As an entire generation of digital natives moves into adulthood in China, age has become paramount among traditional demographics. Up until now, American brands have been at the top of most categories—and for the most part, they remain on top—but even in the largely traditional Far East, the times are indeed a’changing.

China-focused branding firm RTG Consulting Group recently released its 2017 Brand Relevance Report, covering 9 industries and based on aggregated data from quantitative consumer surveys, brand metrics, and qualitative feedback from both industry experts and consumers.

“This is an interesting time for brands,” said Marc-Oliver Arnold, chief strategy officer at RTG Consulting Group, in a news release. “Brands are expanding and targeting up-and-coming niche trend markets, capitalizing on emerging trends to quickly head that sector—brands like adidas, WeChat and Huawei are key examples of the effectiveness of this strategy. To succeed, brands need to move at the speed of modern China’s cultures and subcultures.”

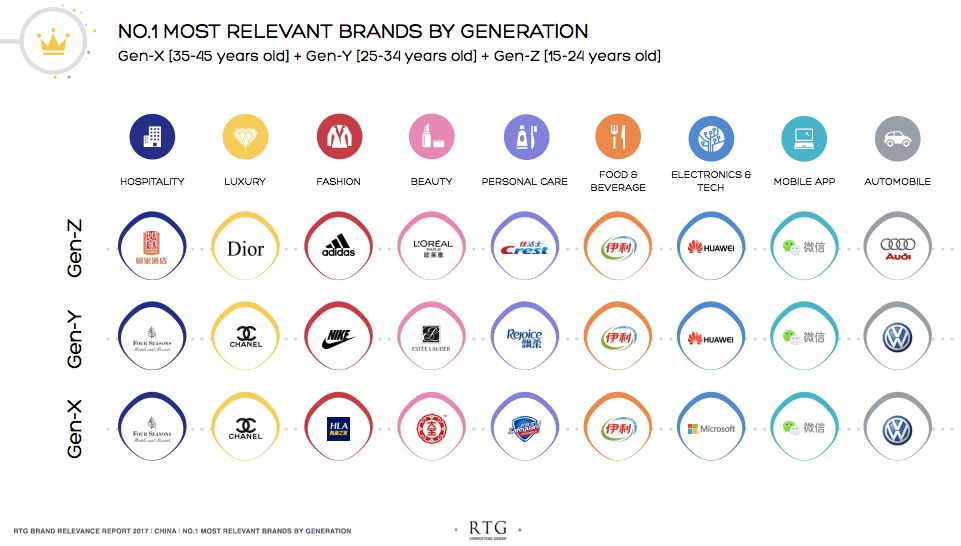

The report sorts brand relevance by age, and highlights generational (Generations X, Y and Z) differences in responses.

Most relevant brands by industry:

“At RTG our mission is to ensure our clients’ brands remain relevant to today’s consumers, so it’s critical to hear from Chinese consumers what brands are most relevant to them,” said Angelito Tan Jr., CEO of RTG Consulting Group, in the release. “What I find most interesting about this year’s report is this trend toward ‘Easternization’ with the increasing resonance of many Chinese brands across several industries. The rising influence and relevance these brands have on Chinese consumers cannot be overlooked. This may have a significant impact on the overall brand market landscape in the near future.”

Key highlights of the research:

- In the Fashion sector, global sportswear brands maintained their dominance, with adidas and Nike winning the top spot for Generations Z and Y, respectively. adidas performed especially well among brands of all categories and respondents of all generations, earning top marks in key metrics like passion, leadership and consistency. The brand has accomplished this by setting up large-scale distribution in lower tier cities while pursuing inventive marketing strategies that endear it to different subcultures, especially amongst Chinese millennials (Gen-Z).

- While international fashion brands enjoyed strong growth, up-and-coming local brand HLA saw a meteoric rise to number four in the overall fashion rankings, topping the rankings for most relevant fashion brand among China’s Generation X.

- In the Mobile App sector, WeChat continues to dominate. Remarkably, only one international mobile app, Amazon, made it in to the top 20. The biggest surprise, however, comes from the fall of Apple in the Electronics & Tech sector. After scoring most relevant in Electronics & Tech in 2016, the brand fell to the 6th spot for 2017 while local brand Huawei tops the ranking thanks to strong momentum with Chinese millennials (Generations Y and Z).

- In the Food & Beverage sector, the biggest winner is local brand YiLi, who scored very high in regards to authenticity, passion, dynamism, trustworthiness, leadership and social responsibility. YiLi is making an increasingly significant impact both domestically and overseas, which is especially impressive given the melamine scandal of 2008. They’ve managed to overcome this momentous setback, regain their reputation and proceed with business growth.

- The only sector where local brands did not experience significant growth is Luxury. Of the top 20 most relevant brands, none are local Chinese. Chanel ranked highest for China’s Generations X and Y, and second for Generation Z, who ranked Dior as their favorite for Luxury.

The report is based on a survey of 5,000 consumers in Shanghai, Beijing, Guangzhou and Chengdu, as well as qualitative interviews with 45 China industry experts and select consumers.