Sustainability is of course a paramount issue for businesses and consumers, and new research shows that, despite the words and actions of bureaucratic backlashers, it’s a common consideration for investment management professionals in the US as well—but trust in the environmental, social and governance (ESG) data used to inform investment decisions by asset owners and managers is lagging, according to a new global study from professional services giant Deloitte and The Fletcher School at Tufts University.

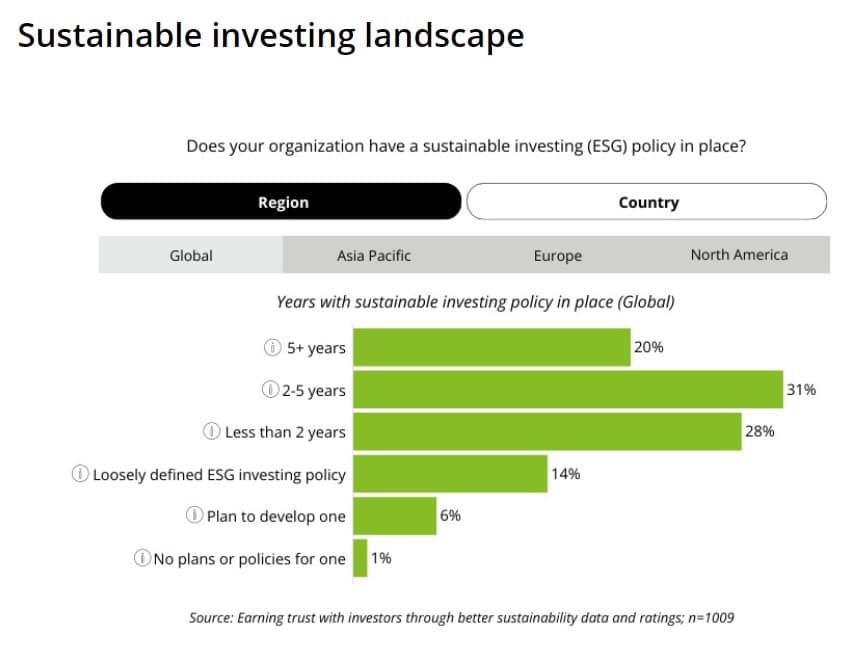

The new study Investor Trust in Sustainability Data reveals that sustainable investing has grown significantly in the US over the past five years, with 83 percent of US investment management professionals surveyed reporting that they have a sustainable ESG investing policy—any policy that takes environmental, social or governance concerns into consideration when measuring the sustainability impact of a business or investment—in place. That is a considerable shift compared to just 27 percent five years ago, according to the research. In fact, just 1 percent of respondents indicate that their organizations have no plans to adopt a sustainable investing policy.

Investors want ESG reporting that supports fundamental analysis

The use of ESG information—including ESG disclosures and ESG-related reports, communications, third-party ratings, and other information—to support fundamental analysis is also widespread among polled US investors, with 81 percent reporting they occasionally or regularly seek out sustainability information as part of due diligence efforts.

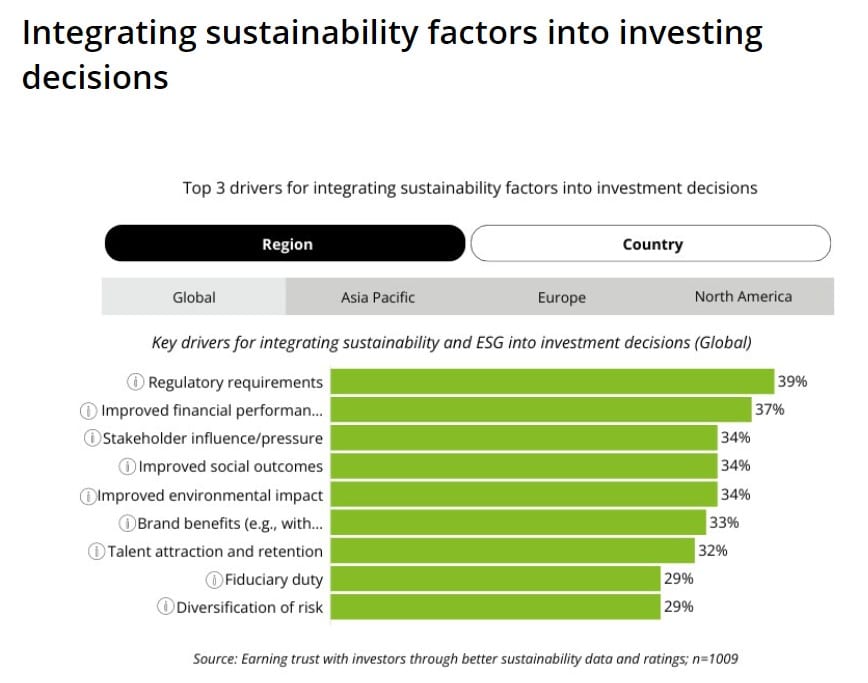

“Many factors, including evolving regulatory requirements, financial performance pressures, and stakeholder expectations, are driving the U.S. movement toward integrating sustainability and ESG into investment decision-making,” said Chris Ruggeri, a Deloitte Risk & Financial Advisory principal and sustainability, climate and equity leader at Deloitte Transactions and Business Analytics LLP (DTBA), in a news release. “As such, company leaders and their boards have an important opportunity to take actions that can improve investor confidence and trust levels in those investments, such as making enhancements to the sustainability information, disclosures, and other sources that inform buy, sell, and hold decisions.”

ESG data concerns from investment managers

Despite the growing demand for sustainability information, U.S. investment management professionals expressed concern over the availability of and access to clear, reliable and trustworthy ESG data to incorporate into their investment approaches. According to respondents, lack of measurable outcomes discernible from corporate disclosures (60 percent), lack of clarity on how to integrate ESG information (63 percent), and inconsistency or incomparability of ESG ratings data (63 percent) are inhibiting their organizations’ abilities to effectively implement ESG investment strategies.

“There is considerable room for improvement in how organizations collect, measure, report on, and validate sustainability data to earn investor trust,” said Michael Bondar, a Deloitte Risk & Financial Advisory principal and global enterprise trust leader at DTBA, in the release. “But, more consistency and dependability in sustainability reporting for measurement and analysis purposes should help enhance confidence for stakeholders throughout the corporate ecosystem.”

“The focus on sustainability data is growing globally. India’s Securities and Exchange Board requires top public companies to disclose ESG related activities, and the European Union now requires sustainability disclosures under the Corporate Sustainability Reporting Directive starting from periods beginning in 2024,” said Bhaskar Chakravorti, dean of Global Business at The Fletcher School at Tufts University, in the release. “And as of this month, rules were adopted in the United States as well.” .

Download the full report here.

Deloitte and The Fletcher School at Tufts University surveyed more than 1,000 asset management professionals from North America, Europe and Asia in August 2023 for perspectives on sustainable investing and trust levels in sustainability disclosures from publicly traded companies. Within that data set, more than 300 U.S. investment professionals, including asset managers (38 percent), investment advisers (32 percent), and asset owners (30 percent; e.g., pension funds, family offices, and sovereign wealth funds) shared thoughts that are recapped in this press release and corresponding report, Investor Trust in Sustainability Data.