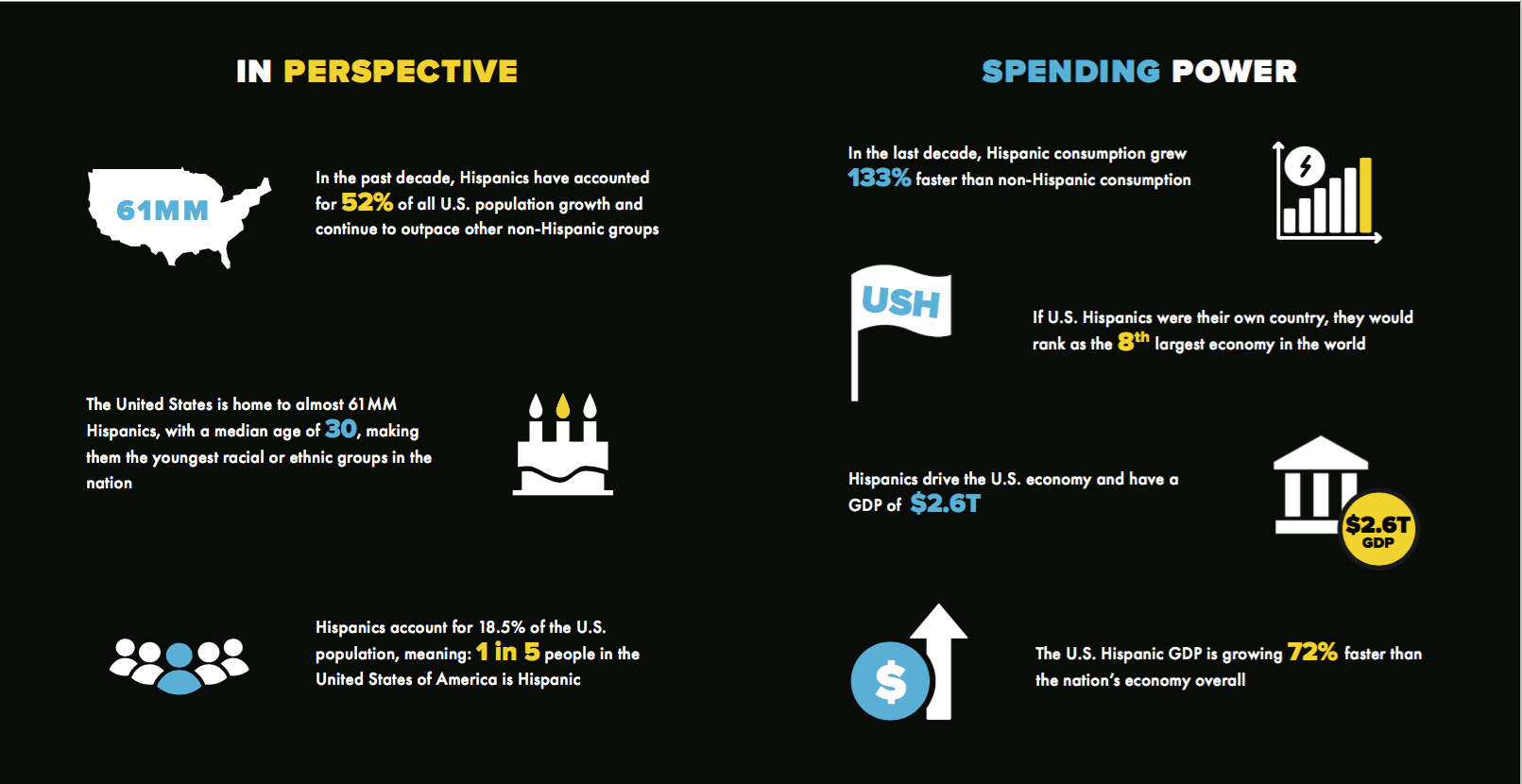

The Hispanic population is one of the fastest-growing demographic groups in the United States and holds significant influence on the economy and cultural landscape. In the past decade, Hispanics have accounted for 52 percent of all U.S. population growth and continue to outpace other non-Hispanic groups.

To compare, the white population’s average growth rate fell slightly below zero while the Black population grew by less than 1 percent per year between 2015 and 2019. They hold a GDP of $2.6 trillion which is growing 72 percent faster than the economy overall and up 35 percent from 2010. With this in mind, it is critical for brands to engage with them effectively with increased precision.

So how can communicators hone their targeting of this audience?

New research from Hispanic digital media company H Code provides insight into the nuances, attitudes, and digital consumption habits of the U.S. Hispanic consumer market following a year of fundamental change in the country’s socio-cultural landscape. The firm’s new Hispanic Digital Fact Pack is a valuable resource for brands as they build out their multicultural engagement strategies, revealing just how much the audience craves a tailored, authentic approach. With the prospect of a return to form in 2021, the Fact Pack provides valuable insight for brands to navigate engaging with this segment during the ramping up period.

“The Hispanic audience is a dynamic, rapidly changing segment that brands can’t afford to discount, especially as they continue to become more integral to the cultural fabric of this country,” said Parker Morse, founder and CEO of H Code, in a news release. “We hope this new resource will provide them with the guidance to engage with them with a renewed sense of authenticity and frequency.”

Top-line insights from the Fact Pack include the following:

Behavior and opinions

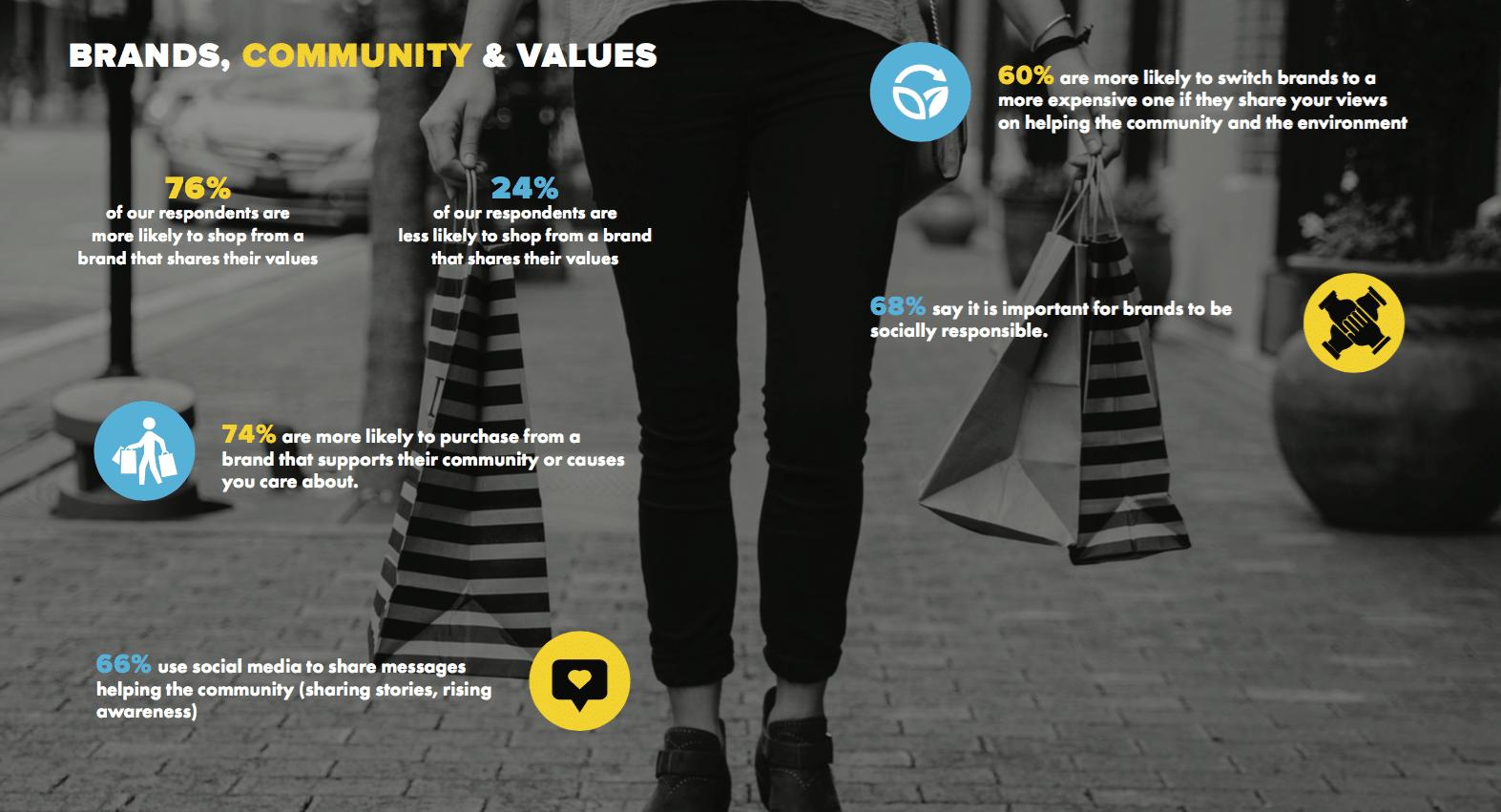

Seventy-one percent of Hispanics are more likely to think favorably about a brand or purchase products if they make an effort to include elements of their specific culture. Increasingly, the majority (70 percent) of Hispanics consider their culture a mix of American and Latinx culture, but the same majority do not think brands target Latinxs enough or understand Latinx culture. The key takeaway is that U.S. Hispanics are interested in brand values and are looking to engage with those who support their community or take the time to understand what matters most to them.

Accountability and a desire for diverse voices were highly resonant themes in social sentiment among Hispanic consumers with 76 percent saying they are more likely to shop from a brand that shares their values. They have also committed more strongly to advocating for social justice online with 66 percent using social media to share activist messages helping the community.

More of the Hispanic population is younger and U.S.-born which is dictating the way they consume content. Younger generations are showing a stronger preference for English or Bilingual ads, demonstrating that the outdated marketing practice of translation does not ensure success for advertisers and their campaigns.

Internet usage

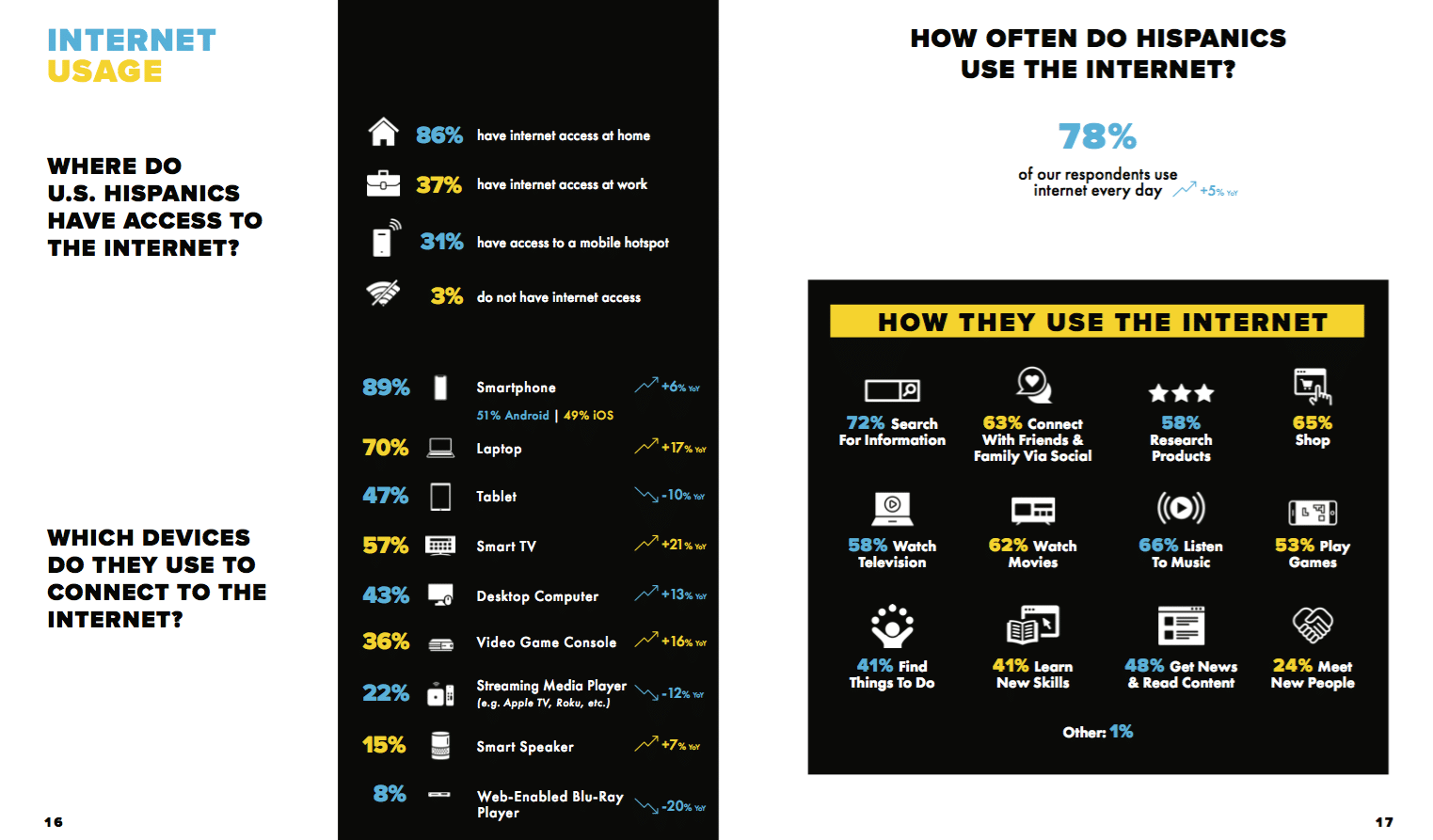

Eighty-six percent of U.S. Hispanics have access to the internet at home, with most using smartphones and laptops to search for information, connect with loved ones or consume content. In a significant shift from previous years, smart TVs were the third most used device among Hispanics when using the internet with 21 percent more users compared to last year while 10 percent less consumers reported using tablets. This is likely attributed to the impact of the pandemic and the increased need for entertainment as Hispanics and those across the nation stay home.

Platforms and devices

More respondents reported owning a smartphone compared to last year (95 percent vs. 93 percent) and have shown strong inclination to adopting other types of smart technology. When it comes to content consumption, 1 in 2 Hispanics have cut the cord and do not have a cable subscription at home. Eighty-three percent of Hispanics also listen to audio and music online. Gaming has also been increasing among Hispanics, with almost 3 in every 4 Hispanics also owning a gaming console.

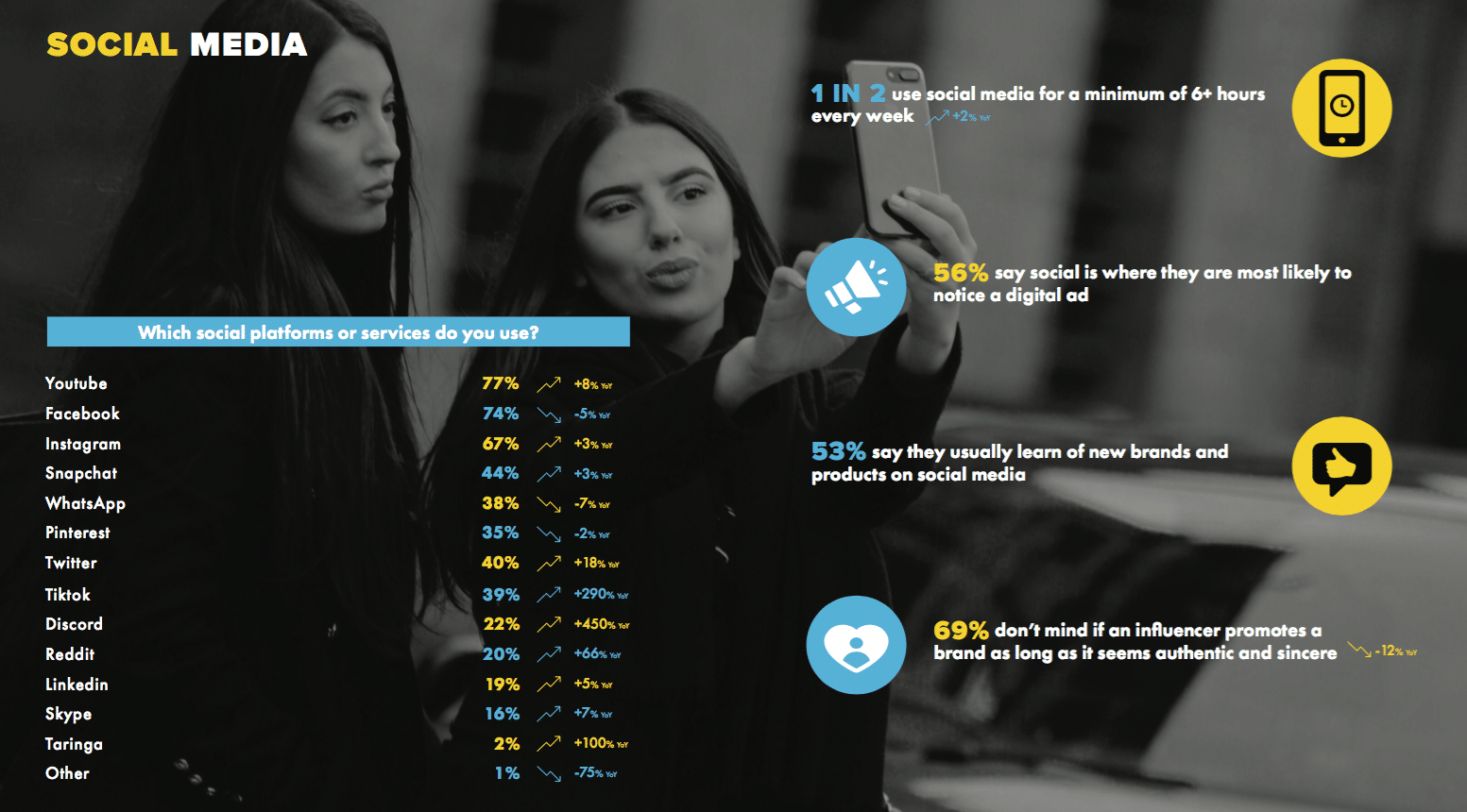

When it comes to social media, over three quarters of Hispanics spend a minimum of 3 hours every week on social platforms, compared to just over two thirds last year, which is where 56 percent of them say they are most likely to notice an ad. Influencer marketing has also caught on, with 69 percent not minding if an influencer promotes a brand as long as it seems authentic and sincere. TikTok usage has surged over the past year with 40 percent of Hispanics using the platform, representing an increase of 290 percent since last year. Video has also become the dominant content format, with 77 percent of Hispanic users favoring YouTube as their top online platform, displacing Facebook, which saw a 5 percent drop-off.

Entertainment and time spent

With more Hispanic consumers staying home due to the pandemic, the internet has become their primary source of entertainment and also a powerful tool for the digital communities they often create. 64 percent reported spending more time connected to the internet than before. Hispanics are enthusiastic tech users and consumers of digital content, with the majority reporting spending at least 1 hour more on activities like streaming TV and movies, playing video games and playing online audio.

Download the 2021 Hispanic Digital Fact Pack here.

The 2021 Hispanic Digital Fact Pack uses data collected from the H Code Intelligence Center’s 2021 Hispanic Digital Consumption Survey, administered from Dec 14 to Dec 27, 2020. The study surveyed 1,269 Hispanic/Latinx respondents—both English and Spanish-speaking—and is representative of all main geographical areas of the United States.