In the wake of a vastly fluctuating economy, new research from B2B precision demand marketing firm Integrate reveals how marketing budgets, priorities, and sentiments have changed in the past six months—and the new challenges marketers are having in validating their budget spend.

The firm’s new State of B2B Marketing Budgets 2023 report, conducted with global research and advisory firm Demand Metric, finds that nearly 50 percent of B2B marketers cite the difficulty of using data to inform decisions and measure performance as their biggest challenge, suggesting an increasing need for marketers to “defend the spend” to finance departments and C-level executives. As a result, nearly 90 percent of marketers surveyed report that data compliance and accuracy is a priority at their company.

“Today’s B2B marketers are in the unenviable position of making the unpredictable predictable in an uncertain market, and that means recalibrating everything from their goals to their focus,” said Colby Cavanaugh, SVP, Marketing at Integrate, in a news release. “This research suggests that today’s marketers are incredibly resilient, and they’re adapting by being flexible and leveraging both what they know works and investing in creative new solutions to drive pipeline.”

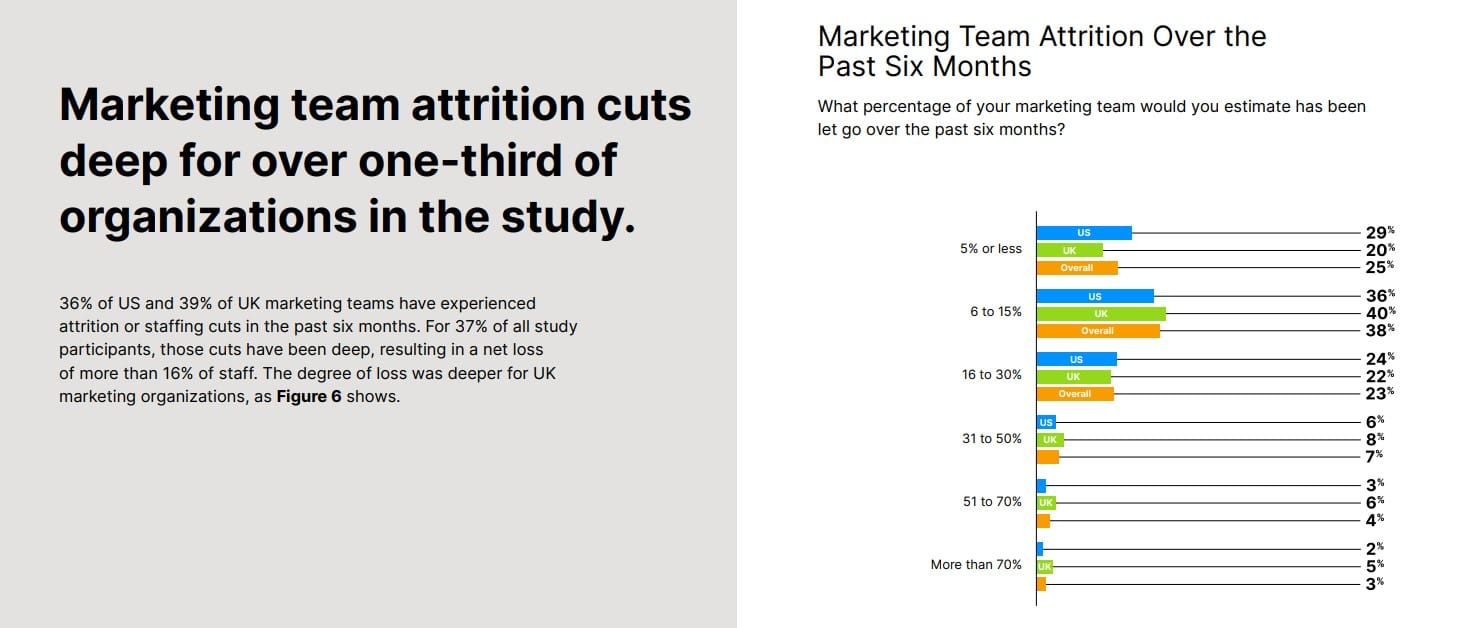

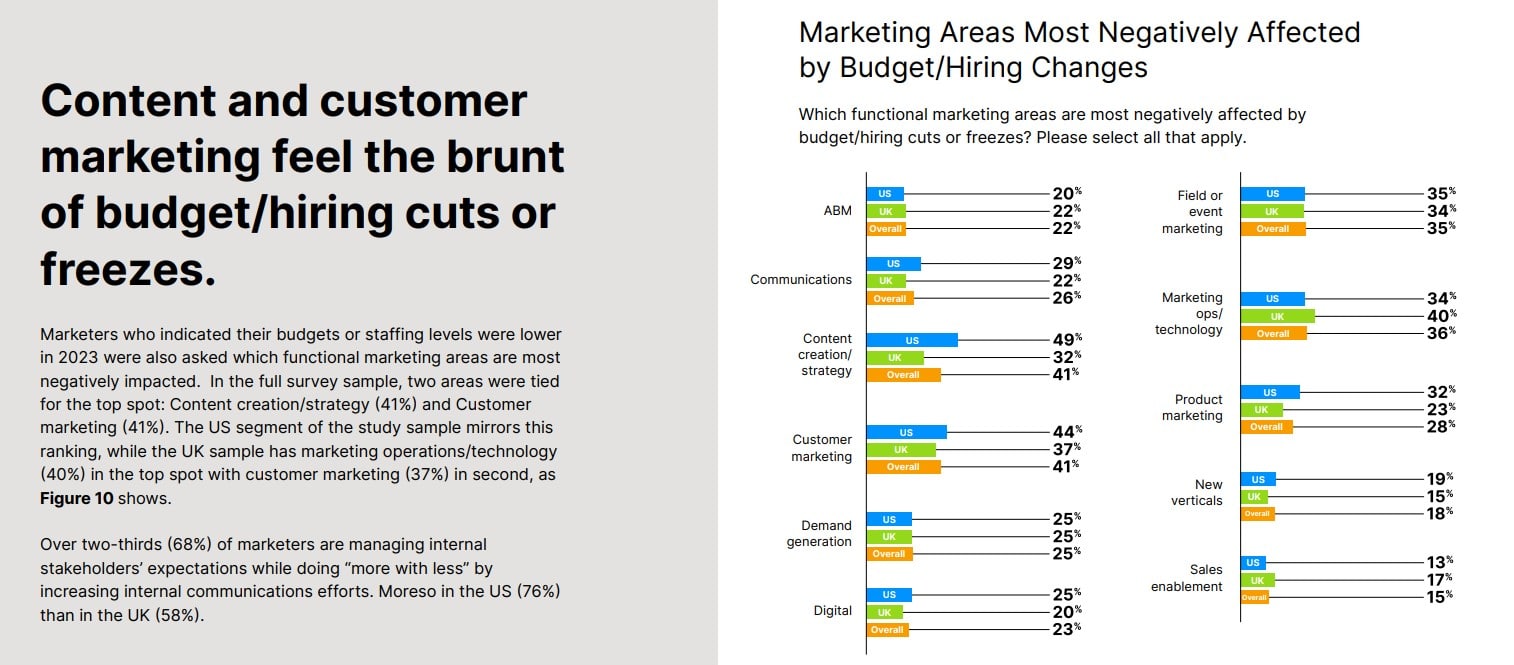

With rising interest rates, bank failures, and other economic headwinds looming, many B2B companies are hedging their bets and tightening budgets, forcing marketers to do more with less. In fact, the next biggest challenges the survey found include headcount cuts (40 percent), increasing growth targets (39 percent), and budget cuts (38 percent). What’s more, two-thirds (66 percent) of respondents report that they are experiencing burnout as a result of additional economic stressors.

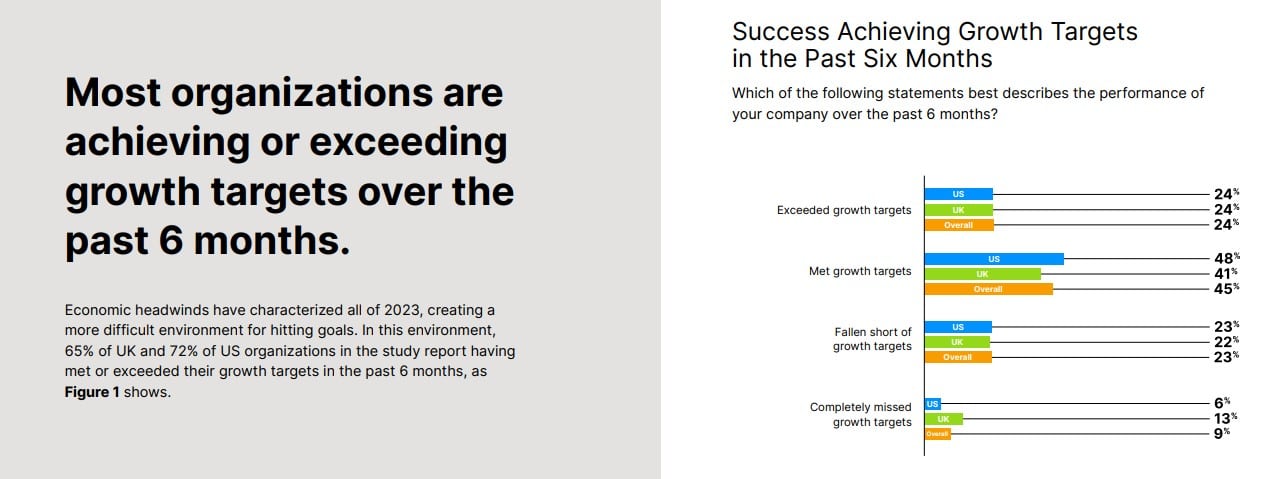

Interestingly, despite these challenges, 72 percent say their marketing team will meet or exceed goals in 2023

Meanwhile, 84 percent of marketers surveyed report having a neutral to optimistic outlook for the remainder of 2023, up slightly as compared to 80 percent six months ago.

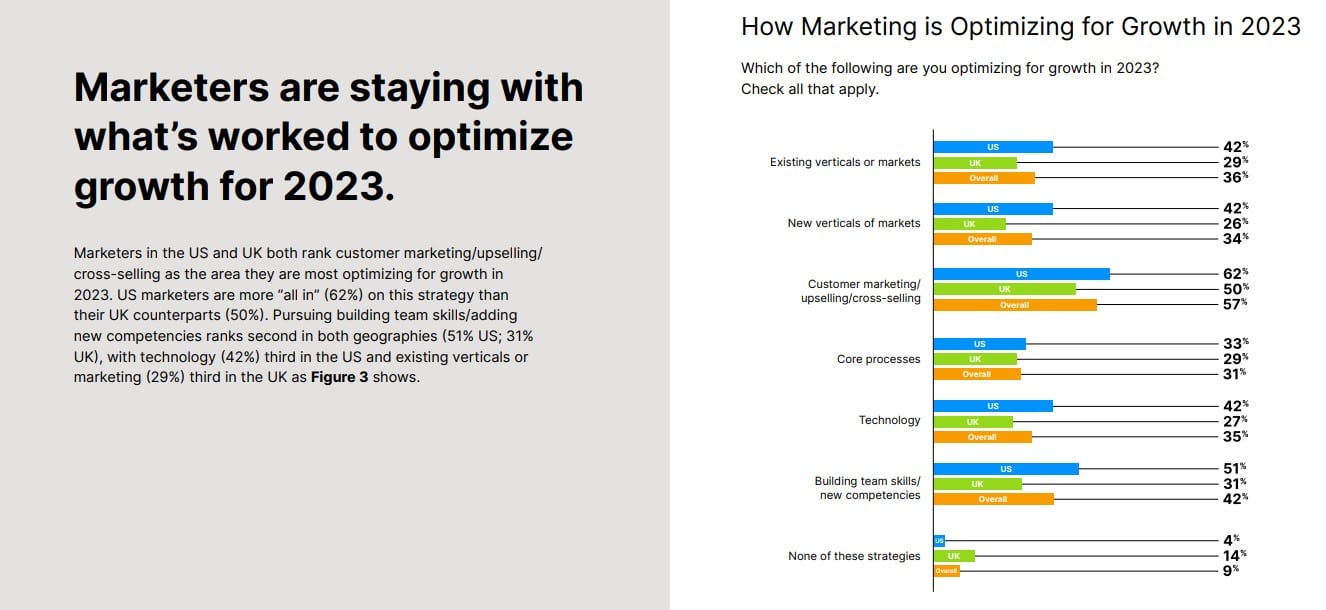

To adapt to these shifting tides, the survey found that 5 percent of B2B marketers are optimizing for growth in 2023 by leveraging customer marketing (upsell/cross-sell); 42 percent are building team skills and adding new competencies; and 3 percent are investing in existing verticals or markets.

They are also cutting travel budgets (46 percent), consolidating teams/job responsibilities (41 percent), and relying more on contractors (36 percent) and agencies (34 percent).

The top three areas marketers plan to invest more in are customer marketing, content creation/strategy, and sales enablement

As for budget spend for specific marketing disciplines, the survey found that about 40 percent of marketers are spending about the same on ABM, communications, content, demand generation, field/event marketing, marketing operations, product marketing, and sales enablement. This is in contrast to the 2022 results, which reported starker changes to planned budget investments, with nearly 50 percent planning to invest more in digital marketing, content creation, and customer marketing, while 53 percent planned to spend less on ABM.

Today, the areas marketers are investing more in include customer marketing (38 percent), marketing operations/technology (37 percent), and product marketing/strategy (36 percent). Conversely, marketers are investing less in ABM (25 percent), communications (24 percent), and demand generation (22 percent).

The survey results find that two-thirds of marketers (67 percent) are satisfied with their current marketing approach and 64 percent are satisfied with their martech stack. However, there is always room for improvement as 80 percent report evaluating their martech stack on a continual basis and 77 percent report redundancies in their martech stack.

“These survey results indicate that despite economic challenges, B2B marketers are forging ahead and making do with the resources they have with a focus on their customer,” said John Follett, co-founder, CXO & head of research at Demand Metric, in the release. “They’re overworked but optimistic and are in the greatest need of accurate and connected data to better understand their buyer, guide their decisions, and defend their spend in difficult times.”

Download the full report here.

This report was fielded in March 2023 to 524 respondents across the U.S. and UK, and is follow-up research to “The State of B2B Marketing Budgets 2022”.