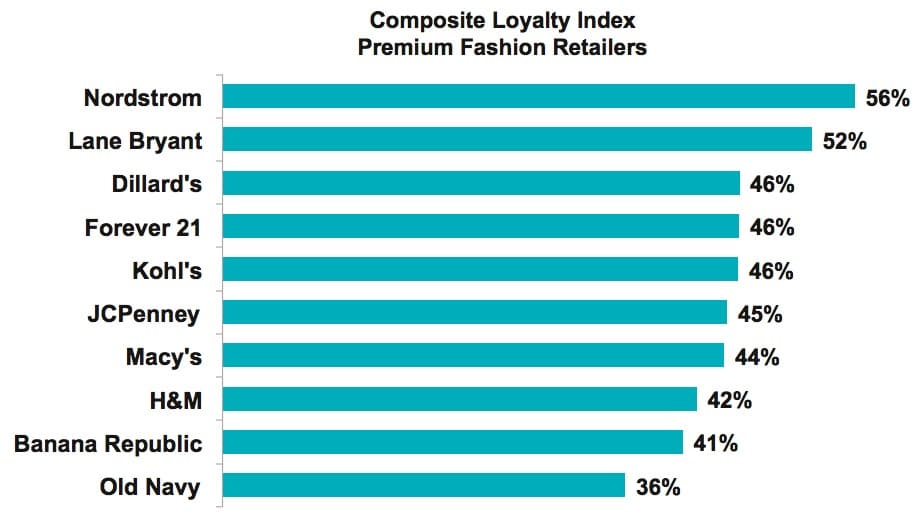

Nordstrom continues to ride high in popularity, ranking as the country’s favorite premium fashion retailer for the sixth year running in Market Force Information’s annual study.

The firm polled more than 10,000 consumers for the study, which ranks premium fashion retail brands, identifies what sets each apart and uncovers retail technology trends.

Lane Bryant gains serious ground to snag No. 2 spot

Although customer service legend Nordstrom again topped the rankings with 56 percent, it lost ground over last year when it scored 64 percent. Meanwhile, Lane Bryant, a plus-size specialty brand, gained seven percentage points this year to earn second place with 52 percent, while Dillard’s, Forever 21 and Kohl’s tied for third with a 46-percent score. Rounding out the list was JCPenney in fourth, Macy’s in fifth, H&M in sixth, Banana Republic in seventh and Old Navy in eighth.

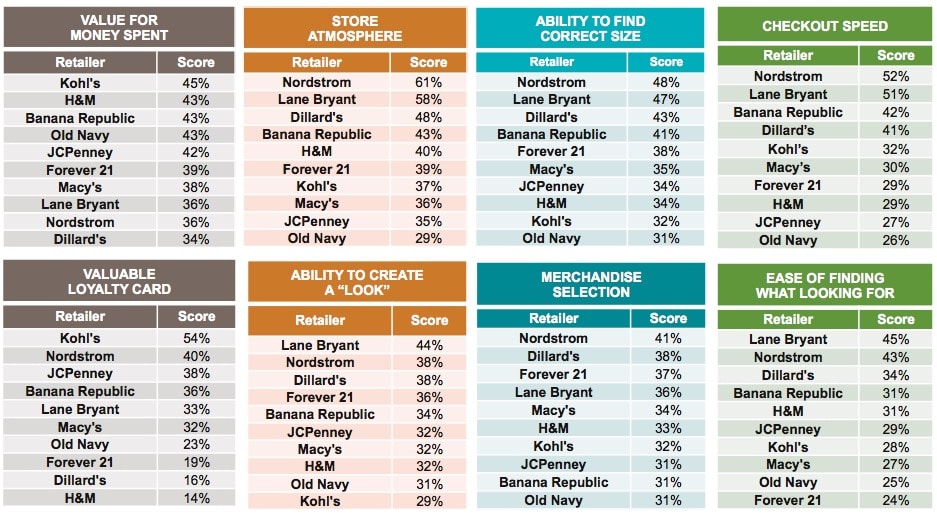

Kohl’s is tops for value and loyalty cards, Nordstrom for selection

Market Force also looked at fashion retailer attributes that matter most to shoppers. Kohl’s ranked first for its loyalty card program, as well as for delivering high value for the money – one of the only categories that found Lane Bryant, Nordstrom and Dillard’s at the bottom. Overall-leader Nordstrom was found to have the best merchandise selection, size options, atmosphere and checkout speeds. Lane Bryant was a clear leader for shoppers’ ability to create a look, and took the No. 1 spot for ease of finding items. Dillard’s and Banana Republic also performed consistently well across the board.

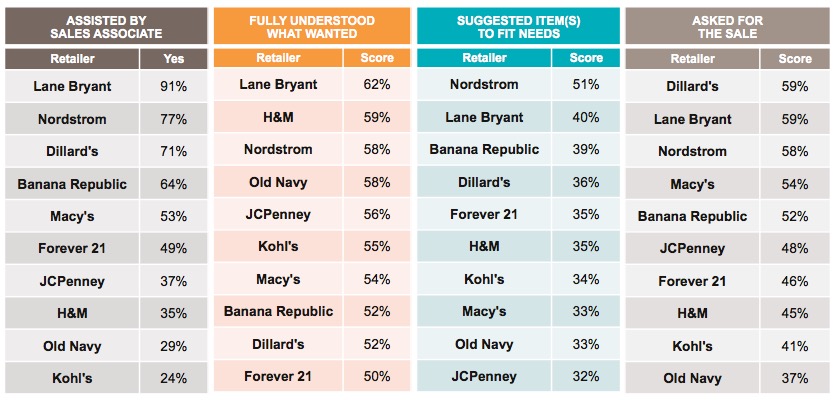

Who’s delivering on sales support?

Many consumers are still navigating through their fashion shopping experience unassisted, despite statistics showing they’re significantly more likely to make a purchase when they receive help from sales personnel. Just 43 percent reported being helped by a sales associate during their last shopping trip, and only 38 percent received suggestions for items that fit their needs. Lane Bryant and Nordstrom associates assisted customers most often, while Kohl’s and Old Navy customers were assisted the least.

“Retailers spend good money to market, promote and advertise their brands to lure shoppers into their door, but if their front-line representatives are failing to engage customers and deliver on the brand promise and fundamental customer service basics, they could easily lose that sale to their competitor next door,” said Brad Christian, chief customer officer for Market Force, in a news release. “Our research shows that just 54 percent of shoppers felt the associate fully understood their needs, which underlines the need to consistently train and assess associates to ensure they’re executing on best practice sales processes.”

Consumer confidence and fashion budgets take dip

Market Force found consumer confidence has slipped, with just 28 percent believing the economy will strengthen in the next year, compared to 40 percent who said as much in its previous year’s study. Slightly more (35 percent) expect it to weaken and 37 percent think it will stay the same. This outlook may be impacting consumers’ allocated fashion budgets, as only 9 percent plan to spend more this year compared to last, while 24 percent will spend less and 67 percent will spend about the same.

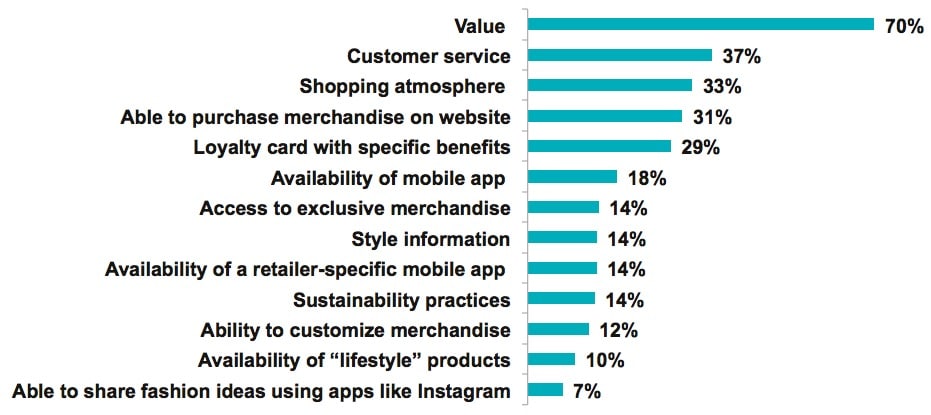

Brick-and-mortar shopping holds strong, driven by value

Brick-and-mortar shopping might be changing shape, but it’s still a popular option among consumers. The study found 76% have shopped at one of their favorite retailers’ physical stores at least once in the past 90 days, with 48% shopping at least three times and 14 percent at least six times. Value is by far the biggest driver in choosing where to shop (70 percent), followed by service (37 percent), atmosphere (33 percent) and the ability to purchase merchandise on a retailer’s website (31 percent).

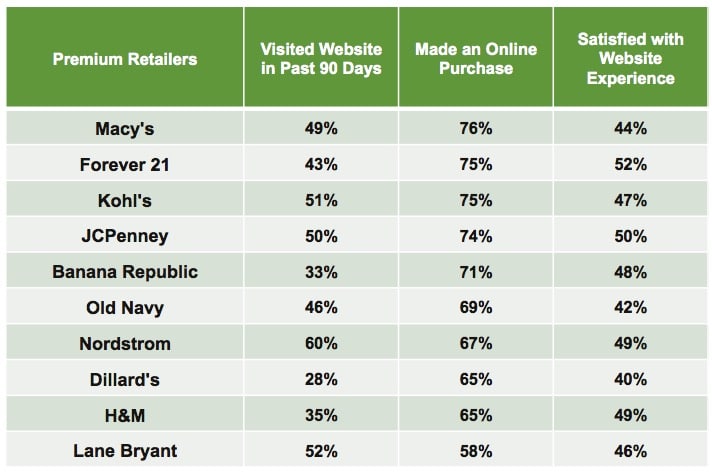

Macy’s cashes in on e-commerce

Fashion retailers’ online and social presence is becoming increasingly important, as more consumers go online to interact with them. Market Force found 75% interact with their favorite fashion retailer online, a 103% increase over the previous year. Most do so to sign up to receive email and text promotions.

In the past 90 days, 42 percent of consumers visited their favorite retailer’s website and 69 percent made a purchase. The most purchased merchandise online by far was casual clothing, followed by shoes, accessories, business clothing and sleepwear. Practically no one reported buying items such as perfume, cosmetics or gift cards online. Respondents reported visiting Nordstrom’s, Lane Bryant’s and Kohl’s websites the most, and making the most online purchases from Macy’s, Forever 21 and Kohl’s.

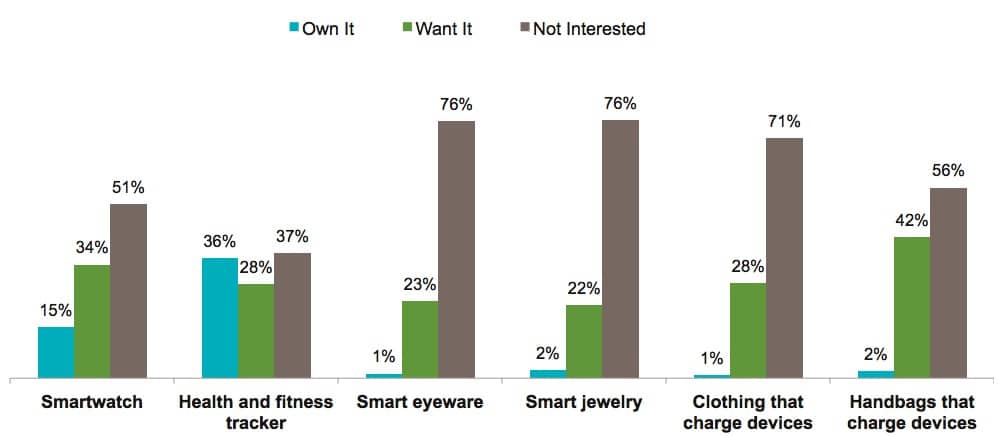

Negligible growth for wearables

Wearables have seen very little movement in the past year, with only a 1% uptick in those who own one (40 percent this year vs. 39 percent last year, and equally split between genders). The most popular type of wearables is health & fitness trackers, and fitness tracking also rates as the most desirable reason for owning one. Interest in and adoption of smart eyewear, jewelry and clothing was negligible, however, 42 percent said they’d like to own handbags that charge devices.

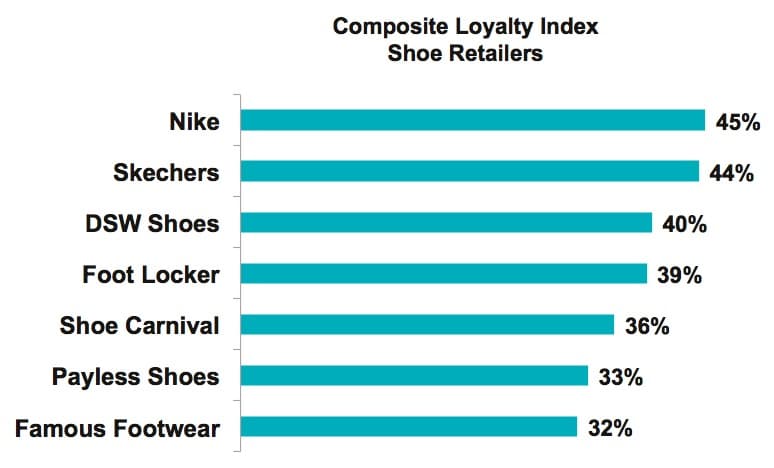

Nike two-peats in shoe rankings

The athleisure market is showing no sign of slowing down, achieving double-digit growth that’s being driven, in large part, by the continued popularity of athletic shoes. Market Force also analyzed shoe retailers and found that Nike is again the king, ranking as consumers’ favorite for the second year running with a 45-percent score. It narrowly beat out Skechers, which earned a second-place ranking with 44 percent, and was followed by DSW Shoes in third with 40 percent. Shoe Carnival made the greatest gains out of the brands studied.

Skechers scored well in most of the attributes studied, including edging out Payless Shoes in the value category and ranking first for merchandise selection and checkout speeds. Foot Locker rated highest for ease of finding products and tied for No. 1 with Nike for store atmosphere, but it had the lowest scores for value. Consumers ranked Nike as the best retailer for them to create an entire look and to find the correct size.

For the rankings, Market Force asked participants to rate their satisfaction with their most recent premium fashion retailer experience, and their likelihood to refer the brand to others. The results were averaged to attain a Composite Loyalty Score. Only retailers with at least 100 locations were included. The survey was conducted online in December 2017 across the United States. There was an overall pool of 10,821 respondents covering all four U.S. Census regions.