Shoppers say their online and in-store behaviors have shifted for traditional consumer packaged goods (CPG) categories, following a year that’s seen the retail and grocery landscapes evolve dramatically. New research from intelligent media delivery firm Valassis examines the best approaches for connecting with the evolved consumer.

Shopper-friendly technology and the continued appeal of coupons are motivating today’s on-the-go consumers to obtain value no matter where or how they shop. According to the study, Empowered Shoppers, Evolving Expectations, 92 percent of consumers use coupons and nearly half (45 percent) use coupons always or very often.

In line with what we’ve seen since the Great Recession over a decade ago, millennials in particular are displaying a growing desire for savings, with 30 percent saying they always use coupons when shopping—a significant increase of 43 percent from 2018. Millennials have an affinity for both paper and paperless coupons—with 92 percent using print and 88 percent embracing paperless coupons received on a mobile device or downloaded to a loyalty card.

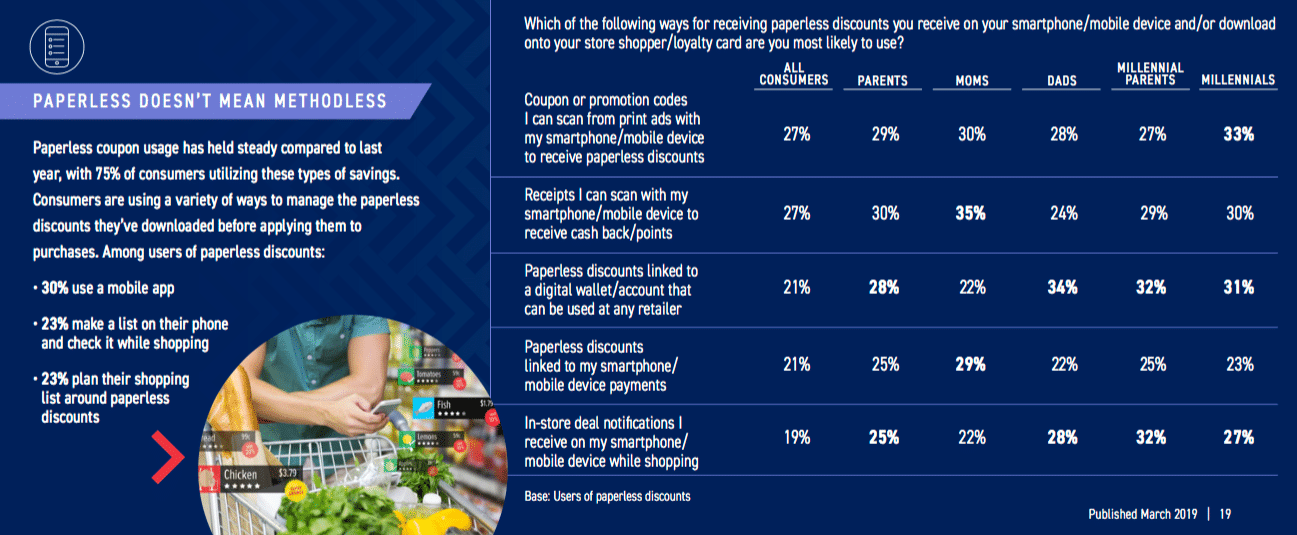

Overall, 91 percent of those surveyed indicate they use paper coupons and 75 percent use paperless discounts, rising to 96 percent among millennial parents using both types of coupons. Parents—especially dads—are more likely to use paper coupons received in the mail, in a store, from coupon books in the newspaper/mail, or printed from a computer.

“Coupons—print and paperless—remain an essential factor in the relationship between brands and consumers,” said Curtis Tingle, chief marketing officer at Valassis, in a news release. “Our latest Coupon Intelligence Report highlights that even as commerce evolves, both online and in-store, shoppers look for ways to save both time and money. With shifting expectations and life-stage needs, flexible and frictionless saving options are needed—no matter the channel—to accommodate consumers’ evolving demands. To activate consumers, marketers must take individual preferences and behaviors into consideration when shaping their strategies.”

Consumers still prefer paper coupons more than other types of discounts, and half of all consumers even favor receiving coupons in the mail. However, over the past two years there has been significant growth in the desire for paperless discounts; preference for mobile discounts and those downloaded to a loyalty card are both up compared to 2017 (increases of 19 and 14 percent, respectfully).

In terms of overall sentiment, 89 percent of respondents say using coupons saves them a lot of money. In fact, 85 percent are willing to shop at multiple stores to find the best price and 82 percent will readily switch stores based on weekly specials. Additionally, coupons influence 86 percent of consumers to try new products.

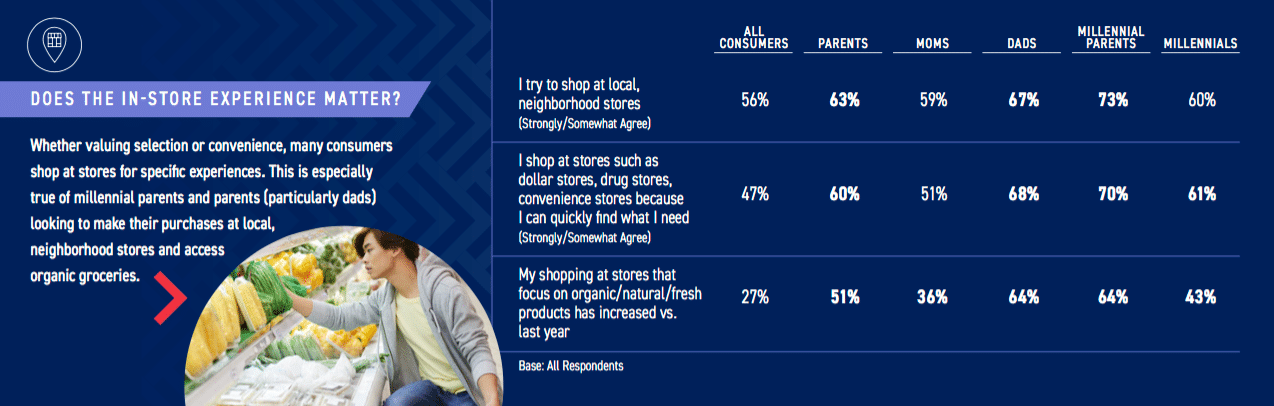

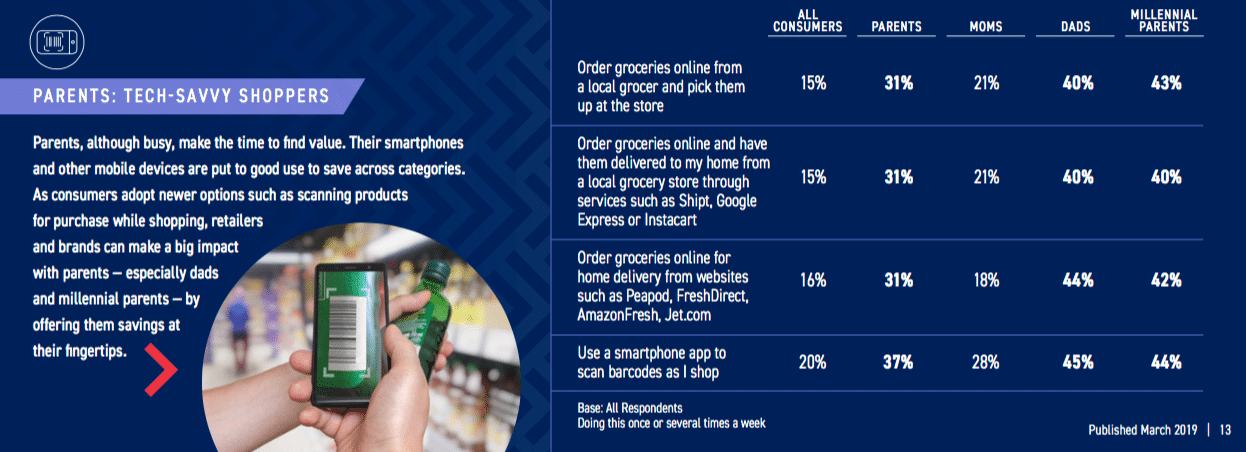

With shoppers empowered by all of the savings options and new ways to shop, marketers should also keep in mind the following shopper profiles to better gain a holistic understanding of today’s modern, dynamic consumers:

In-store

In-store shoppers—those that complete the majority of their purchases via brick-and-mortar channels—are primarily baby boomers (40 percent), and tend to skew female for shopping in-store for food and household goods.

- When it comes to food purchases, more than half of consumers (63 percent) do all or most of their shopping in-store although there has been a considerable shift to shopping online for food this past year.

Online

Online shoppers—those that complete the majority of their purchases via online channels—are heavily weighted toward millennials and Gen Xers and are most likely to have children in the household.

- Overall, nearly 30 percent of shoppers purchase household goods online, a 38 percent increase from 2018.

- 28 percent shop for health and beauty care products online, a 40 percent increase from 2018.

Omnichannel

Omnichannel shoppers—consumers that do half of their shopping online and half in-store—are primarily millennials (approximately 40 percent).

- The percentage of omnichannel shoppers remained relatively consistent since 2018.

Download the full report here.

The study was fielded in the third quarter of 2018 in conjunction with a global, third-party market research firm with proficiency in internet surveys. The sample was derived from an online consumer opinion panel, and all participants were at least 18 years of age and living in the contiguous United States. Consumers were emailed an invitation to participate in the survey and were given three days to complete it. The survey was closed once 1,000 completed responses had been reached. The responses were weighted by factors obtained from national census data to provide appropriate representations of demographic groups at summary levels.