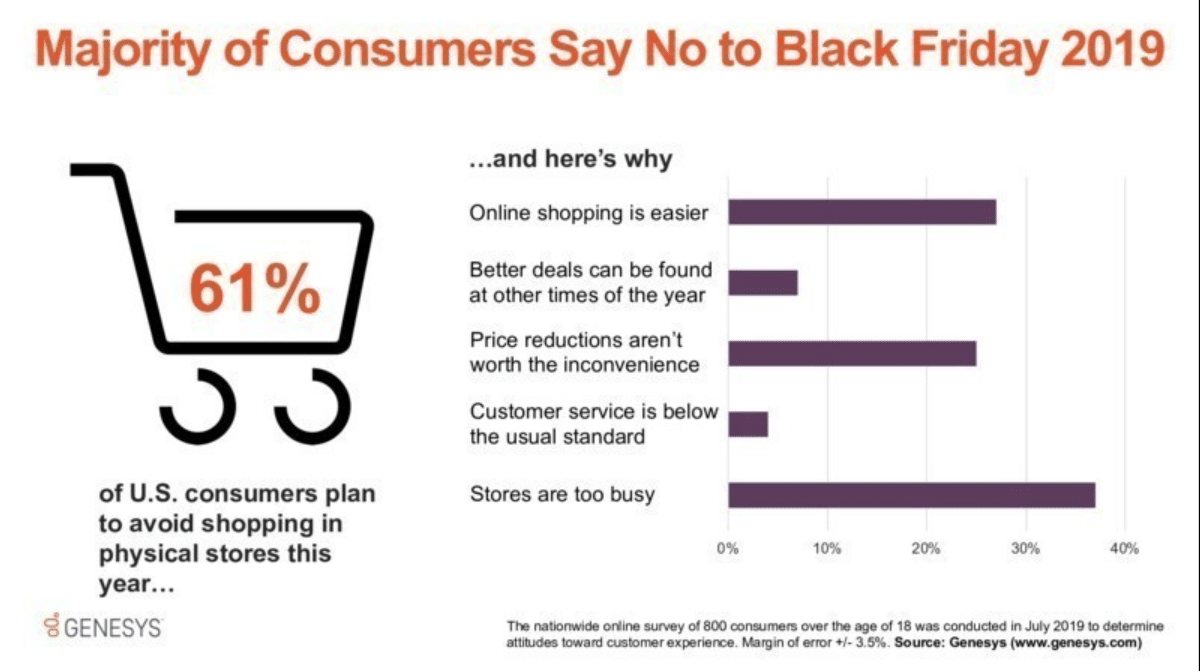

This year has been hard on brick-and-mortar stores, with many famous brands reducing their shopping mall footprint. While a recent survey from omnichannel CX firm Genesys uncovers a bright spot on the fourth-quarter horizon for U.S. retailers, seasonal challenges remain. The good news is slightly more consumers say they intend to go into physical stores on Black Friday this year than in 2018 (39 percent, up 2 percent from the response in a similar consumer survey last year).

Of the 61 percent of U.S. consumers who do not plan to go into physical stores this year on Black Friday, one third (33 percent) say they simply “never” go. What poses difficulty for retailers is that 28 percent claim they used to go shopping on Black Friday, but have stopped.

Why are Black Friday shoppers staying home?

U.S. survey participants cite three main reasons for not planning to go into physical stores on Black Friday 2019:

- The stores are too busy (37 percent)

- The price reductions are not worth the inconvenience (25 percent)

- Online shopping is easier (27 percent)

That first figure represents a whopping 30-percent drop from the 2018 Genesys survey is the impression that brick-and-mortar stores are too busy, when 67 percent of respondents cited the crowds as their main reason for staying home. In addition, the survey found poor customer service isn’t the culprit for many Americans’ choice to avoid stores this season. In fact, only 4 percent say it is their primary reason for not going into brick-and-mortar stores on Black Friday (a drop from 8 percent in the 2018 survey).

Is there a gender gap among Black Friday shoppers?

Contrary to stereotypes, the survey results find American men (45 percent) are more interested in brick-and-mortar shopping than women (33 percent)—the same gender split as last year’s survey. There is also a definite gender difference regarding online shopping, with 30 percent of female respondents citing it as their primary reason for avoiding brick-and-mortar stores on Black Friday versus only 23 percent of males.

Is there a generation gap in Black Friday shoppers?

Post-Millennials and Gen X Americans may offer a lifeline to brick-and-mortar stores. The survey results show these younger generations are the most optimistic when it comes to braving Black Friday crowds. In fact, there are more respondents aged 18-24 (44 percent), 35-44 (47 percent) and 45-54 (46 percent) who say they plan to go into physical stores this Black Friday than in 2018, with each group increasing by several percentage points.

Millennials ages 25-34 are the largest age group planning to go into physical stores, at 51 percent. However, while this sounds positive, it is a significant drop from the 60 percent of the same group in the 2018 survey. Even worse, Millennials (35 percent) are more likely than the national average (27 percent) to feel online shopping is easier than dealing with the chaos that is Black Friday.

Baby Boomers ages 55-64 are the least likely age group to say they plan to go into physical stores this Black Friday (18 percent), which also represents about a 5-percent decrease from the 2018 survey. In addition, they are the age group most likely to say they used to participate in Black Friday, but don’t anymore (45 percent). Meanwhile, Baby Boomers over age 65 are the group most likely (53 percent) to say they “never” go into brick-and-mortar stores on Black Friday.

Does geography affect Black Friday shopping?

More survey respondents living in the Western region (47 percent) say they plan to go into physical stores this Black Friday, compared to Northeasterners who clocked in with the lowest likelihood at just 33 percent. Northeasterners are more likely (35 percent) than the national average (27 percent) to feel that online shopping is easier. Northeasterners also represent the largest regional populace (36 percent) to say they used to go into physical stores over the holiday weekend but no longer do. The same percentage of Southerners (36 percent) say they simply never go.

In July 2019, Genesys commissioned a nationwide survey of 800 consumers over the age of 18 on their attitudes toward customer experience. The survey pool had a 50/50 gender split covering six age ranges in four geographic regions. The margin of error is plus/minus 3.5%.