Post-pandemic solutions in financial services, and many other industries, will be a hybrid of digital and in-person services as companies evolve from traditional “B2B” and “B2C” services and communications to more personalized “B2I” services and communications—Business to Individuals. In all channels, B2I is defined as gathering and understanding current and prospective customer’s preferences and requirements to provide precisely what they want, how, and when they want it.

In-person selling has always been the personification of B2I, but digital B2I is rapidly catching up and, in some respects, surpassing it. Nevertheless, as we emerge from the pandemic in the months ahead, we are likely to see a pent-up demand for more of a human touch, for human contact, for personal service in every channel—the ultimate form of B2I communication.

Personalize digital offerings and communications with customers

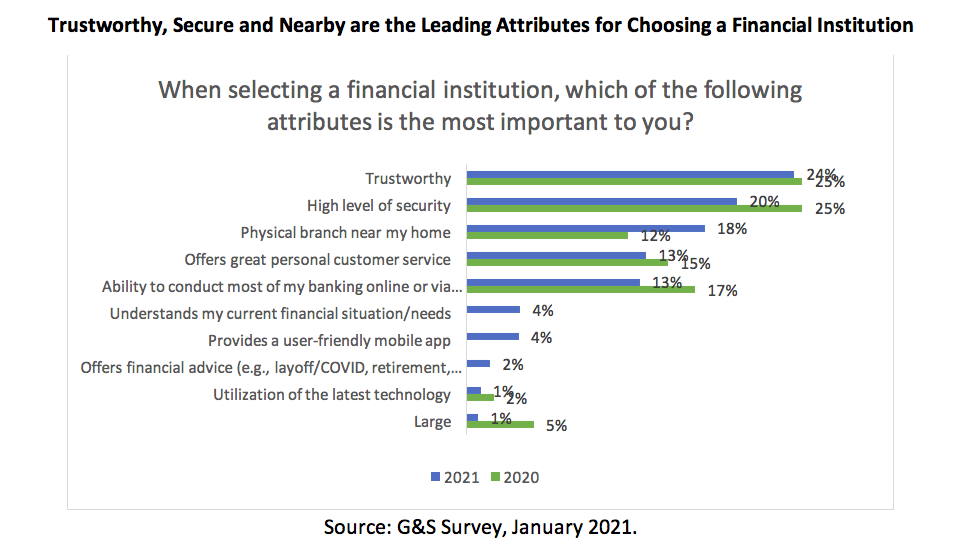

Today, consumers consider advanced digital services across multiple channels to be table stakes. In fact, only one percent of consumers identified “the latest technology” as an important attribute for choosing a financial institution.

To win and maintain customer loyalty, financial brands must demonstrate a clear focus on consumer needs and preferences, supported by an array of digital transaction options that provide a superior customer experience. Now is the perfect time to double down on technology that analyzes behavior and engagement data to provide more nuanced interpretations of user preferences. This approach will better enable financial services organizations to provide highly personalized services and communications using a combination of technology and intuitive, in-the-moment customer engagement. Companies in the vanguard of their industries are already doing this.

Humanize customer engagements and communications

Digital and human services are both essential in today’s financial services landscape. Yet, companies have emphasized the virtues of expanding digital channels for years, often at the expense of the human element. During the pandemic, customers have focused on virtual services out of both preference and necessity.

As COVID-19 ebbs, financial service enterprises have an opportunity to shine a light on their people—their greatest asset and front-line differentiator. This can mean making it easier for customers to get through to a customer service specialist during telephone encounters. Or offering non-AI live chats online with human experts. Organizations can differentiate by promoting this human touch and focusing external communications on the talented team of people serving customers.

Humanize community relationships

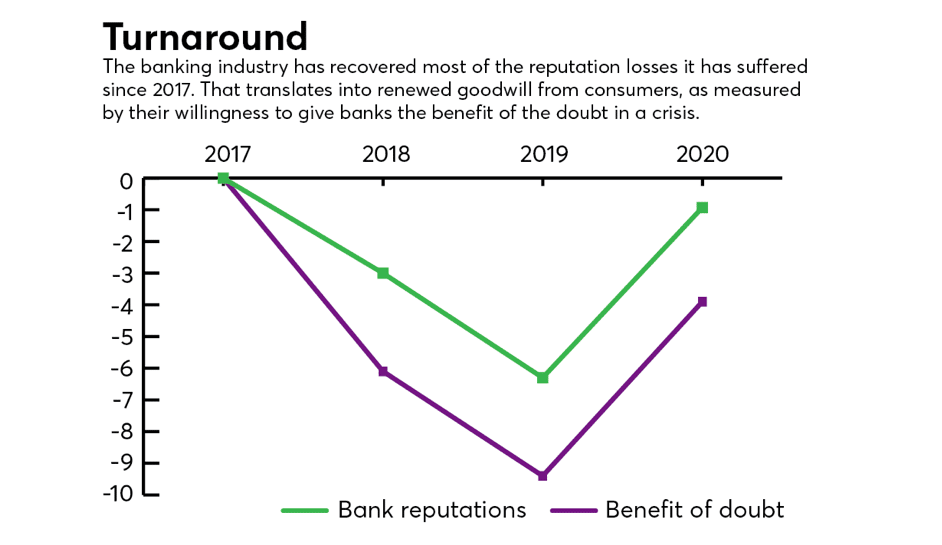

Another way to humanize financial brands is a genuine commitment to corporate citizenship. The pandemic, social and racial justice movements, #MeToo activism, new leadership in Washington—all these and more have made the American public acutely focused on where private sector enterprises stand on social issues. Many banks of all sizes met the COVID-19 crisis with policies and programs that created goodwill in their communities and helped reverse banking industry reputation declines experienced over the last several years.

Source: 2020 Annual American Banker/RepTrak Survey of Bank Reputations

The goodwill that many banks experienced in 2020 was the result of humane policies and social programs designed to help those most impacted by the pandemic. These ranged from forgiveness of temporary missed loan payments without penalties to small business support through active financial counsel or Paycheck Protection Program loans to encouraging employee community volunteer participation and leadership.

In addition to existing internal inclusion/anti-discrimination employment policies, many financial institutions are working to more actively diversify their leadership and Boards. Others have initiated programs to root out possible systemic bias in policies and penalties for consumers based on income, age, gender, race, or ethnicity.

Consumers will increasingly reward financial institutions that support a more equitable future. A growing body of research is demonstrating how organizations with progressive diversity, equity and inclusion (DE&I) practices are outperforming their peers. Research by McKinsey shows that the most ethnically diverse companies are 35 percent more likely to outperform the least ethnically diverse companies. According to research from Glassdoor, 67 percent of job seekers say that a diverse workforce is an important factor to them when considering companies and job offers.

Double down on humanization and personalization

The pandemic has created myriad opportunities to look at existing structures and processes in a fresh way. For financial services, this can mean permanently reducing restrictive barriers to help dismantle systemic bias. Unfortunately, too many Americans remain unbanked or underbanked due to:

- Traditional banking account balance requirements and fees

- Restrictive and sometimes punitive credit policies

- Implicit bias in assumptions regarding various consumer demographics

- A traditional “culture” around financial institutions does not always feel welcoming to all

These dynamics can create a negative impact on the financial stability and social mobility of large segments of the population. They also represent a significant opportunity to broaden customer bases while contributing to a stronger, more equitable economy and society.

An immediate opportunity for financial services companies is communicating with consumers in their 20s and 30s. The convenience of Venmo and ApplePay are one reason young people have avoided credit cards. Promoting the reduction of restrictive barriers or elimination of “gotcha fees” among Millennials and Gen Z are examples of how financial institutions can broaden their customer base while helping fledgling financial consumers become responsible, economically stable citizens. Structuring the right products for them – and then understanding how to reach them effectively as communicators—will be equally critical.

While tremendously challenging, the pandemic has also opened a significant opportunity for financial services organizations to rethink how they operate, serve, and connect with customers. Communication professionals have a critical role in creating a roadmap for how we collectively reshape the future.