When business leaders come to work in the mornings, they are figuratively walking into an office that is eyeball-high in data—so much information that it’s literally impossible to comprehend even a fraction of it, much less analyze it and make good decisions from it. The irony is that somewhere within that roomful of numbers, stats and facts lies the most useful and valuable asset businesses have today.

New research from credit monitoring and risk management firm Creditsafe on AI’s role in business risk reveals that companies are desperate for stronger data management and advanced analytics. While it’s already difficult to tackle that challenge amid a looming recession, your finance team’s digital skills gap is only making things worse.

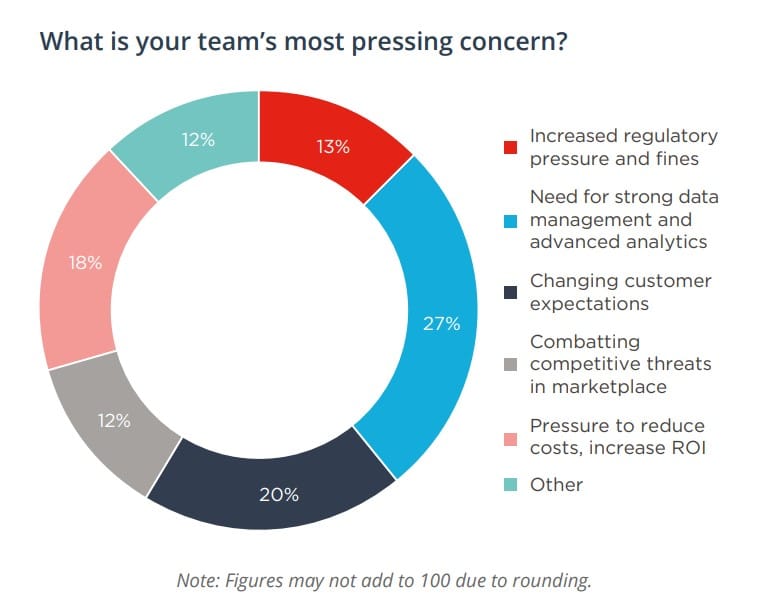

The firm’s new study, AI’s Role in Business Risk, reveals that 27 percent of businesses cite a need for strong data management and advanced analytics as their most pressing concern in 2023—which isn’t surprising given how valuable data is in analyzing growth patterns and trends, managing cash flow, identifying risks and making decisions.

The firm’s new study, AI’s Role in Business Risk, reveals that 27 percent of businesses cite a need for strong data management and advanced analytics as their most pressing concern in 2023—which isn’t surprising given how valuable data is in analyzing growth patterns and trends, managing cash flow, identifying risks and making decisions.

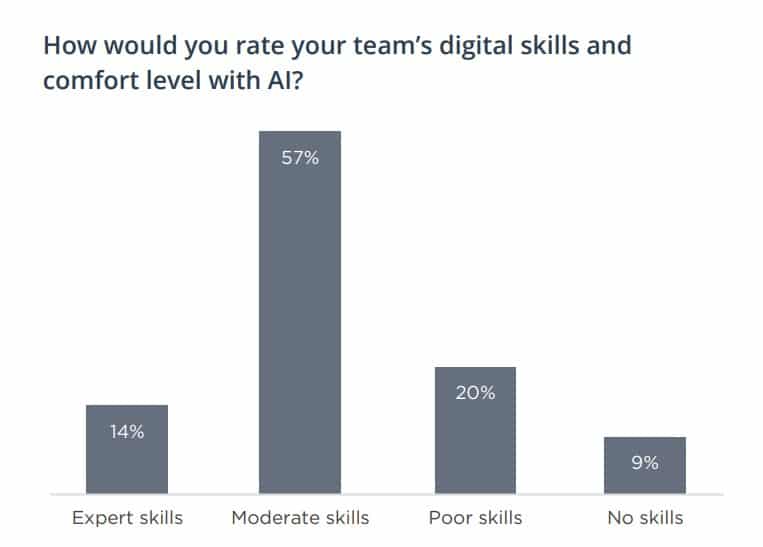

But these skills are especially important for the finance department, who are charged with protecting one of the company’s greatest assets—cash flow. Unfortunately, 29 percent of finance managers have little to no digital skills and aren’t comfortable with AI. And only 14 percent cite expert digital skills—which also certainly will lead to inaccurate data, skewed analysis, poorly informed decisions and, worst of all, lost revenue.

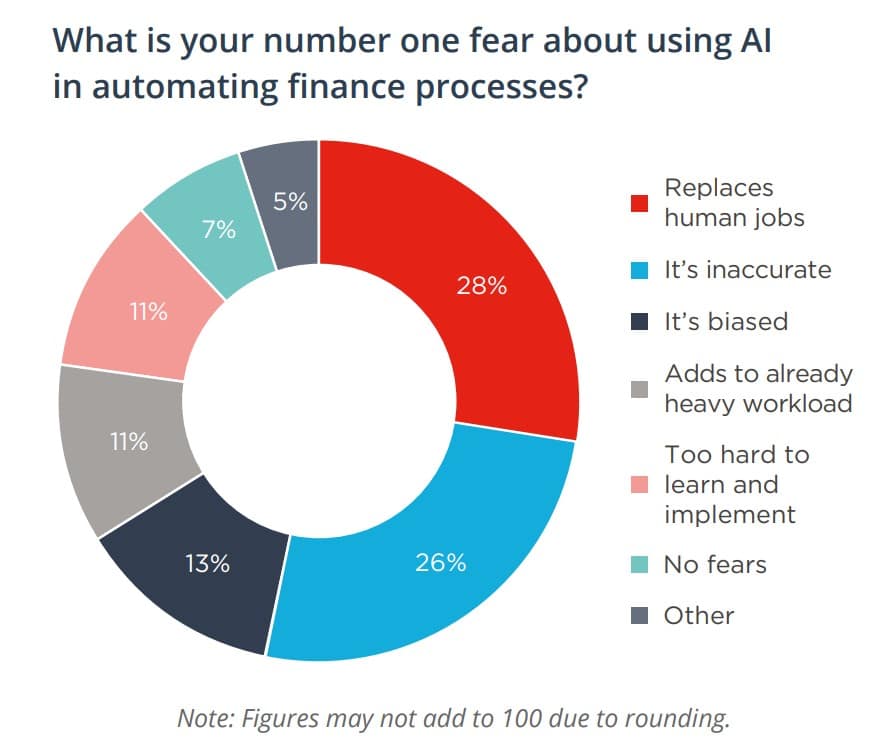

“Most finance professionals are wizards at using Excel to manage cash flow, invoicing and collections,” said Matthew Debbage, CEO of the Americas and Asia at Creditsafe, in a news release. “But when it comes to using AI and machine learning in customer onboarding processes (i.e. B2B credit checks, Know Your Customer/ID verification, anti-money laundering and compliance checks), they’re often skeptical and mistrusting of AI. A lot of this mistrust comes from frustrations that AI will just be another thing to add to their already full workloads or that it will be too hard to learn and implement. But given the improvements other departments are already seeing from AI—including increased productivity, better detection and prevention of risks, more informed decision-making and revenue growth—finance teams can’t afford to fall behind the digital transformation curve any longer.”

“Most finance professionals are wizards at using Excel to manage cash flow, invoicing and collections,” said Matthew Debbage, CEO of the Americas and Asia at Creditsafe, in a news release. “But when it comes to using AI and machine learning in customer onboarding processes (i.e. B2B credit checks, Know Your Customer/ID verification, anti-money laundering and compliance checks), they’re often skeptical and mistrusting of AI. A lot of this mistrust comes from frustrations that AI will just be another thing to add to their already full workloads or that it will be too hard to learn and implement. But given the improvements other departments are already seeing from AI—including increased productivity, better detection and prevention of risks, more informed decision-making and revenue growth—finance teams can’t afford to fall behind the digital transformation curve any longer.”

Key findings from the research study include:

B2B credit checks aren’t always cut and dry—at least half require in-depth analysis

Almost all (97 percent) finance managers process up to 100 credit applications a day. And for 63 percent of businesses, it takes up to 5 people to make credit decisions on new customers, while 22 percent of companies involve 6-10 people in the process. On top of that, 75 percent of finance managers take up to a full day (8 hours) to reach a credit decision on a single customer. Now consider this: 50-99 percent of weekly credit decisions require in-depth analysis for nearly half (46 percent) of businesses, while 10 percent of businesses admitted that further analysis is needed on every credit application they review.

AML and compliance checks are frequently skipped during customer onboarding

Given the U.S. government’s tough stance on financial crimes and sanctions violations, you’d think companies would make AML and compliance checks a top priority and religiously use them during the customer onboarding process. But our study shows that’s far from the reality. In fact, almost half (41 percent) of businesses only run AML checks on customers sometimes or rarely, while 38 percent take the same lax attitude with compliance checks. To make matters worse, 21 percent never run AML checks and 15 percent never run compliance checks.

Limited budgets and the generational tech gap make it hard to build strong finance teams

Limited budgets and the generational tech gap make it hard to build strong finance teams

For example, 29 percent of the respondents said not having enough budget and resources was the biggest challenge they faced with recruiting and retaining finance talent. Additionally, 19 percent of finance managers believe insufficient digital skills and lack of experience with finance software make it hard to build strong finance teams. What’s more, 21 percent of the respondents attributed slow user adoption of technology as the reason for finance’s hiring challenges.

Manual customer onboarding processes leave businesses more vulnerable to financial losses and regulatory violations

The study found that 82 percent of businesses still rely on manual credit decisioning processes. Given how pervasive and useful AI is in businesses today, this could explain why 27 percent of finance managers believe their credit decisioning process is rigid and ineffective. When we asked these respondents why they feel this way, 49 percent said it’s either because the credit decision process is too reliant on manual processes or that it takes too long to reach a decision. These two reasons are important, as they could lead to errors, missed data points, skewed analyses and, ultimately, the wrong decision being made—costing the business dearly from a financial and reputational perspective.

“Customer onboarding isn’t just one department’s problem—it affects every department and the bottom line,” said Debbage. “Not investing in the right technologies or integrating your legacy data with credit risk and compliance platforms could leave your business open to more risks and deplete more of your cash flow.”

Download the full report here.

The firm surveyed over 300 finance managers in the United States to understand their perceptions of AI and automation and how those perceptions influence their willingness to automate financial processes. They also wanted to get a clear picture of the influence finance’s digital skills have on the company’s likelihood to digitally transform financial processes. The survey was fielded in May 2023 and included companies of all sizes and across all industries.