Crisis can strike in many forms—is your company prepared? Even though business owners acknowledge the importance of best practices to protect their livelihoods, employees and customers, new research from insurance and financial services firm Nationwide reveals many proprietors are unprepared for the future or unexpected events.

Most business owners say it’s important to plan for cyberattacks, natural disasters and succession. But the vast majority of owners report they don’t have formal plans in place, even as catastrophic weather events like Hurricane Harvey continue to rise and ransomware attacks become more common. These findings stem from Nationwide’s third annual survey of more than 1,000 business owners across the country with up to 299 employees.

“Business owners are the backbone of our economy,” said Mark Berven, president of property and casualty for Nationwide, in a news release. “But they can often believe the myth that ‘it could never happen to me.’ That’s why it’s crucial business owners remain prepared. Whether it’s planning for leadership succession or enduring an unexpected event like a cyberattack, the viability of businesses across the country is a requirement for a healthy economy that we can’t ignore.”

Nationwide’s survey asked business owners to report their experience across a wide range of topics, and results revealed alarming discrepancies in how business owners think vs. how they behave in three main categories:

Cyberattacks

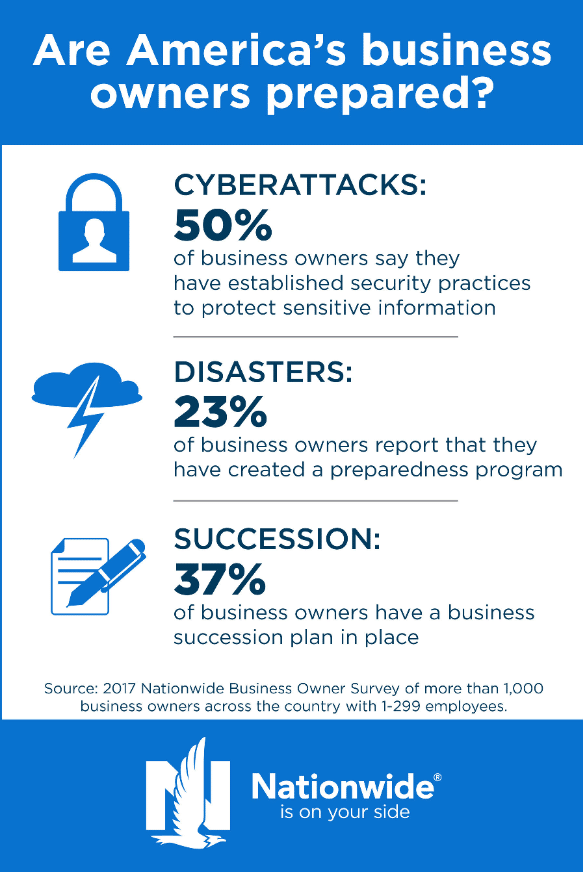

Eighty-three percent of owners report that they believe it’s important to establish security practices and policies recommended by the U.S. Small Business Administration (SBA) to protect sensitive information, but only 50 percent say they have established security practices to protect sensitive information.

Disasters

Sixty-four percent of owners say it’s important to create a preparedness program as recommended by the SBA, yet only 23 percent report that they have created one.

Succession

Sixty-five percent of owners report that they believe it’s important to choose a successor for their business as recommended by the SBA, even though only 37 percent actually have a business succession plan in place.

While many business owners are not prepared for the risks they face, two exceptions stood out:

Millennials

This generation is more likely than Baby Boomers or Gen Xers to say it’s important to create a business succession plan (38 percent) and build disaster preparedness kits (35 percent). They say they are also more confident in securing a financial future (82 percent).

African-American

These business owners are more likely than Hispanic or Caucasian owners to say they have a plan in place to protect employee data (56 percent), a disaster recovery plan (46 percent) and a cyber-attack response plan (41 percent). They also report that they are more confident in securing a financial future (86 percent).

Business owners can learn how to create a cybersecurity plan, disaster plan and succession plan through the Small Business Administration. Learn more about crisis preparedness on Nationwide’s blog page.

Nationwide commissioned a 20-minute, online survey among a sample of 1,069 U.S. small business owners. Small business owners are defined as having between 1-299 employees, 18 years or older, and self-reported being a sole or partial owner of their business. The margin of error for this sample is +/-3% at the 95% confidence level. Conducted by Edelman Intelligence, a full-service consumer research firm, the survey was fielded between May 16-24, 2017. As a member of CASRO in good standing, Edelman Intelligence conducts all research in accordance with Market Research Standards and Guidelines.