With many brands and businesses now resuming operations, society has entered a new phase of the COVID crisis—and consumer expectations and behaviors are changing in real-time. New research from customer experience consultancy Market Force Information examines the new dynamics of the marketplace, with the expectation that new behavioral trends are likely to last well past the current crisis.

The research examines how U.S. consumers see retailers and restaurants responding to infection control, use of alternate shopping and dining methods, as well as behavior and attitude changes towards contactless transactions, and their problem experiences. This second wave report, following up a study conducted in early April, focuses on how consumer perceptions have changed between wave one and two.

Changes in consumer sentiment from April to May

As consumers are eager to get out, the collective belief that we should continue to shelter in place has decreased 12 percent, from 80 percent in April and down to 68 percent in just a one-month period. Although there is still uncertainty on how the consumer market will operate once this pandemic is over, this most recent study confirmed that shopping behaviors are changing—and B2C business will have to adapt to new customer expectations.

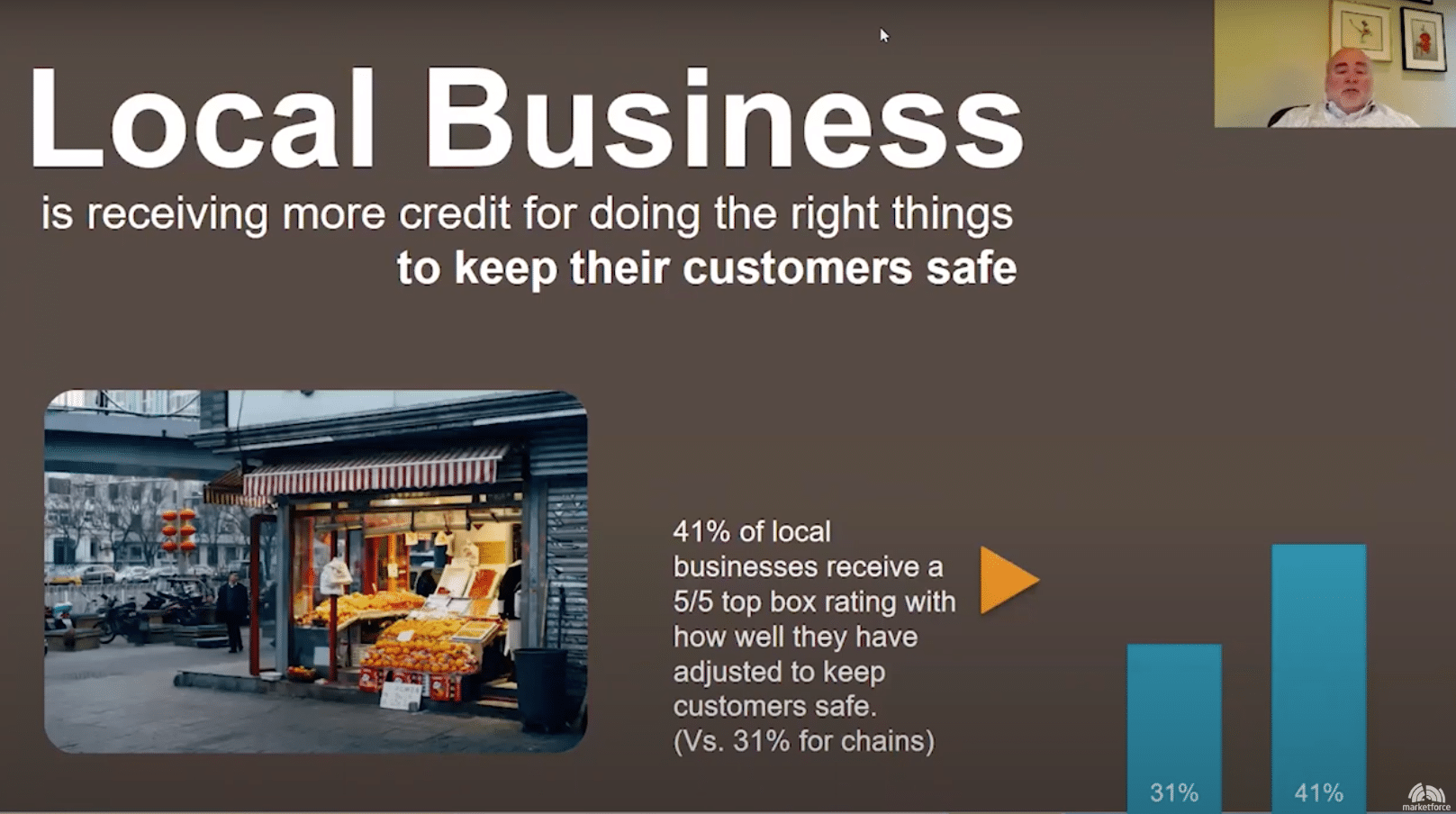

As we saw in the first wave, and more apparent in this second wave, consumer sentiment is high for local and independently run business as they receive credit and praise for taking noticeable percussions to keep customers safe. Results show that 41 percent of local businesses received a five-out-of-five top box rating with how well they have adjusted to keep customers safe, versus 31 percent when compared to national chains.

The study reveals a 10-point gap between local and national brands, and a great opportunity for big brands to excel—as Phil Doriot, Market Force’s vice president of analytics and Insights explains, “The opportunity for national chains is to commutate the local aspect of the business using store management to create a sense of community and promoting safety procedures.”

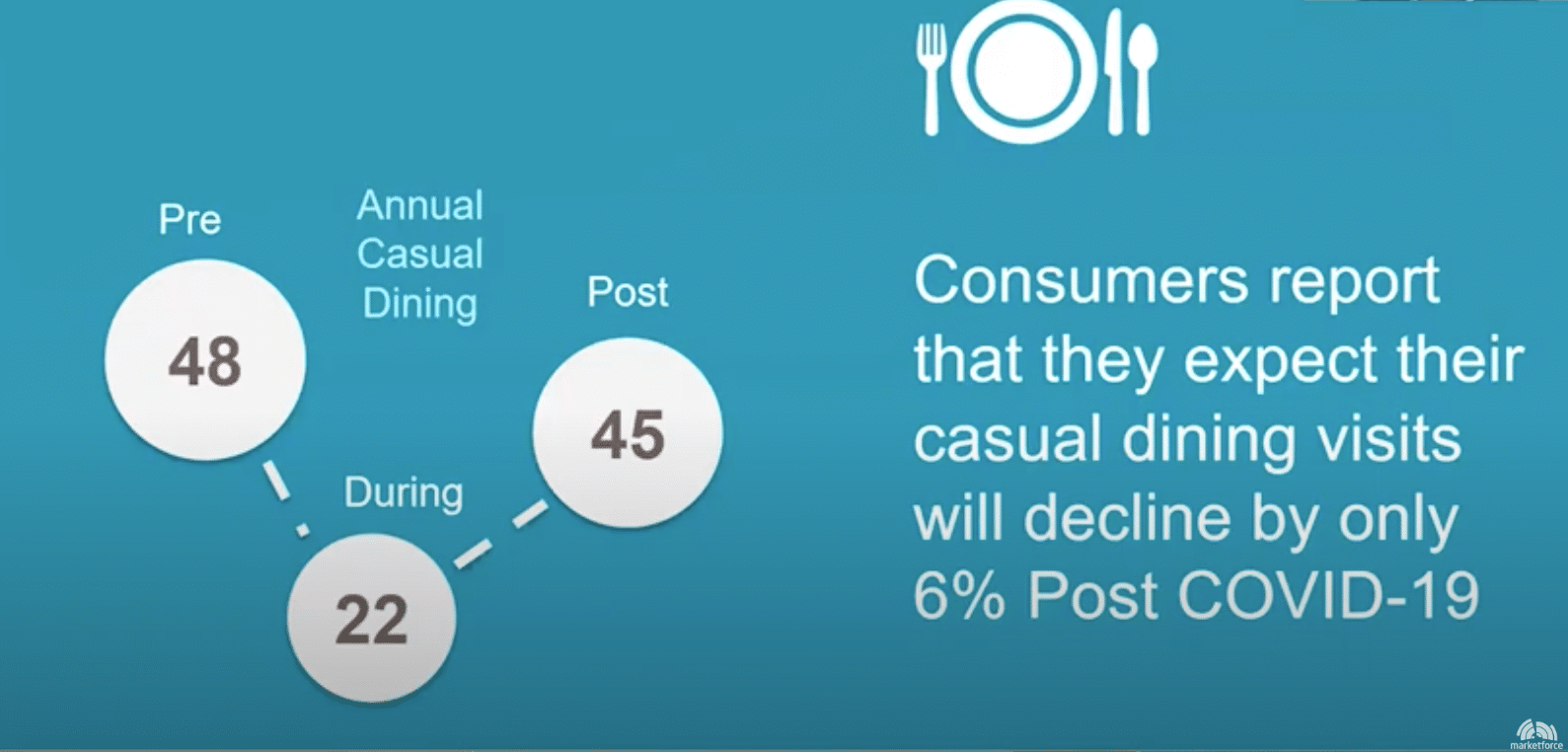

Taking the current pulse of the restaurant industry, survey results demonstrate that 30 percent of dinners who chose to eat at a new quick serve restaurant (QSR) did so only because their first choice was not open yet. As more families are preparing food and dining at home, availability, scalability and greater satisfaction with family meals deals will represent an opportunity for QSRs and casual dining restaurants to up their game. Contrary to how diners selected a restaurant before the coronavirus pandemic, they are now seeking out locations with less traffic and contactless food service.

Expectations and success drivers

Visits to grocery brands are expected to decrease 22 percent after the pandemic, with annual visits dropping from 85 visits pre-pandemic, to 60 visits during the pandemic, and 65 probable visits post-pandemic. Although trip frequency is down, the good news is basket size is up. To make the most of declined in store visits; the report results demonstrated the following consumer success drivers: having popular items in stock, no crowding in isles and check outlines, and the obvious perception that employees are following cleanliness standards.

Visits to QSR restaurants are expected to decrease 17 percent after the pandemic with annual visits dropping from 76 visits pre-pandemic, to 49 visits during the pandemic, and 63 probable visits post-pandemic. To make the most of declined visits; the report results demonstrated the following customer success drivers: convenient restaurant location, perceived value for the dollar, and availability of contactless food pick up.

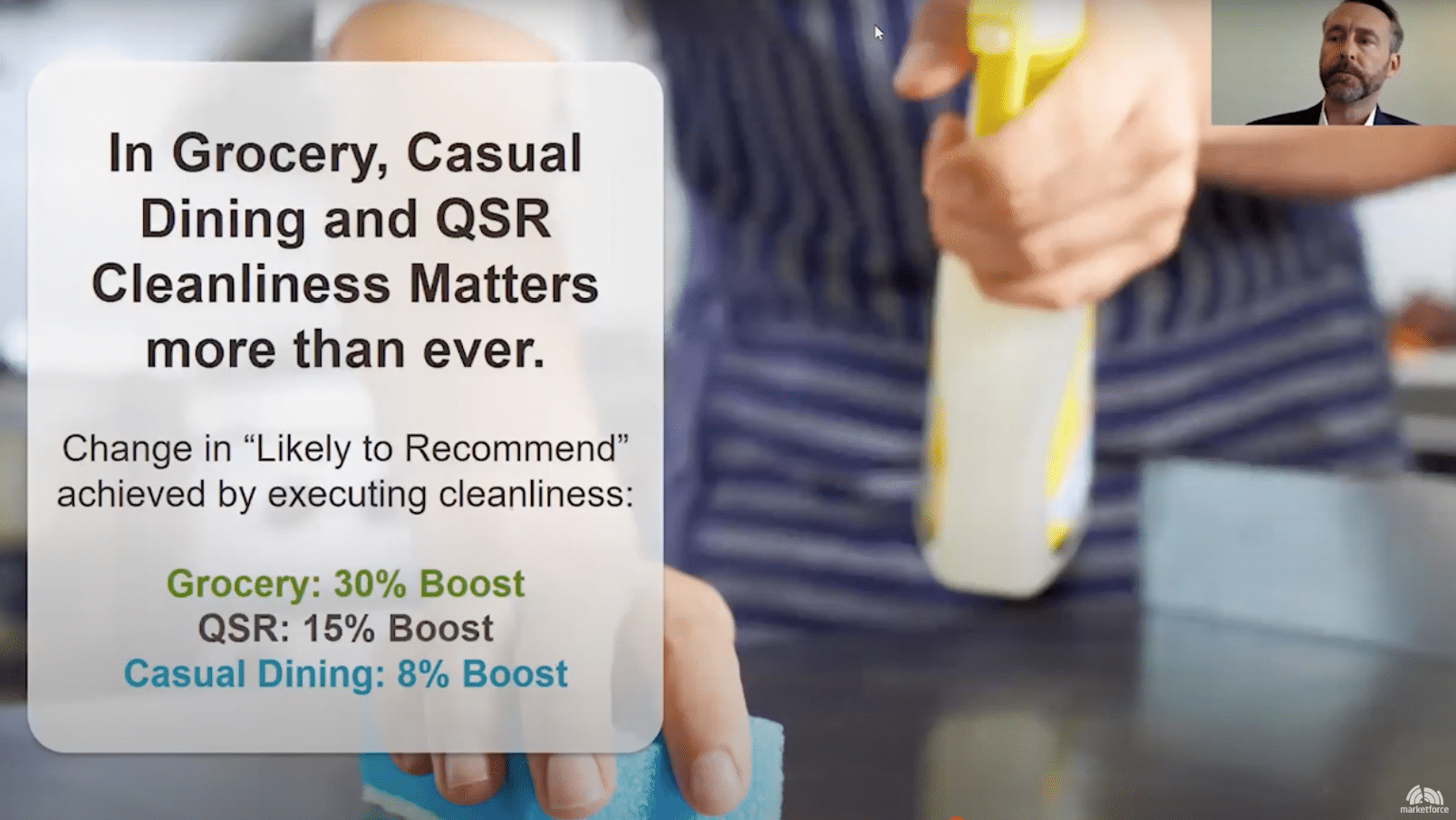

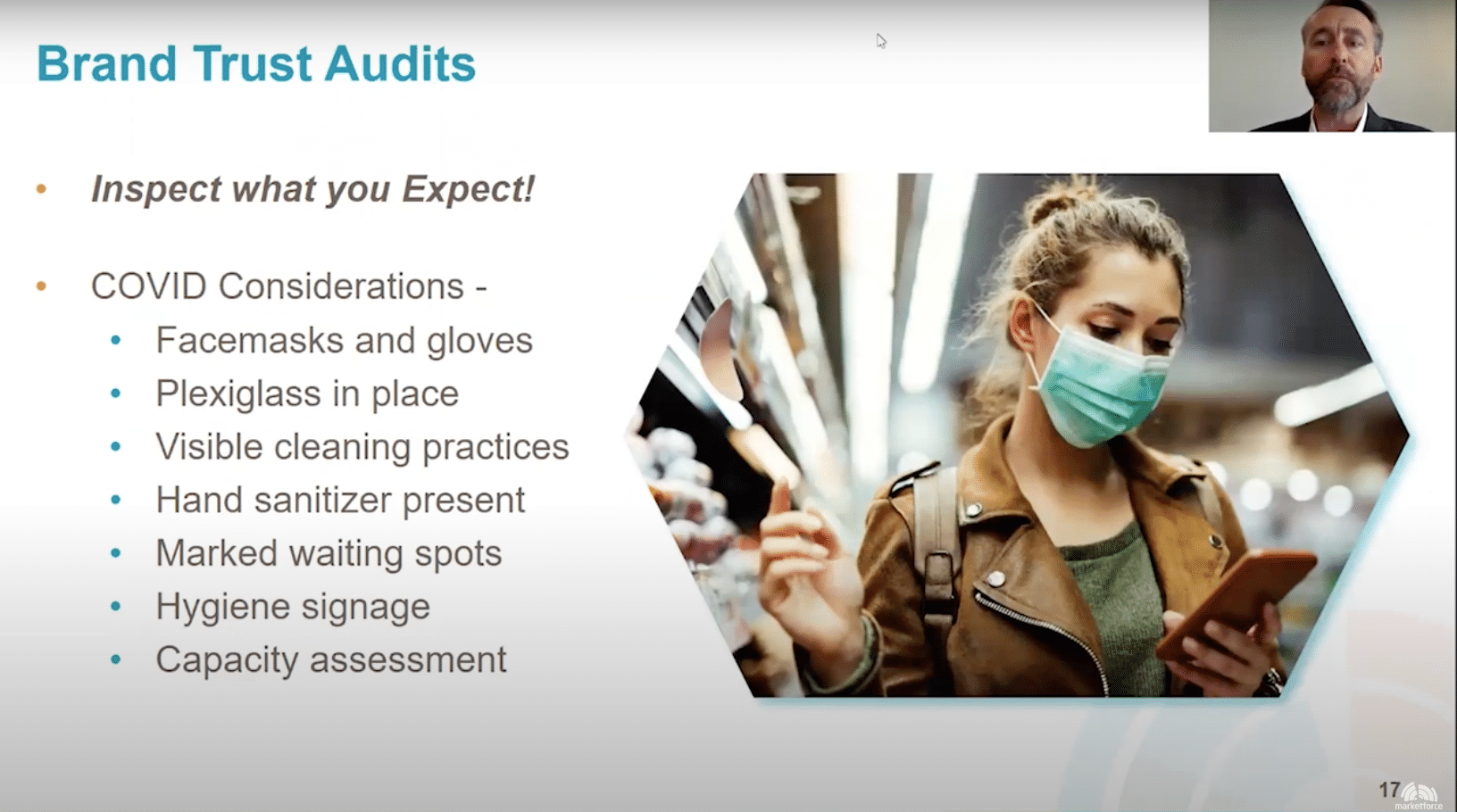

Ultimately, when it comes to consumer sentiment, the researchers found the most important factor in re-opening the economy is making sure consumers feel safe when they visit your business location. In addition to executing excellence in the overall customer experience, how the brand directs shoppers into the store, supports an organized in store experience, and executes cleaning standards will make the difference in a satisfied customer who is likely to recommend your business to others.

Download a recording of Market Force’s on-demand webinar here.

The survey was conducted in May 2020 across the United States. The pool of 3,964 respondents represented a cross-section of the four Census regions and reflected a broad spectrum of income levels, with 65% reporting household incomes of more than $50,000 a year. Respondent ages ranged from 18 to over 65 where approximately 71% were female, 28% were male, and 1% preferred not to answer. Market Force asked survey participants to rate their last experience at a casual dining, QSR, or grocery chain and their likelihood to recommend it to others based on consumer expectations and behaviors in light of the COVID-19 pandemic.