With consumers now expecting food and beverage brands (among others) to commit to ESG standards, most industry leaders expressed a strong desire to embrace those objectives in a new survey, and are seeking the ability to stand behind claims to ensure that ingredients in their supply chains are properly sourced and labeled. But this new research reveals that commitment alone for these brands is far from enough to properly comply—and won’t demonstrate to consumers that they are actually walking the sustainability talk.

The new survey report from networked ingredients marketplace TraceGains highlights the disconnect between well-meaning brands and their ability to deliver ESG-compliant products in the context of an increasingly complex global supply chain. Based on responses from nearly 350 food safety and quality professionals, the firm’s State of ESG Compliance for the Food and Beverage Industry report cites a series of obstacles standing in the way for even the best-intended brands, including loose guidelines for choosing ingredient suppliers, higher ingredient prices and a lack of automation and technology to ensure compliance.

The good news: The large majority of food brands remain committed to sustainability

Despite the challenges, most CPGs are committed to the cause and looking for solutions:

- 64 percent of brands acknowledge the importance of being ESG-compliant.

- Nearly half (46 percent) prioritize doing business with ESG-compliant ingredient suppliers.

- Key drivers for being more ESG-focused included a combination of evolving regulatory landscapes (32 percent), consumer demand (27 percent), and competitive pressures (18 percent).

- Half (50 percent) of all respondents said they’d be willing to stop production on a product altogether if it could not be produced in accordance with ESG objectives.

The bad news: Sourcing ESG-compliant ingredient suppliers remains a huge challenge

Brands have a strong desire to build ingredient supply chains that align with ESG goals, but general market confusion over sustainable food labeling and the lack of formal guidelines to validate ESG partners create barriers to success:

- 41 percent feel they are falling short of achieving full ESG compliance.

- Nearly half (42 percent) rely on informal methods to select ingredient suppliers like word-of-mouth conversations (23 percent) or relying solely on suppliers’ claims (35 percent).

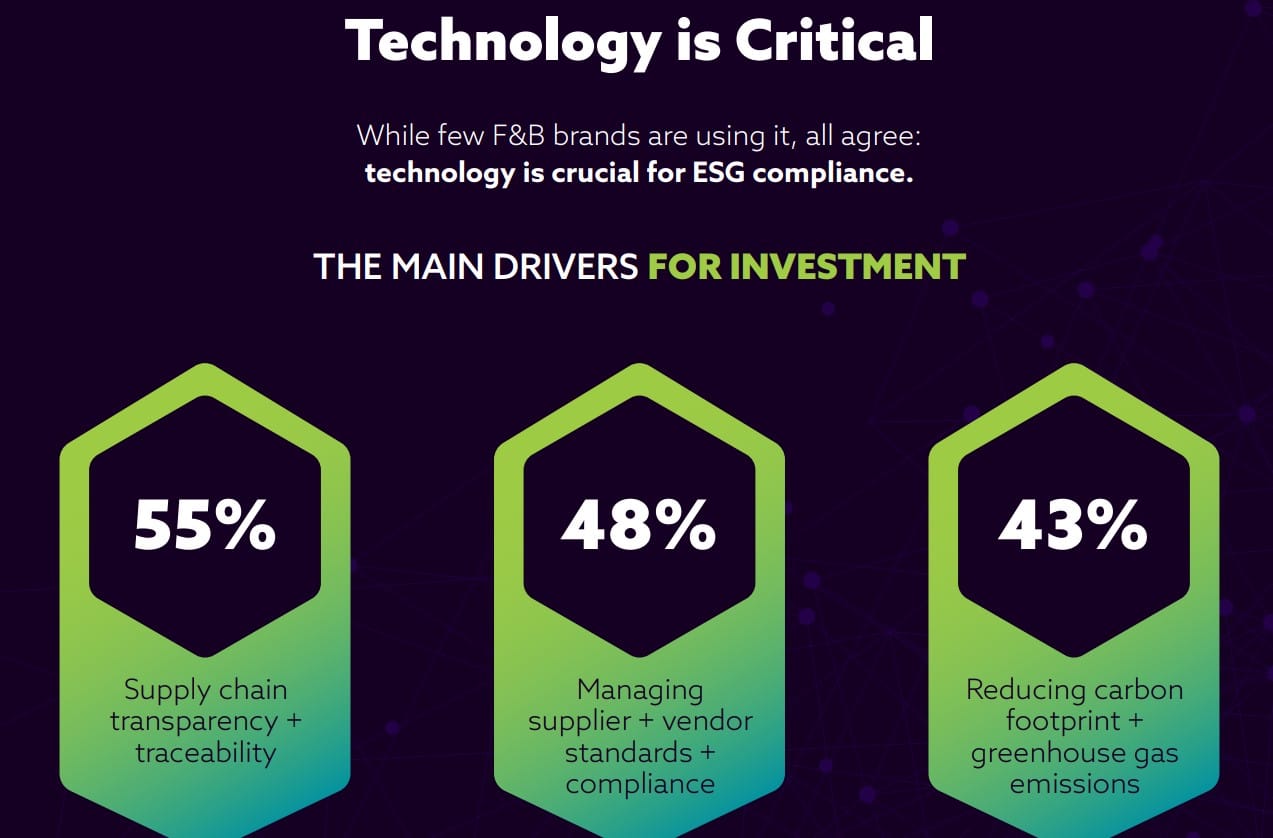

- Only 16 percent of brands use a formal, technology-assisted selection process for validating ESG partners.

- 55 percent demand more transparency into ingredient supply chains, with nearly half (49 percent) wanting visibility into Tier-2 and Tier-3 suppliers.

The future: Navigating the path to sustainability

Regardless of the challenges, food and beverage brands are intent on becoming more ESG-compliant with some emerging brands even committed to sacrificing a profit to do so:

- 42 percent plan to increase their usage of ESG-compliant ingredients within the next six to 12 months.

- One-third (35 percent) are willing to pay up to 10 percent more for ESG-compliant ingredients, and 32 percent would pay up to 20 percent more.

“We applaud the willingness of brands and manufacturers to foster and uphold ethical and sustainable practices, and their commitment to ‘walk the talk’ to prevent products from hitting the shelves that don’t align with ESG goals,” said Paul Bradley, senior director of product marketing at TraceGains, in a news release. “Our report shows that even with good intentions, actually delivering on ESG promises across the business demands unwavering dedication.”

Download the full report here.

From June 22 through July 7, 2023, TraceGains conducted an online survey of 343 food and beverage leaders across quality, operations, safety and R&D roles at large CPG companies in North America, the UK, EMEA, APAC, and LATAM, with 61 percent of survey respondents reporting revenues upwards of $25M.