Even though the health & hygiene industry has increased its performance from a year ago, largely due to the increased demands for germ-killing products during the pandemic, it still ranked eighth out of the 10 industries studied in MBLM’s Brand Intimacy COVID Study, an analysis of brands based on emotional connections during the pandemic.

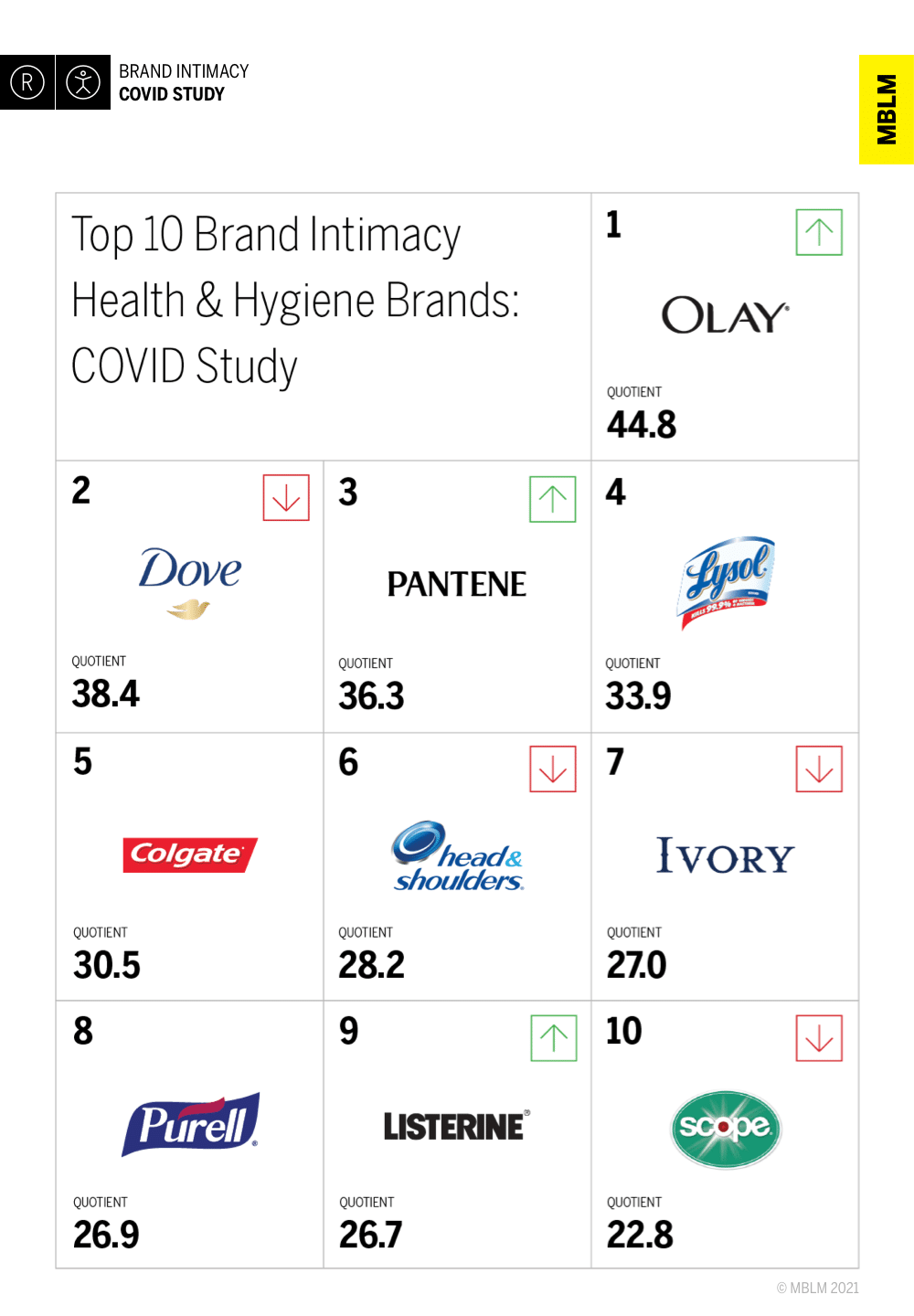

Olay made the best emotional connections with customers in the sector, followed by Dove and Pantene. The remaining brands in the top 10 for the industry are Lysol, Colgate, Head & Shoulders, Ivory, Purell, Listerine and Scope. Lysol and Purell are both new entrants to the top 10, which is attributed to the pandemic and the focus on sanitization.

Lysol’s sales grew 50 percent year-over-year during the first quarter of 2020, when the pandemic hit. Overall, hand sanitizer sales grew by 600 percent in 2020. Purell saw sales rise by 568 percent from February 2020 through February 2021. Purell ranks #1 out of all brands for consumers willing to pay 20 percent more for its products and #2 overall for increased usage since COVID.

According to MBLM’s study, intimate brands continue to significantly outperform the leading brands in the Fortune 500 and S&P 500 indices across revenue growth, profit growth and stock price.

“We observed that consumers’ bonds with hygiene products have grown significantly during COVID, due to our focus on preventing disease,” said Mario Natarelli, managing partner at MBLM, in a news release. “Overall, however, the industry has seen minor improvement from our previous study. Shortages, price gouging and limited communications may have minimized gains the industry made. We believe brands in this space have not leveraged the bonds established with consumers to create stronger emotional connections.”

Additional notable health & hygiene industry findings include:

- The industry has an average Brand Intimacy Quotient of 31.6, below the cross-industry average of 38.1. However, the category has increased its average Quotient Score by 5 percent

- Consumer preference for Pantene has increased, while preference for Ivory and Head & Shoulders has decreased

- Brands perform better with men than women and with consumers older than 35 years old versus those under 35

- The category also improved its performance on the “willing to pay 20 percent more” and “can’t live without” measures, which is not surprising given the key roles several brands have played during the pandemic

MBLM also wrote an article examining the health & hygiene industry entitled, “How Health & Hygiene Brands Are Building Intimacy During the Pandemic.” The piece discusses the industry findings of MBLM’s study and also looks at how the top two brands communicated during the pandemic on their websites and outbound social.

View the health & hygiene industry findings here. Download the industry report here. Download the main Brand Intimacy COVID Study report here.