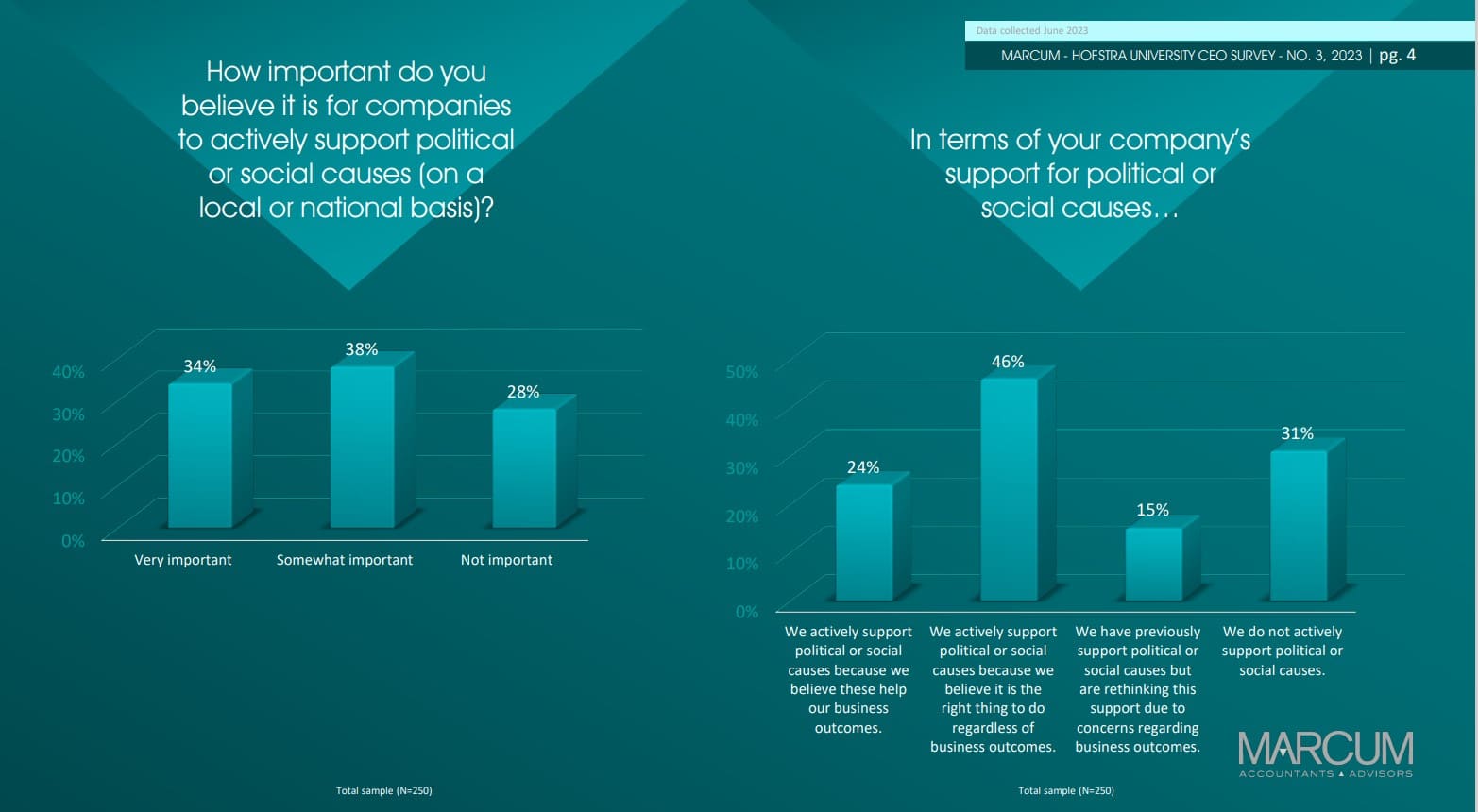

Middle-market CEOs have a brighter outlook as we head into fall than they did at the start of Q2, according to the latest research from accounting and advisory firm Marcum and Hofstra University’s Frank G. Zarb School of Business. Brand Purpose appears to be on their minds as most acknowledge that we’re now in a world where social activism increasingly intersects with business—more than 7 in 10 (71.6 percent) of 250 chief execs surveyed said they felt it was important for companies to actively support political or social causes.

Interestingly, nearly a quarter of CEOs said supporting social and political causes actively contributed to achieving their business outcomes, and 45.6 percent said they believe it is the right thing to do regardless of the impact on their bottom line. Also, about a third (33.6 percent) said that embracing ESG causes is a central focus in their business planning and actions.

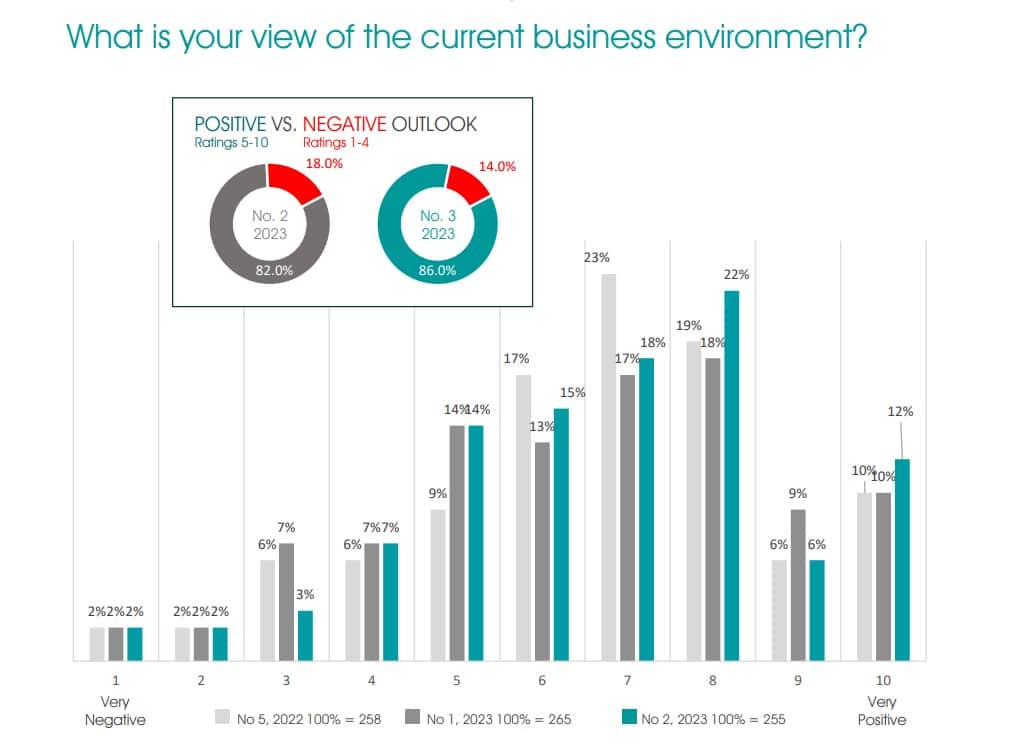

The latest CEO survey from the two organizations—which continues to track CEO sentiment over time, providing compelling insight into the evolving mindset of CEOs across a range of industries—reveals a noticeable uptick in optimism. Compared to April, 12.4 percent of respondents rated their outlook as “very positive,” up from 9.8 percent. More than a third (39.6 percent) placed themselves in the high range of optimism, an increase from 37.6 percent.

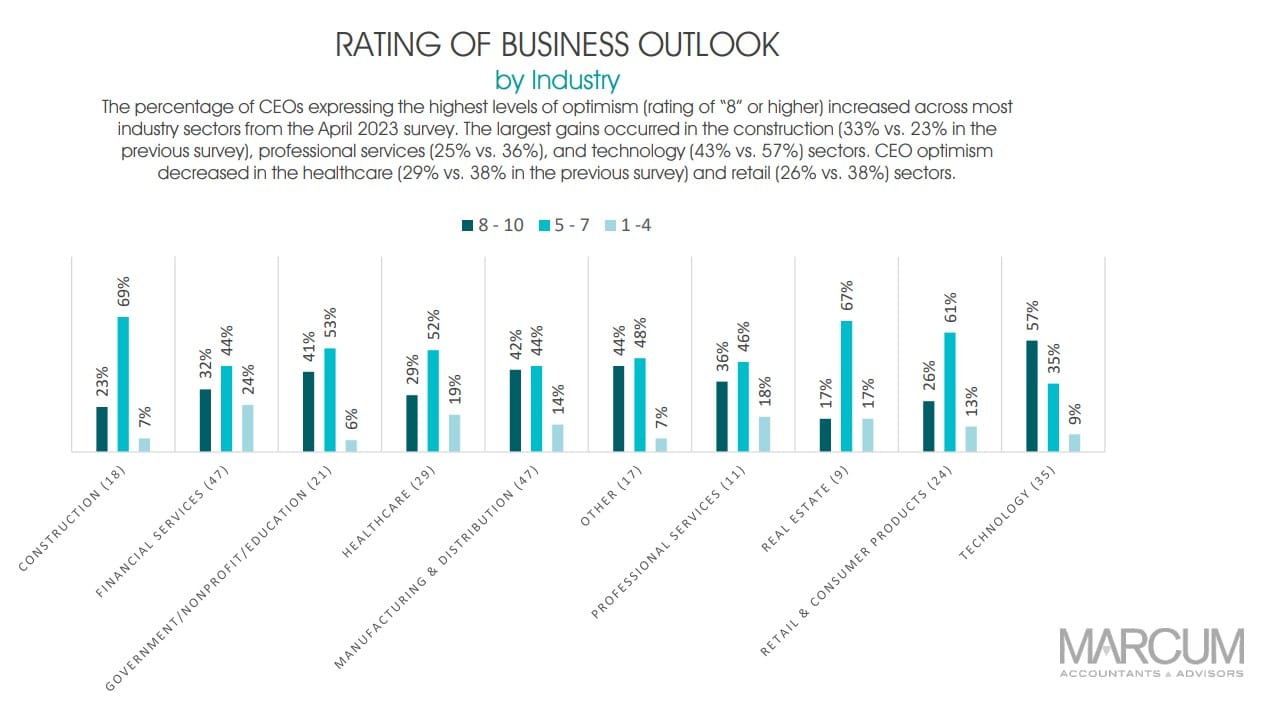

This sense of optimism was not reflected across all industries surveyed

The largest gains came in the construction, professional services, and technology sectors. But the healthcare and retail sectors saw a dip in CEO optimism, indicating the nuanced industry dynamics at play in the current business environment.

“The embrace of environmental, social and governance (ESG) is, quite literally, a generational change driven by young people who make decisions about what they buy and where they work based on a company’s ethical impact,” said Janet Lenaghan, dean of the Frank G. Zarb School of Business, in a news release. “We focus on ESG at Zarb in many ways and across all disciplines in the curriculum, with experiential learning opportunities like our student-managed sustainability fund, and through an interdisciplinary graduate dual-degree program.”

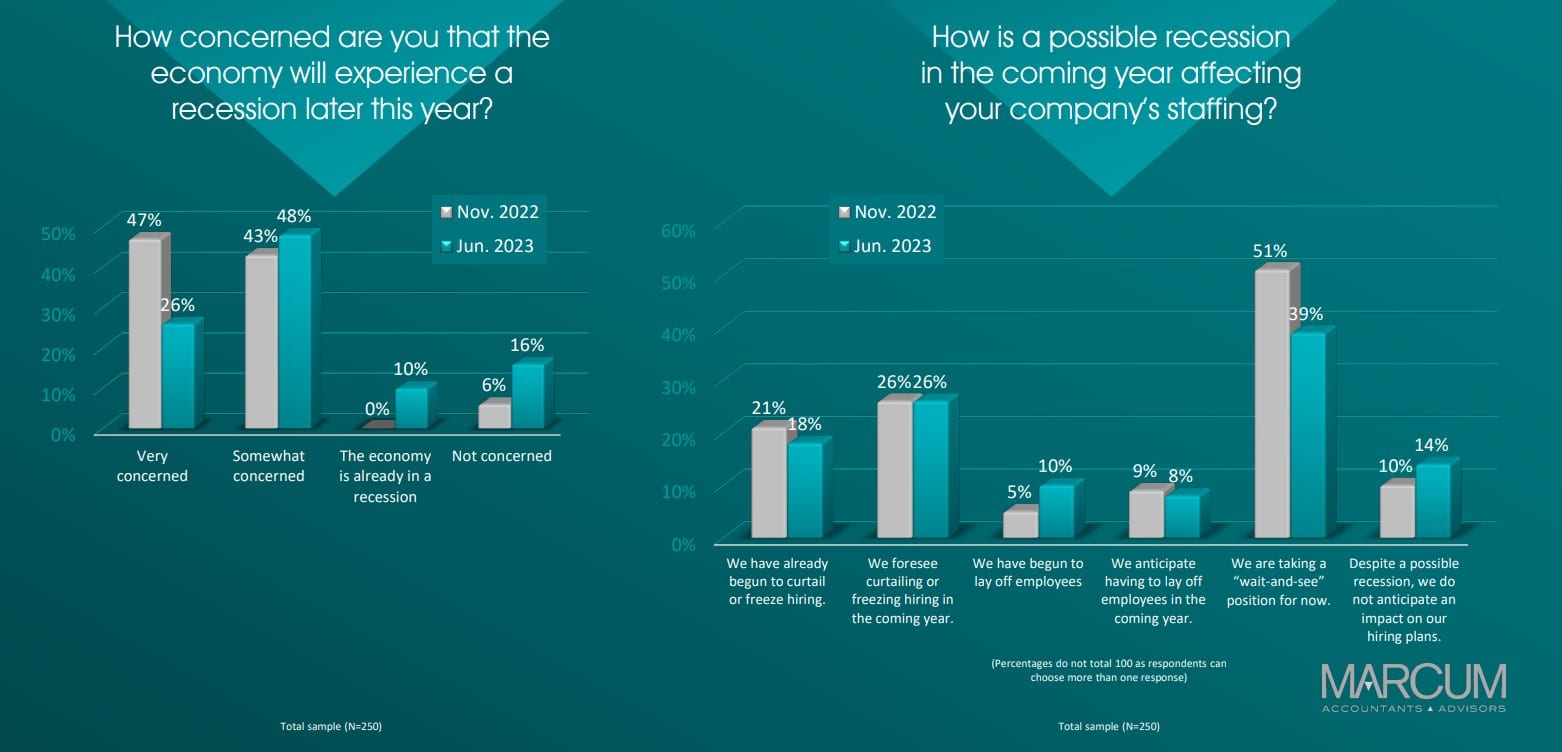

Despite the improved economic sentiment, the shadow of a recession continues to linger among CEOs

The latest data shows a substantial drop in CEOs who say they are ‘very concerned’ about a recession, from 46.5 percent in November 2022 to 26.4 percent now, but 74.0 percent retain some concern. Moreover, 61.6 percent admit these concerns impact their staffing plans, with 17.6 percent already curtailing hiring and 9.6 percent laying off staff. Conversely, CEOs expressing no recession concern have increased from 6.3 percent to 15.6 percent, indicating a shifting economic landscape.

“Our latest CEO survey shows that optimism is on the rise, but it’s clear that these leaders are keenly aware of the challenges ahead,” said Jeffrey Weiner, chairman & CEO of Marcum, in the release. “From managing economic uncertainties and grappling with talent shortages to mitigating the impact of rising operational costs, CEOs will need adaptability and grit in this fluid business landscape.”

The survey is developed, conducted, and analyzed by Zarb School MBA students, led by Dr. Andrew Forman, associate professor of international business and marketing, in partnership with Marcum.

“The Marcum-Hofstra CEO survey provides students with the basis to consider whether it is prudent and beneficial for companies to focus resources and attention on the broader issues confronting their communities and society at large,” said Dr. Forman, in the release. “While many CEOs felt it was important for the companies to support political and social causes, their motives vary. This provides a springboard for students to think critically about how broader concerns affect corporate decision-making.”

Other key findings:

Business planning

- Economic concerns continue to be a dominant influence in business planning, despite a slight decline from 58.0 percent to 55.2 percent since April.

- The availability of talent remains a key factor, reflecting the ongoing struggle for human resources in a tight labor market.

- Rising material and operational costs continue to weigh heavily on the minds of CEOs, with this concern showing a small increase since the previous survey.

Environmental, social and governance (ESG)

- 15.2 percent of CEOs said they were rethinking previous support for political or social causes due to concerns over the impact on their business.

- 43.6 percent of CEOs said they consider ESG goals, but they are secondary to company goals.

- 12.8 percent of CEOs said ESG goals are not part of their planning, and they do not expect it to be in the future.

The survey is a periodic gauge of mid-market CEOs’ outlook and priorities for the next 12 months, polling the leaders of companies with revenues ranging from $5 million to $1 billion-plus. This latest survey was conducted the week of June 19, 2023, and polled 250 mid-market CEOs.