The holiday season is a complex time of year for retailers in any economy—but in 2022, record-high inflation, blowback from global supply chain disruptions, and an intensely competitive labor market threaten to take the “happy” out of holidays before the season even starts, new research from multinational tech firm UKG finds.

In the firm’s new report, Retail’s 2022 Holiday Season Outlook, retailers say they’re committed to elevating the customer experience in stores for the holidays—it’s their #1 priority for the season—and 91 percent agree store employees are instrumental to bringing these experiences to life. However, 84 percent of retailers acknowledge that customer expectations today are higher than what their stores can deliver in terms of service (up from 75 percent in 2021).

The firm’s third-annual retail holiday season survey and trend report finds many U.S.-based retail stores are struggling to meet sales goals because they’re short staffed (80 percent, up from 68 percent in 2021) and say customers will likely feel the impact of these labor challenges when shopping for the holidays (72 percent).

Almost all retail stores will be understaffed at least once a week throughout the holidays

Despite their best efforts, 95 percent of retailers predict weekly understaffing in stores during the holiday season. One in 10 (11 percent) say stores could be understaffed five days a week minimum, and nearly 1 in 3 (29 percent) are preparing to be short-staffed “most weekends.” To help fill labor gaps during their busiest months, 77 percent plan to tap gig workers, and retailers estimate on-demand talent could represent up to 14 percent of their total in-store workforce for the 2022 season.

Do people want to work in retail anymore?

Looking back, 36 percent of retailers had to alter store hours in 2022 due to insufficient staffing, and nearly 1 in 5 (19 percent) said their stores were understaffed at least half the time in August. Explosive turnover, employee ghosting, and unplanned absences are all partially to blame. The monthly UKG Workforce Activity Report similarly highlights a steady decline in retail shift work throughout 2022, including a 3.1 percent drop from August to September.

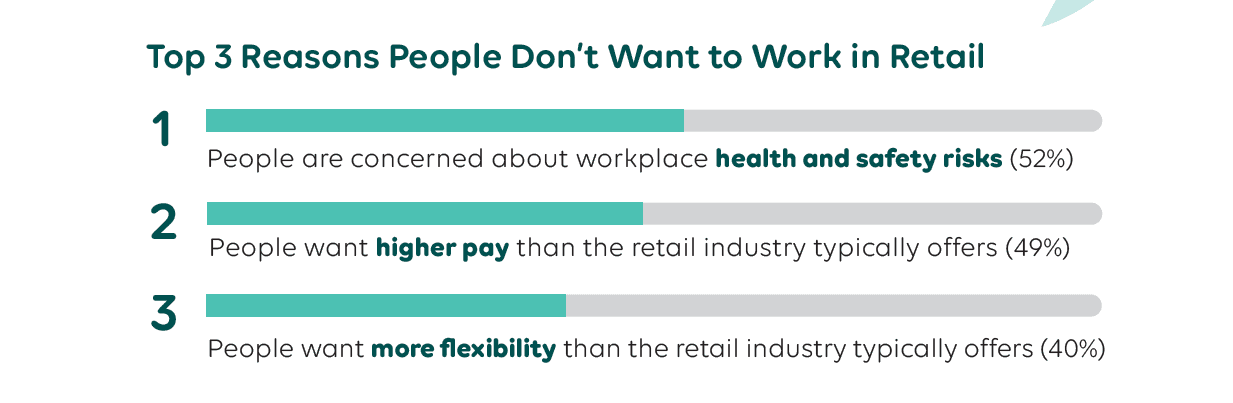

Taking stock of recent staffing patterns, close to two-thirds of retailers (63 percent) get a vibe that people just don’t want to work in retail anymore—a preference they feel is primarily motivated by concerns about workplace health and safety risks, such as catching COVID-19 or dealing with hostile customers (52 percent), as well as a desire for increased pay (49 percent) and flexibility (40 percent).

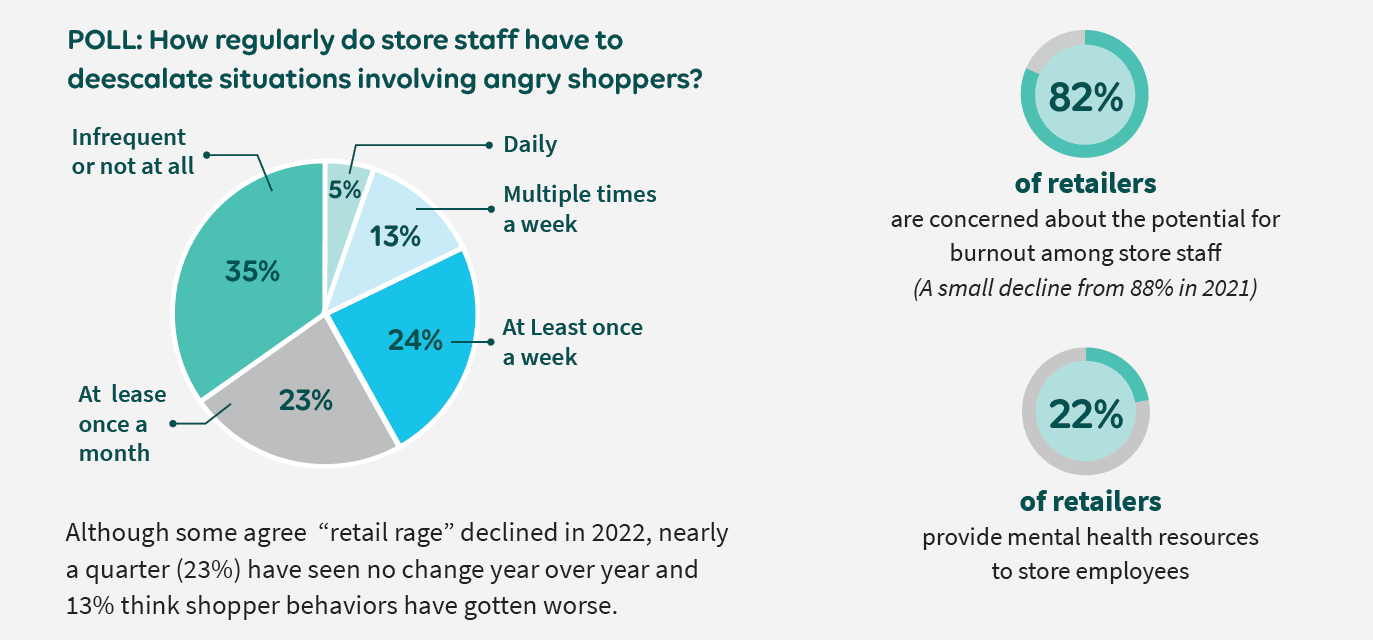

A pandemic-era rise in retail theft and guest-on-associate violence poses real impacts to employees’ physical and mental health. Store staff are responding to situations involving angry shoppers once a week or more, according to 42 percent of retailers, and 13 percent say shopper behavior has gotten worse recently, not better. Nearly a third of retailers (31 percent) said store managers quit in the past 30 days because they were mistreated by customers.

Store managers are also quitting in search of greater schedule flexibility, according to 50 percent of retailers. Jobseekers increasingly want flexibility to work the shifts they want (39 percent agree this is a top consideration), and the survey reveals numerous opportunities to capitalize on this unmet demand to attract and retain talent (e.g., offering on-demand employment in house, allowing employees to self-schedule), as detailed in the report.

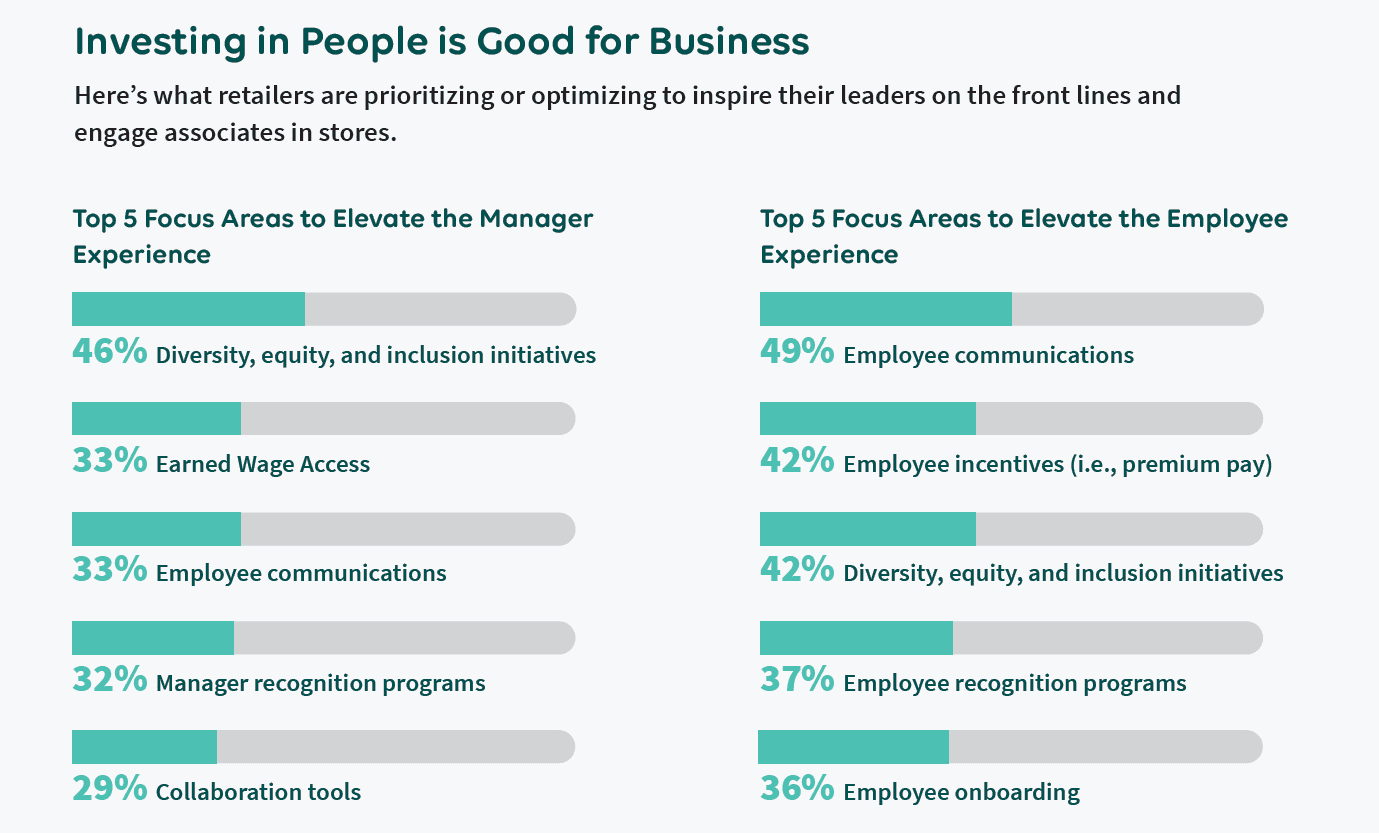

“Understanding why people are gravitating away from retail work or leaving their employer in search of a better alternative is the first step toward fixing the workplace experience and developing a safe and comfortable environment for employees to work and customers to shop,” said Rob Klitsch, director of the retail, hospitality, and food service practice at UKG, in a news release. “Employee experience determines customer experience, so to improve the latter, retailers must address their people’s needs first.”

Retailers hesitant to hire amid economic uncertainty

Put in a tough position, retailers approach holiday hiring with caution.

- Only 40 percent say their stores are hiring seasonal workers for the holidays, and 35 percent will recruit fewer seasonal workers than last year.

- A third (33 percent) are scaling back all hiring in stores for the remainder of 2022, and more than a quarter say in-store hiring freezes are likely (26 percent). Another 26 percent are actively taking steps to reduce headcount today.

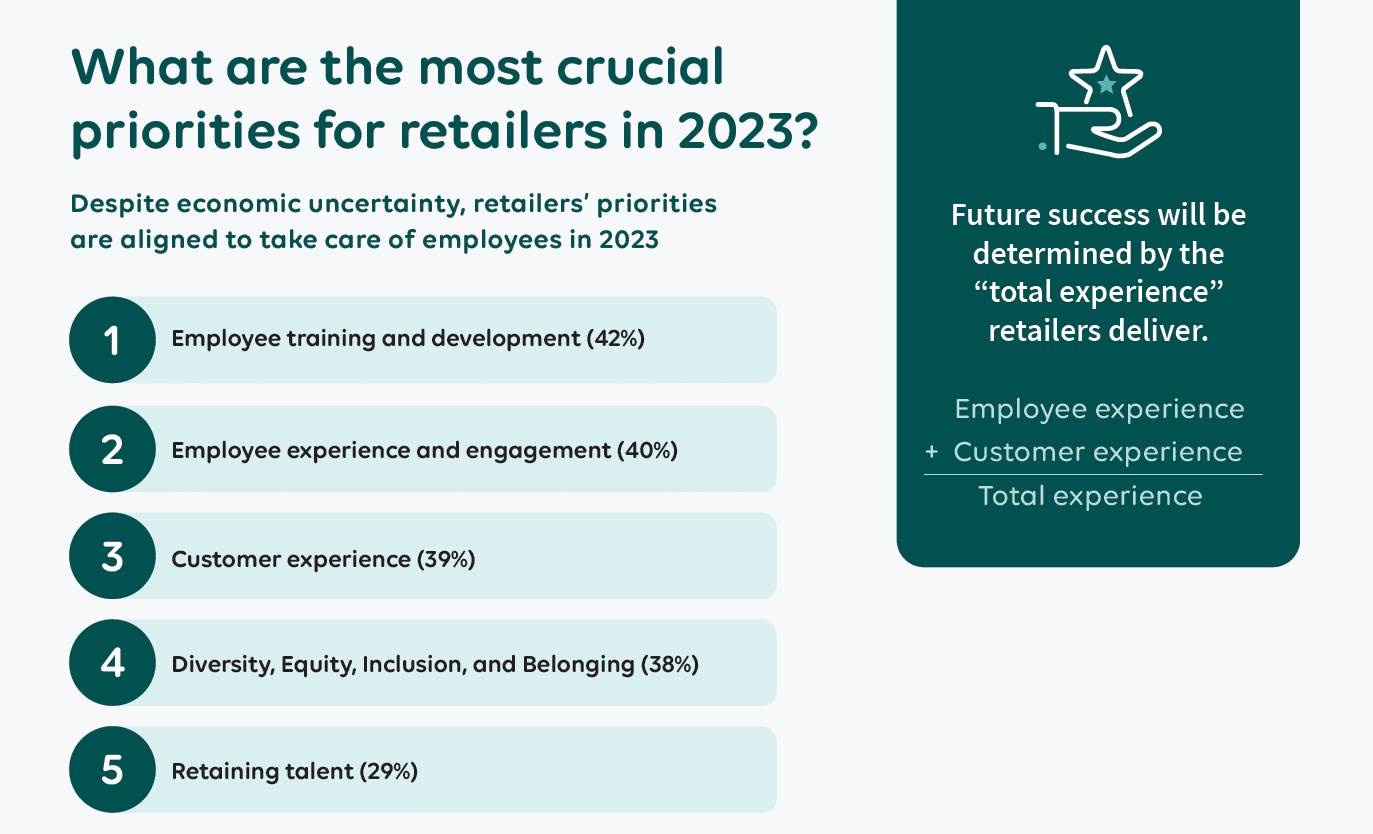

Future success will be determined by “total experience”

Priorities for retailers in 2023 are aligned to provide a powerful total experience for people to shop and work: their top three initiatives span employee training and development (42 percent), employee experience and engagement (40 percent), and customer experience (39 percent).

“Bringing exceptional experiences to life for managers, employees, and customers simultaneously is vital year-round. The key is to listen, adopt, and adapt quickly, because the future of work is now,” said Klitsch.

Download the full report here.

This survey was commissioned by UKG and conducted online between August 31 and September 9, 2022, among a pool of 305 store managers, owners, and executives representing U.S.-based retailers spanning numerous industry segments, including big-box retailers, department stores, drugstores, and others specializing in apparel, electronics, furniture, home, luxury, discount, and sporting goods. Around one-third of retailers surveyed (31 percent) have more than 25 stores, 56 percent employ more than 500 employees, and 42 percent % operate a distribution center or warehouse.