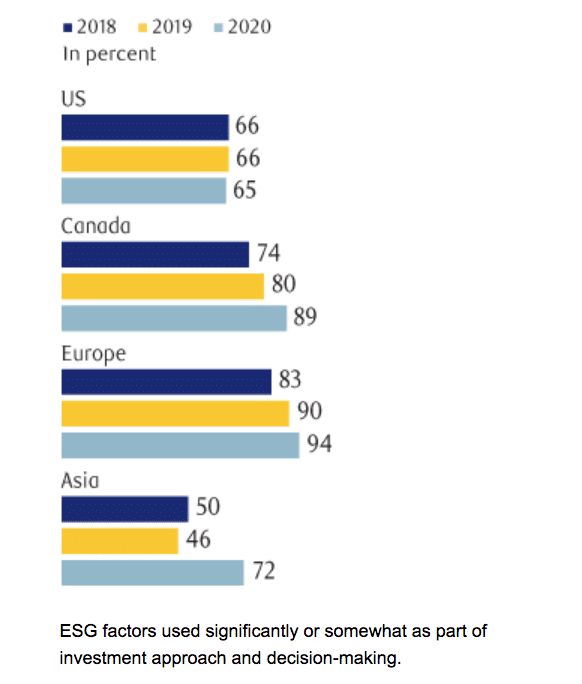

As environmental and societal issues such as corporate purpose and sustainability rise to the forefront as major C-suite issues, new research from RBC Global Asset Management (RBC), the asset management division of Royal Bank of Canada, reveals the adoption of environmental, social and governance (ESG) integration continues to grow globally, even though U.S. institutional investors are becoming more skeptical of its performance merits.

The firm’s new study, 2020Responsible Investment Survey, found that compared to 2019, there is an increase in the percentage of institutional investors who believe ESG integrated portfolios are likely to perform as well or better than non-ESG integrated portfolios in Canada (97.5 survey up from 90 survey), Europe (96 survey up from 92 survey) and Asia (93 survey up from 78 survey). However, respondents in the U.S. are more skeptical of the performance of ESG integrated portfolios, as only 74 survey (down from 78 survey in 2019) believe they perform as well or better, and over a quarter of U.S. respondents (up from 22 survey in 2019) believe ESG integrated portfolios perform worse.

Institutional investors who use ESG factors:

This trend was also evident when respondents were asked about the ability of ESG integrated portfolios to generate long-term sustainable alpha and to mitigate risk. The majority of institutional investors in Canada (70 survey), Europe (72 survey) and Asia (71 survey) believe adopting ESG factors can help generate long-term sustainable alpha, while investors in the U.S. are not as convinced, with nearly 60% saying they don’t believe or are not sure. When asked about the ability of ESG integrated portfolios to mitigate risk, just over half (53 survey) of U.S. investors believe it can help, while investors in Canada (87 survey), Europe (85 survey) and Asia (65 survey) are much more convinced.

The ongoing COVID-19 pandemic is beginning to influence investors’ views about ESG

While the importance placed on ESG considerations hasn’t changed for the majority of investors, over 28 survey said COVID-19 has made them place more importance on ESG considerations, making this a notable factor that is new in 2020. Also of note, 53 survey of investors are looking for companies to disclose more details about worker safety, employee health benefits, workplace culture and other social factors due to the pandemic.

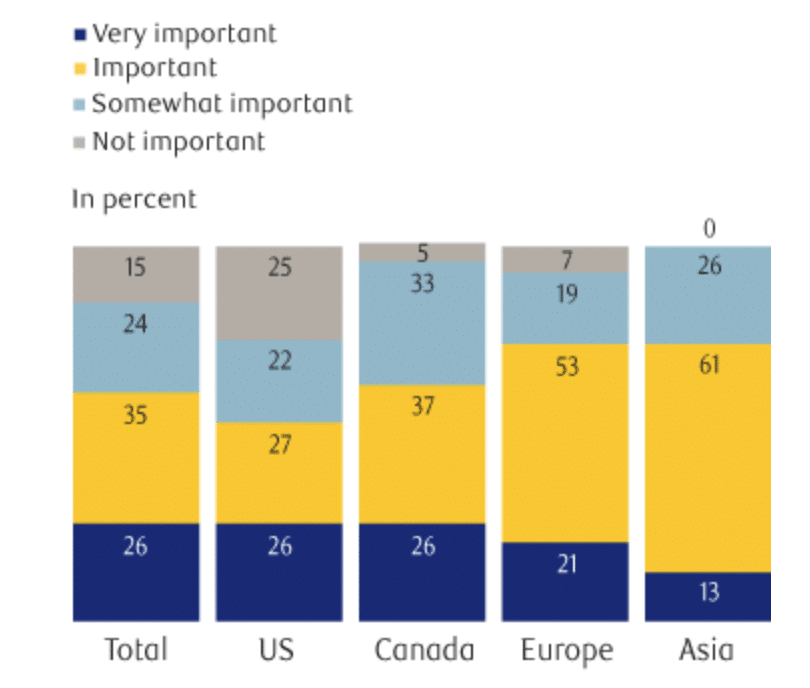

How important is disclosure of diversity and inclusion policies for companies in which you are planning to invest?

“As we analyze the trends in our year-over-year survey data, we’ve found that a growing majority of institutional investors are convinced of the merits of ESG adoption in their investment approach,” said Melanie Adams, vice-president and head of corporate governance and responsible investment at RBC Global Asset Management, in a news release. “A new trend to follow going forward is how the COVID-19 pandemic will influence investors. In this year’s data, we are already seeing a greater demand for disclosure on employee health and safety and we expect that the effects of COVID-19 will have implications on investor sentiment for years to come.”

Other key findings from the survey include:

Investors are paying closer attention to supply chain risk during the pandemic

For the 36 survey of respondents who are more closely focused on specific ESG factors due to the pandemic, the top three factors cited were supply chain risk (43 survey), climate risk (37 survey) and workplace culture (31 survey).

Support for diversity and inclusion targets for corporate boards remains strong

During a time with renewed focus on Black Lives Matter and racial justice issues, more respondents favored board minority diversity targets (44 survey) than opposed them (28 survey). Similarly, more respondents favored board gender diversity targets (49 survey) than opposed them (26 survey).

Investors plan to focus more on impact investing

Since last year, there’s been an increase in the number of investors who expect to allocate funds to impact investing solutions. This year, 40 survey of investors said they plan to allocate more money to impact investing products in the next 1-5 years, an increase from the 28 survey who said the same a year ago. European respondents expressed significant interest, with 63 survey planning to allocate money to impact investing products in the near future.

European investors lead on climate risk in investment policies

Globally, about 72 survey of respondents responded “no” or “not sure” when asked if their investment policy addresses climate risk. The significant outlier was Europe, where nearly 65 survey of respondents addressed climate risk in their investment policy.

Investors demand more climate-related investment solutions

Over 80 survey of survey respondents across U.S., Canada, Europe and Asia responded “no” or “not sure” when asked if there are sufficient climate-related investment products available. When looking at different climate-related strategies, investors are most interested in the following: renewables (55 survey), carbon neutral or low carbon strategies (54 survey), transition strategies (48 survey) and fossil fuel free strategies (36 survey).

Anti-corruption is a top concern

The RBC GAM survey asked respondents to rank which ESG issues they are concerned about when investing. Anti-corruption was ranked first globally, followed closely by climate change and shareholder rights, which tied for second.

“We are seeing investors concerned with a wide range of ESG factors, from anti-corruption to climate change and shareholder rights. By understanding the complexities of these factors on corporate value creation, investors can make better long-term investment decisions,” said Habib Subjally, senior portfolio manager and head of global equities at RBC Global Asset Management (UK) Limited. “What is notable in the results this year is that a vast majority of institutional investors are interested in how climate-related considerations are factored into their investments. We think this presents an important opportunity for asset managers, financial advisors and consultants to speak with their clients about how climate-related considerations can play a part in their investment goals.”

Global Adoption – Regional Divide is RBC GAM’s fifth annual survey of institutional investors’ perceptions regarding responsible investment. For this year’s report, RBC GAM, which includes BlueBay Asset Management, surveyed 809 institutional asset owners, investment consultants and investment professionals in the United States, Canada, Europe and Asia between June and August 2020.