percent), followed by Latin America (27 percent) and Africa (24 percent), are more likely to expect a decrease in employees in the next 12 months.

Australia/New Zealand chief executives (13 percent) are the least likely to expect their total fixed investment to be down more than 20 percent a year from now, compared to 1 March 2020 levels. Business leaders in the Middle East/North Africa (41 percent) and South Asia (40 percent) are the most likely to expect a decrease in fixed investments.

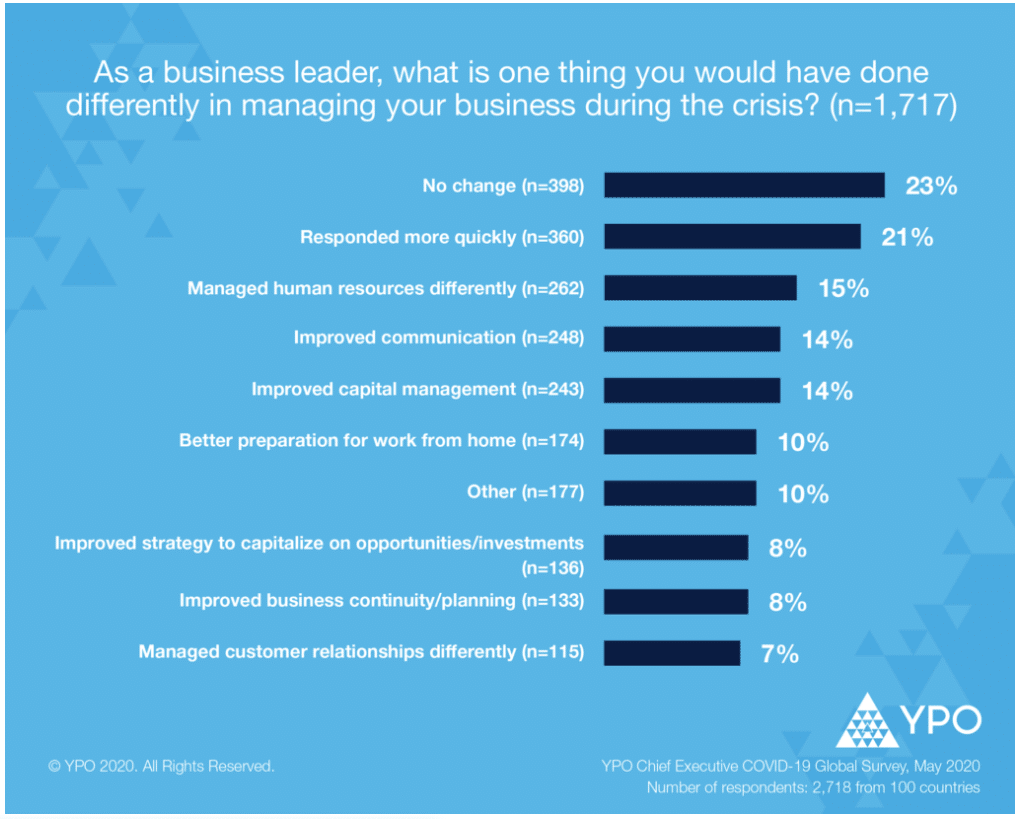

How would leaders do things differently if they had the chance?

Business leaders, when asked how they would handle the crisis differently, mainly shared (23 percent) that they would not change their leadership approach while others cited they would be quicker to respond (21 percent), manage human resources differently (15 percent), improve communications (14 percent), and improve capital management (14 percent).

The YPO Survey on COVID-19 was conducted by YPO from 27-30 May 2020 via an online questionnaire. A total of 2,718 YPO members responded to the survey. The members in this sample are representative of the larger YPO population and come from 100 different countries. The margin of sampling error is plus or minus 1.79 percentage points at the 95 percent confidence level.

*South Asia includes India, Nepal and Sri Lanka.

**Asia includes Cambodia, China, Hong Kong, Indonesia, Japan, Republic of Korea, Malaysia, Myanmar, Philippines, Singapore, Taiwan, Thailand, and Vietnam.