Business leaders and their communications counselors are struggling to choose from the ever-growing number of executive visibility platforms and lack a strategic approach to prioritizing time and resources spent on thease programs, according to a new study from Burson-Marsteller. Most respondents say they do not feel well-informed enough to take a strategic approach to executive visibility programs, and have difficulty measuring their executives’ return on participation (ROP) in such efforts.

The research revealed that the process for determining which executive visibility platforms to leverage is often ad-hoc and informal; on average, only one in four respondents say they “kind of understand” the options available. When making decisions about which platforms to pursue, more than half of respondents (58 percent) say they rely on word-of-mouth, especially if an executive mentions or recommends a particular event or platform. In seeking to prioritize and rank the most valuable platforms, many tied for the top spots, perhaps indicating that the sheer volume of options and lack of strategic approach has led to challenges in prioritization.

“We’ve seen tremendous growth in the number of platforms available to U.S. executives who want to raise their public profiles and establish themselves as thought leaders,” said Alan Sexton, chair of U.S. Corporate and Financial Practice at Burson-Marsteller, in a news release. “A more ‘target-rich’ environment means more opportunities for visibility than ever, but also a more complex and challenging landscape. Executives and their communications teams clearly recognize this, and see the need for a more sophisticated, strategic approach to executive visibility programs.”

“Beyond getting into the top venues or using the most popular digital platforms, smart companies are aligning their thought leadership programs with their business strategies and priorities,” said Burson-Marsteller U.S. CEO Mike Fernandez, in the release. “When a strategic process is set from the earliest stages of evaluation and selection and linked to measurable outcomes, it can be a winning formula.”

The survey was conducted in partnership with research firm PSB and included a quantitative online survey of 300 vice presidents and above (“business decision-makers”) from large companies and mid-sized enterprises. Qualitative in-depth-interviews were also conducted to delve deeper into the quantitative findings.

Other key findings include:

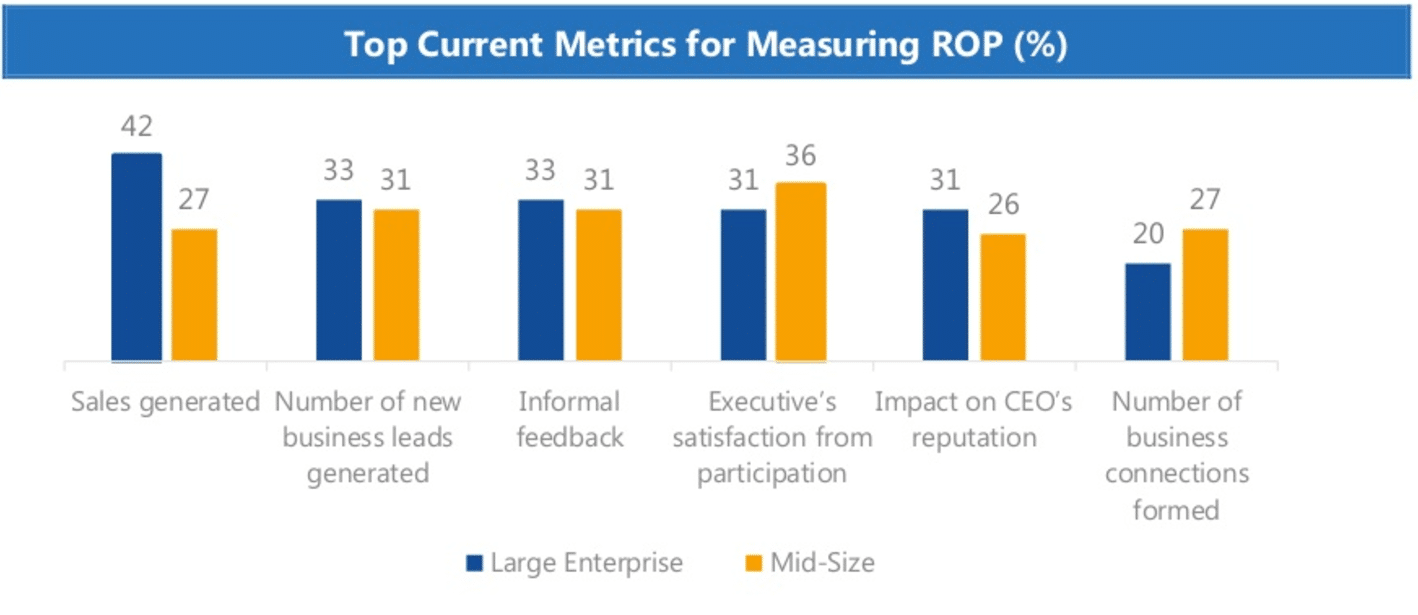

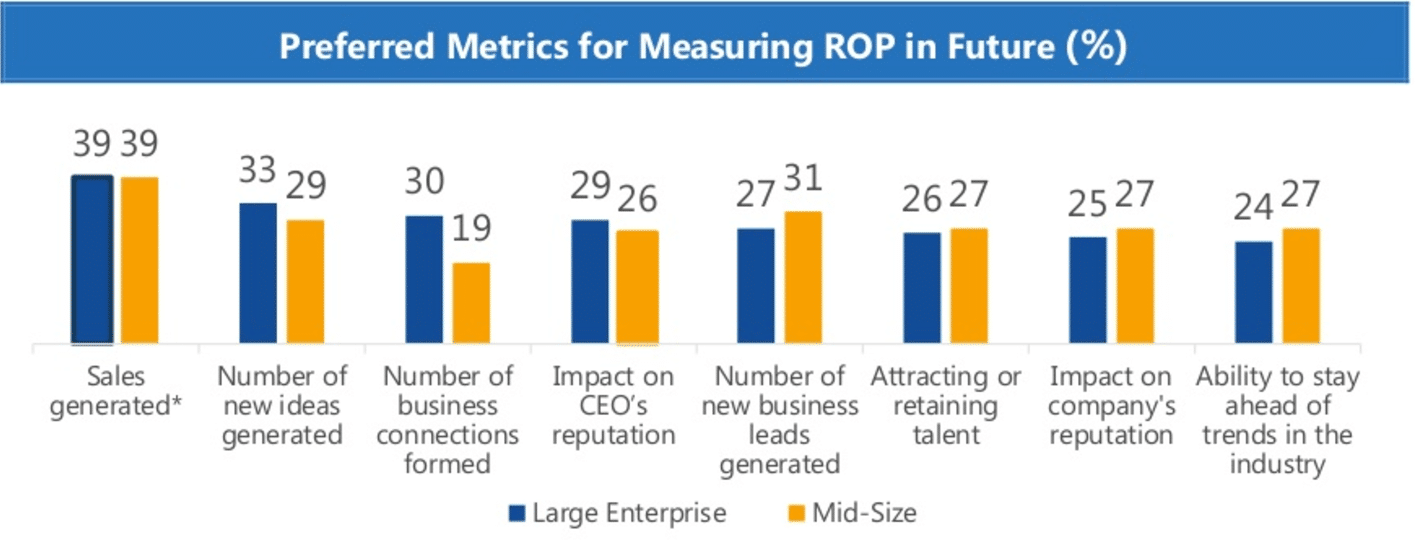

- Measurement is Ad-Hoc and Under-Resourced: Almost four in five of respondents say they want a more structured and systematic approach to determine ROP, but 40 percent feel they do not have the financial and human resources to do this. Respondents believe measuring success is as much art as science; what is important to one person or department may not be important to another.

- Sales Leads are the Default Success Metric: In the absence of better and more relevant indicators, sales activity is the default metric currently used by 42 percent of business leaders to gauge the value of different platforms. Decision-makers and communicators recognize there are other, less tangible benefits, but need assistance to identify specific objectives and measures of success.

- Most Valuable Platforms of the Future Differ from Today’s: Respondents see CEO summits and councils as important conferences and events today, but think technology, women’s and ideas-focused conferences are gaining importance. Corporate reputation, workplace and CEO awards and rankings are seen as important now; however, opportunities related to innovation, diversity and sustainability are expected to increase in importance in the coming years.

- Increasing Focus on Digital Platforms and “Owned” Events: Moving forward, decision-makers want to be more active on digital platforms. Also, recognizing the opportunities in creating their own branded channels, many want to host their own events rather than participate in third-party conferences.

- CEOs Have Markedly Different Priorities: When it comes to choosing platforms, CEOs are more concerned about visibility, thought leadership and connecting with multiple stakeholders, while other business decision-makers are more focused on clients or customers and new commercial opportunities. For example, CEOs (55 percent) are more likely than other decision-makers (35 percent) to think it is important to speak with the media when attending conferences and events. Importantly, CEOs also have different views on measuring ROP: CEOs value the impact it has on their reputation (42 percent) over sales generated (33 percent). Other decision-makers prioritize sales generated (35 percent) and number of new business leads generated (33 percent).

Most valuable platforms

Respondents were asked to select opportunities they view as important today and those they see as becoming more important in the next few years. Based on these perceptions, a ranking of the “Most Valuable Platforms” emerged, with many opportunities tied for the top spots.

Events and conferences:

| CURRENTLY IMPORTANT | GAINING IMPORTANCE | |||

| Rank | Platform | % | Platform | % |

| 1 | Bloomberg LIVE Events, hosted by Bloomberg

Consumer Electronics Show, hosted by Consumer Technology Association |

42 | Aspen Ideas Festival, hosted by The Atlantic and The Aspen Institute

Bloomberg Technology Conference, hosted by Bloomberg Milken Institute Global Conference, hosted by Milken Institute Events hosted by YouTube |

28 |

| 2 | AWS re:Invent, hosted by Amazon

CEO Council events, hosted by The Wall Street Journal Microsoft CEO Summit, hosted by Microsoft |

41 | Fortune Most Powerful Women Summit, hosted by Fortune

Events hosted by The New York Times Women in the World Annual Conference, hosted by Women in the World and The New York Times |

27 |

| 3 | Forbes Global CEO Conference, hosted by Forbes

Events hosted by The New York Times WSJ ECO:nomics, hosted by The Wall Street Journal

|

40 | Brainstorm E, hosted by Fortune

Conference of the Parties (COP), hosted by United Nations Framework Convention on Climate Change Corporate Conference, hosted by Council on Foreign Relations Dreamforce, hosted by Salesforce Events hosted by LinkedIn Zeitgeist, hosted by Google |

26 |

| 4 | CEO Summit, hosted by Yale School of Management

World Business Forum, hosted by World of Business Ideas

|

39 | Annual Meeting at Davos, hosted by World Economic Forum

AWS reInvent, hosted by Amazon Buttonwood, hosted by The Economist CERAWeek, hosted by IHS Markit FT Innovate, hosted by The Financial Times Events hosted by Politico Sustainable Brands’ Annual Conference, hosted by Sustainable Brands The Future Of: events, hosted by The Wall Street Journal (formerly known as Viewpoints Executive Breakfast Series) TEDGlobal, hosted by TED World Innovation Forum, hosted by World of Business Ideas |

25 |

| 5 | Annual Meeting at Davos, hosted by World Economic Forum

APEC CEO Summit, hosted by Asia-Pacific Economic Cooperation Forbes Healthcare Summit, hosted by Forbes WSJ D.Live, hosted by The Wall Street Journal

|

38 | APEC CEO Summit, hosted by Asia-Pacific Economic Cooperation

BSR Conference, hosted by Business for Social Responsibility Forbes Healthcare Summit, hosted by Forbes GreenBiz Annual Conference, hosted by GreenBiz SXSW Conference, hosted by South By Southwest Techonomy Annual Conference, hosted by Techonomy Media Inc. World Retail Congress, hosted by Ascential World Water Week, hosted by Stockholm International Water Institute |

24 |

Awards and rankings:

| CURRENTLY IMPORTANT | GAINING IMPORTANCE | |||

| Rank | Platform | % | Platform | % |

| 1 | Fortune’s 100 Best Companies to Work For | 47 | Fast Company’s Most Creative People in Business | 33 |

| 2 | Forbes’ America’s Best Employers

Fortune’s World’s Most Admired Companies |

44 | Glassdoor’s Highest Rated CEOs | 29 |

| 3 | Forbes’ World’s Most Innovative Companies | 42 | DiversityInc’s Top 50 Companies for Diversity

Newsweek’s Top Green Companies in the World |

26 |

| 4 | Barron’s World’s Best CEOs

Barron’s World’s Most Respected Companies Chief Executive Magazine’s CEO of the Year Forbes’ World’s 100 Most Powerful Women |

40 | Fast Company’s World’s Most Innovative Companies

Forbes’ World’s 100 Most Powerful Women Glassdoor’s Best Places to Work National Association for Female Executive’s Top Companies for Executive Women |

25 |

| 5 | Dow Jones Sustainability Indices

Fortune’s Businessperson of the Year |

39 | Corporate Knights’ Global 100 Most Sustainable Corporations in the World

CR Magazine’s 100 Best Corporate Citizens |

24 |

Burson-Marsteller, in partnership with Penn Schoen Berland, interviewed business decision-makers about the value and challenges of various platforms – specifically conferences and events, corporate awards and rankings, and digital and social channels. Our research sought to identify which platforms are most relevant today, and which emerging platforms companies are gravitating toward to reach and influence stakeholders in the future. The research was both quantitative and qualitative, including an online survey of 300 vice presidents and above (“business decision-makers”) from large (10,000+ employees or $5 billion+ in revenue) and mid-sized enterprises (1,000 – 9,999 employees or $500 million-$4.9 billion in revenue) and eight in-depth-interviews (IDIs) that delved deeper into the quantitative findings. The online survey was conducted between June 8 and June 17, 2016. The IDIs were conducted between October 14 and November 15, 2016.