Retailers rely on retargeting ads to alert us to what we might not know we need in order to move the sales needle, while many consumers feel the practice has become overused and overly intrusive. Shoppers and marketers may be on opposite sides when it comes to retargeting, but new research shows they agree on one critical point—it’s ineffective in its current state.

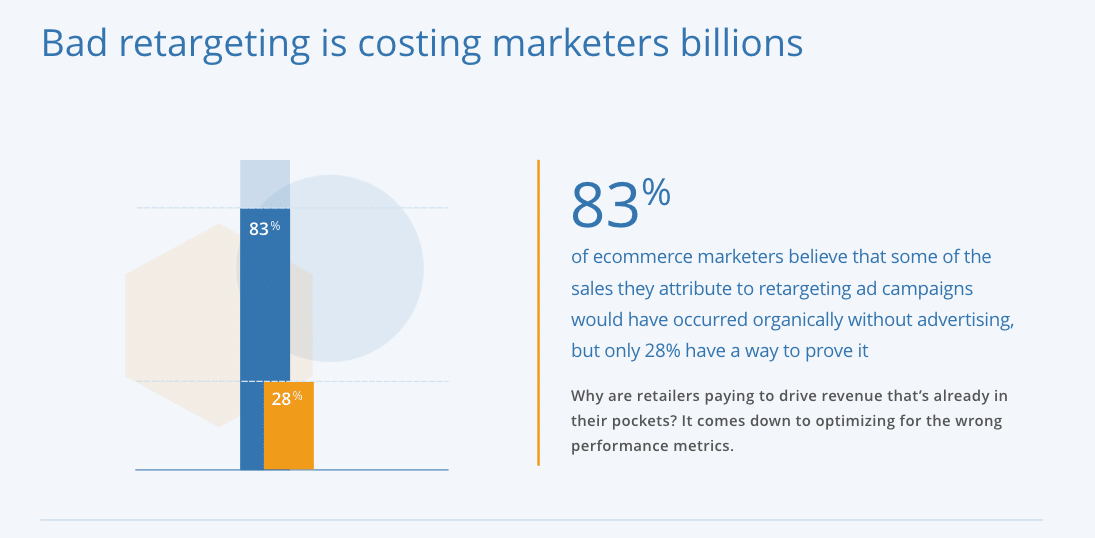

According to the data from performance ad software firm Nanigans, 83 percent of marketers believe retargeting ads have taken credit for sales that would have occurred without the ads in the first place, and 57 percent of consumers feel that retargeting ads have had no influence on their decision to purchase something online.

This reveal underscores what both parties have independently suspected for some time—that retargeting campaigns aren’t optimized correctly, and as a result, are largely ineffective in influencing purchase decisions in their current form.

“Our research proves that the current retargeting experience is a frustrating one for consumers, and a wasteful and damaging one for retailers, who are spending billions of dollars every year on digital advertising that is having no effect on top-line revenue,” said Ric Calvillo, co-founder and CEO of Nanigans, in a news release.

“Ultimately, any digital ad spend should be driving incremental growth, and it’s up to CMOs to improve their retargeting strategies to ensure they don’t leave money on the table,” Calvillo added. “It’s shocking that 43 percent of retail marketers have never run a lift test on their digital advertising, when it’s the gold standard for measuring ad effectiveness. Marketers who don’t optimize for incremental growth are not only wasting budget, but also negatively impacting the customer experience by showing irrelevant ads in excess.”

The advertisers surveyed, which included some of the largest retailers in the U.S., spent an average of $16.7 million on performance media in 2017

Despite nearly 75 percent of retail marketers reporting that they don’t currently have a way to measure if sales attributed to retargeting would have occurred organically, spending is bullish. In fact, 53 percent of retail marketers said they plan to increase digital ad spend over the next 12 months, with an average expected increase of 24 percent.

The failure of marketing departments to adapt means retailers will likely continue to lose money from their retargeting strategy—and consumers can expect more frustration from irrelevant ads during their browsing sessions

To improve the ad experience, 33 percent of consumers demanded that retailers work to realize when shoppers are no longer interested in a product—and adjust retargeting campaigns accordingly. Further, 88 percent of consumers report seeing retargeted ads for products they’ve already purchased. Fortunately, it’s achievable for brands to combat both complaints by taking more control over their retargeting campaigns by taking them in-house. In a DSP Report Wave last October, Advertiser Perceptions reported 32 percent of brands run programmatic in-house, which aligns with another survey conducted by NewBase in March 2018.

Nanigans’ data indicates that this trend will accelerate among retail marketers as 25 percent of advertisers plan to shift their management strategy in-house over the next 12 months.

Additional survey findings include:

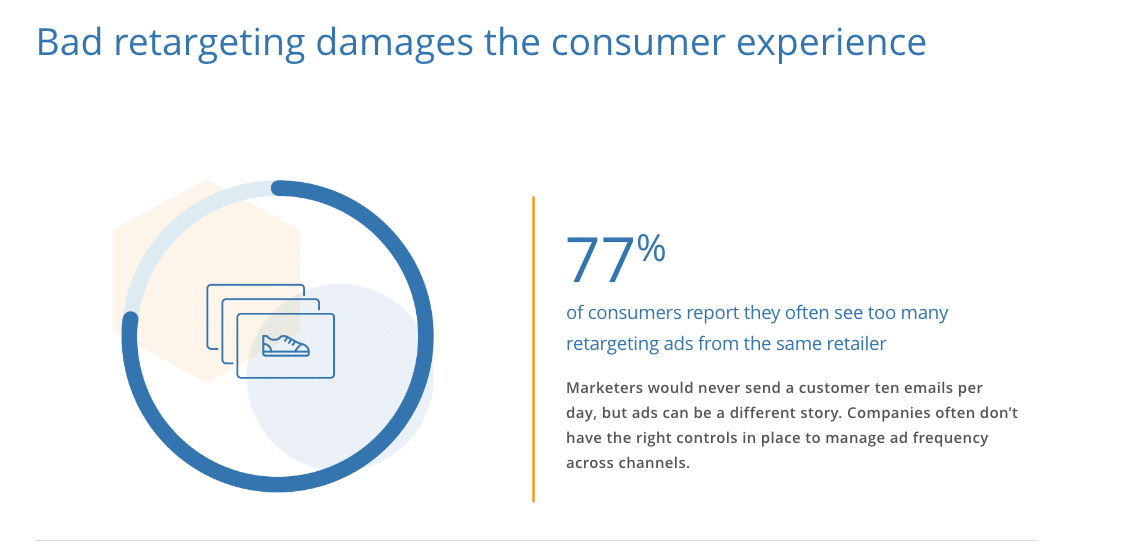

- 77 percent of consumers feel like they see too many retargeting ads from the same retailers.

- 55 percent of retail marketers cite “measuring the true business impact of advertising” as their biggest challenge

- 45 percent of retail marketers list Return on Ad Spend (ROAS) as their primary metric for measuring advertising effectiveness, and 14 percent said they use six or more KPIs to measure campaign effectiveness

View an interactive report highlighting the findings here.

Nanigans collected this data based on responses from 1,000 consumers and over 100 top US retail and ecommerce advertising executives.